Whales with a lot of money to spend have taken a noticeably bearish stance on GE Aero.

Looking at options history for GE Aero GE we detected 18 trades.

If we consider the specifics of each trade, it is accurate to state that 38% of the investors opened trades with bullish expectations and 44% with bearish.

From the overall spotted trades, 8 are puts, for a total amount of $719,424 and 10, calls, for a total amount of $393,922.

Expected Price Movements

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $140.0 and $190.0 for GE Aero, spanning the last three months.

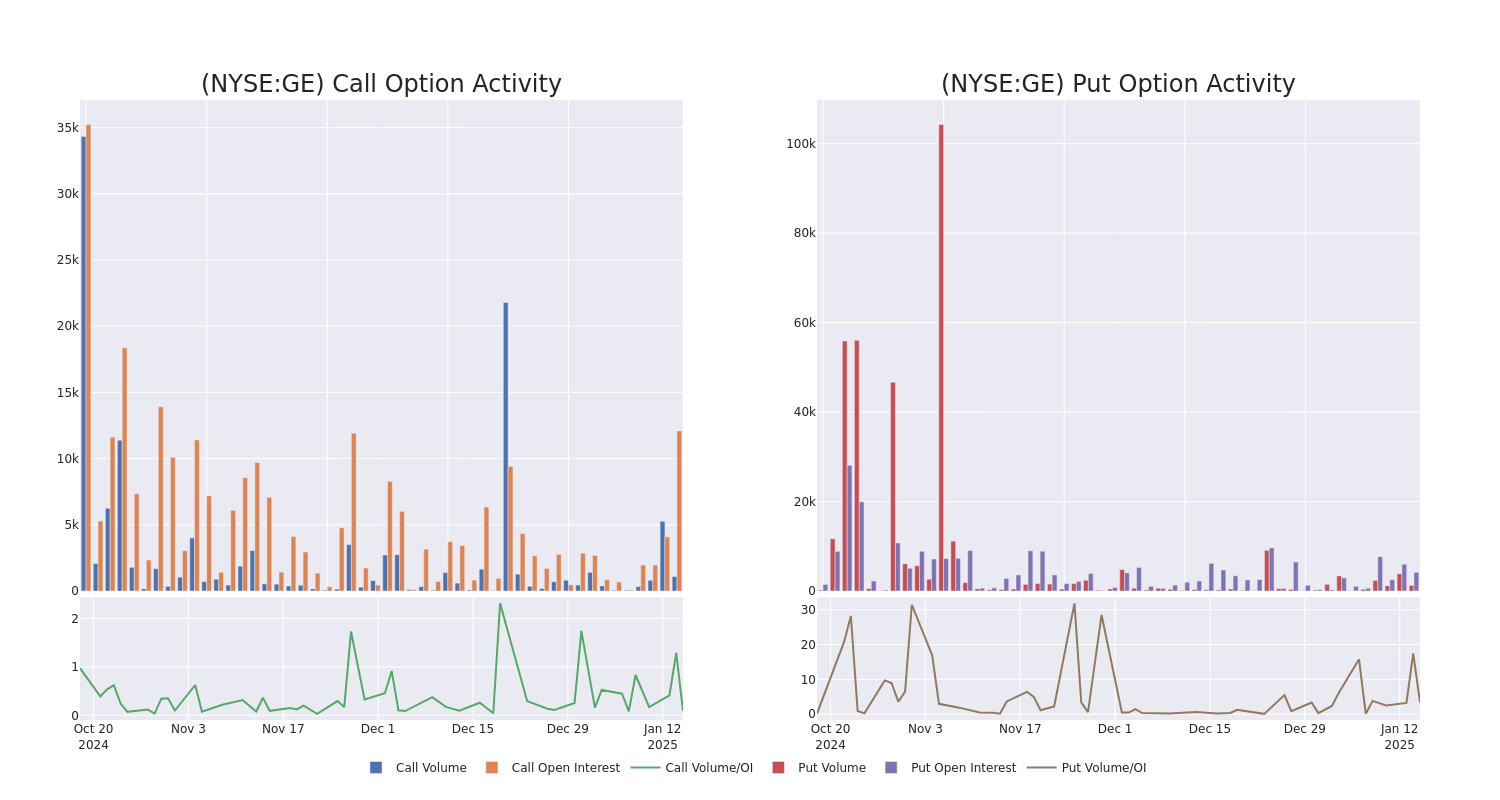

Insights into Volume & Open Interest

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in GE Aero's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to GE Aero's substantial trades, within a strike price spectrum from $140.0 to $190.0 over the preceding 30 days.

GE Aero Option Activity Analysis: Last 30 Days

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| GE | PUT | TRADE | BEARISH | 01/16/26 | $14.85 | $13.8 | $14.55 | $170.00 | $244.4K | 127 | 168 |

| GE | PUT | TRADE | BEARISH | 03/21/25 | $12.05 | $11.65 | $11.89 | $185.00 | $104.6K | 1.5K | 173 |

| GE | PUT | SWEEP | BULLISH | 03/21/25 | $12.05 | $11.5 | $11.4 | $185.00 | $97.1K | 1.5K | 85 |

| GE | PUT | SWEEP | BEARISH | 03/21/25 | $14.85 | $14.4 | $14.8 | $190.00 | $75.4K | 256 | 54 |

| GE | PUT | SWEEP | BEARISH | 03/21/25 | $15.3 | $14.75 | $15.09 | $190.00 | $74.4K | 256 | 204 |

About GE Aero

GE Aerospace is the global leader in designing, manufacturing, and servicing large aircraft engines, along with partner Safran in their CFM joint venture. With its massive global installed base of nearly 70,000 commercial and military engines, GE Aerospace earns most of its profits on recurring service revenue of that equipment, which operates for decades. GE Aerospace is the remaining core business of the company formed in 1892 with historical ties to American inventor Thomas Edison; that company became a storied conglomerate with peak revenue of $130 billion in 2000. GE spun off its appliance, finance, healthcare, and wind and power businesses between 2016 and 2024.

Where Is GE Aero Standing Right Now?

- Trading volume stands at 2,337,200, with GE's price up by 1.68%, positioned at $179.84.

- RSI indicators show the stock to be may be overbought.

- Earnings announcement expected in 8 days.

What The Experts Say On GE Aero

A total of 1 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $228.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access. * An analyst from Deutsche Bank persists with their Buy rating on GE Aero, maintaining a target price of $228.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest GE Aero options trades with real-time alerts from Benzinga Pro.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.