Whales with a lot of money to spend have taken a noticeably bullish stance on Palo Alto Networks.

Looking at options history for Palo Alto Networks PANW we detected 8 trades.

If we consider the specifics of each trade, it is accurate to state that 62% of the investors opened trades with bullish expectations and 12% with bearish.

From the overall spotted trades, 2 are puts, for a total amount of $57,462 and 6, calls, for a total amount of $380,500.

Predicted Price Range

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $150.0 to $240.0 for Palo Alto Networks over the recent three months.

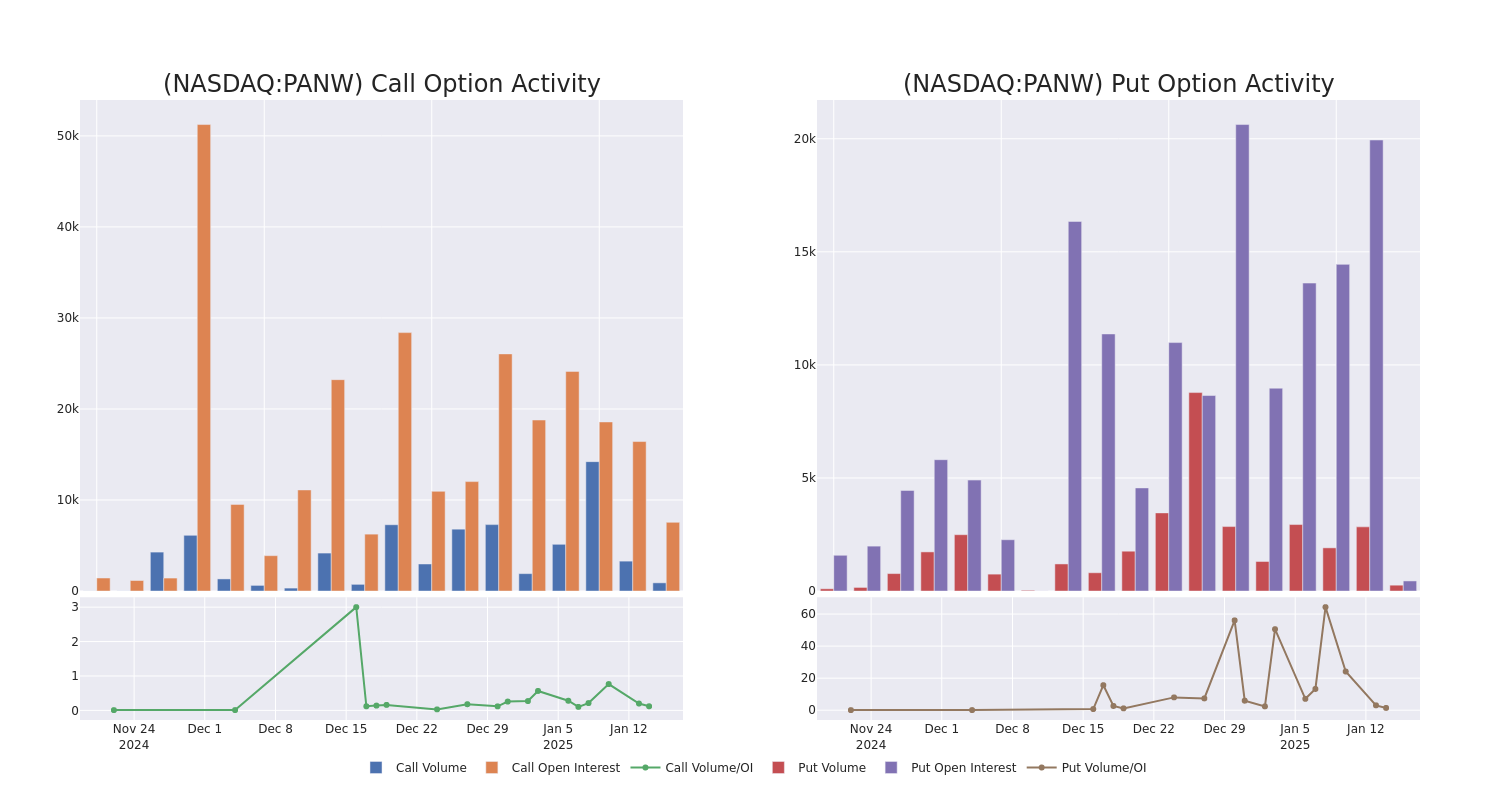

Analyzing Volume & Open Interest

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Palo Alto Networks's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Palo Alto Networks's whale trades within a strike price range from $150.0 to $240.0 in the last 30 days.

Palo Alto Networks Option Volume And Open Interest Over Last 30 Days

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| PANW | CALL | TRADE | BULLISH | 01/16/26 | $28.25 | $28.25 | $28.25 | $170.00 | $104.5K | 538 | 3 |

| PANW | CALL | TRADE | NEUTRAL | 09/19/25 | $22.6 | $21.55 | $22.05 | $170.00 | $99.2K | 295 | 45 |

| PANW | CALL | TRADE | BULLISH | 01/16/26 | $7.85 | $7.85 | $7.85 | $240.00 | $54.1K | 529 | 69 |

| PANW | CALL | TRADE | BULLISH | 02/14/25 | $4.15 | $3.95 | $4.15 | $175.00 | $49.8K | 557 | 422 |

| PANW | CALL | SWEEP | BULLISH | 01/17/25 | $19.25 | $18.35 | $19.0 | $150.00 | $39.8K | 5.1K | 21 |

About Palo Alto Networks

Palo Alto Networks is a platform-based cybersecurity vendor with product offerings covering network security, cloud security, and security operations. The California-based firm has more than 80,000 enterprise customers across the world, including more than three fourths of the Global 2000.

Present Market Standing of Palo Alto Networks

- Currently trading with a volume of 920,141, the PANW's price is up by 0.9%, now at $169.32.

- RSI readings suggest the stock is currently may be oversold.

- Anticipated earnings release is in 35 days.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Palo Alto Networks options trades with real-time alerts from Benzinga Pro.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.