Deep-pocketed investors have adopted a bullish approach towards Taiwan Semiconductor TSM, and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in TSM usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga's options scanner highlighted 94 extraordinary options activities for Taiwan Semiconductor. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 44% leaning bullish and 43% bearish. Among these notable options, 21 are puts, totaling $1,160,142, and 73 are calls, amounting to $6,777,913.

Expected Price Movements

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $70.0 to $330.0 for Taiwan Semiconductor over the last 3 months.

Volume & Open Interest Trends

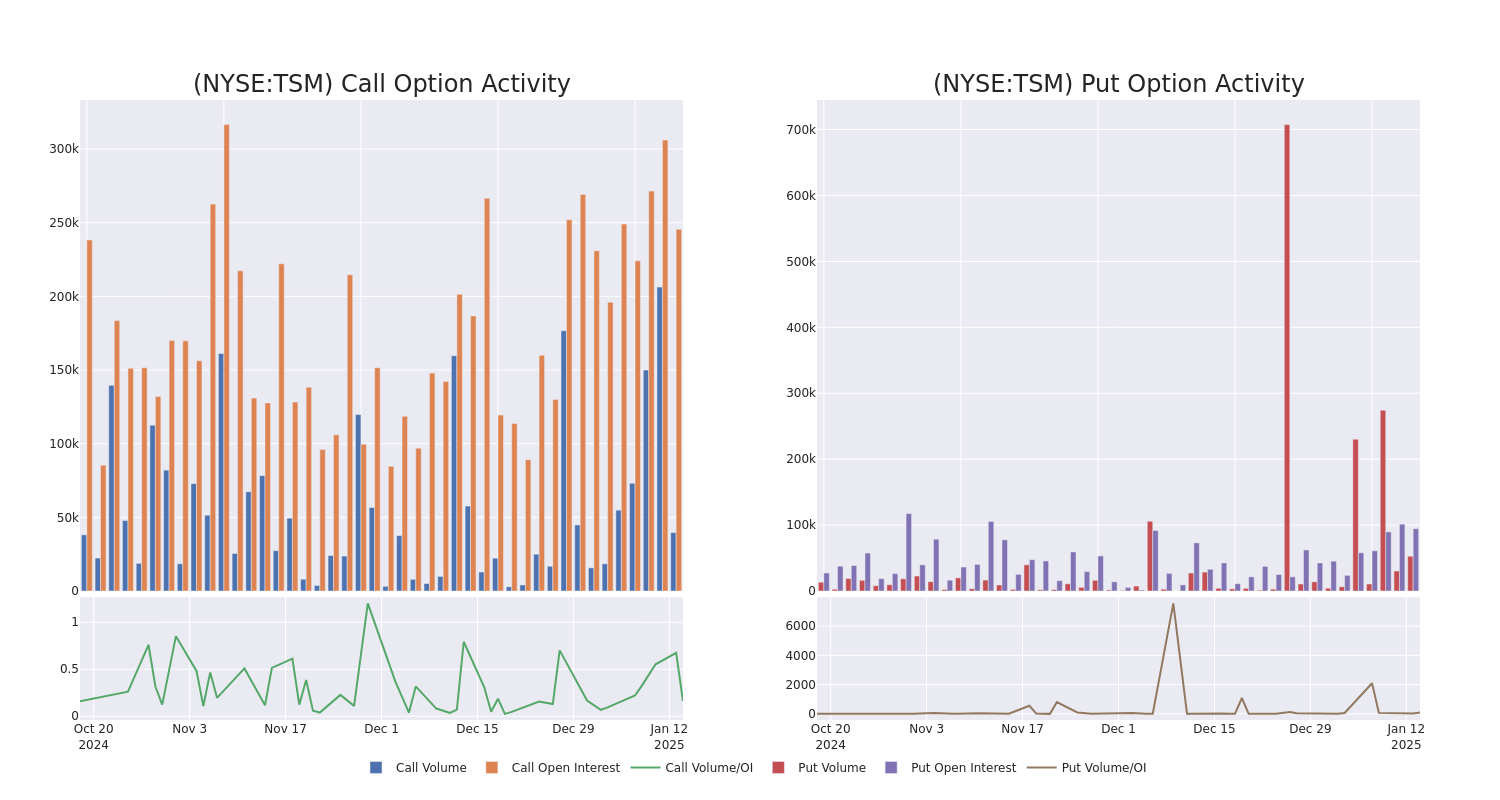

In today's trading context, the average open interest for options of Taiwan Semiconductor stands at 5107.12, with a total volume reaching 72,173.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Taiwan Semiconductor, situated within the strike price corridor from $70.0 to $330.0, throughout the last 30 days.

Taiwan Semiconductor Option Activity Analysis: Last 30 Days

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| TSM | CALL | SWEEP | BEARISH | 01/17/25 | $40.65 | $40.3 | $40.3 | $165.00 | $302.2K | 2.2K | 85 |

| TSM | CALL | SWEEP | BULLISH | 06/20/25 | $6.0 | $5.95 | $6.0 | $260.00 | $222.6K | 9.5K | 2.6K |

| TSM | CALL | TRADE | BULLISH | 03/21/25 | $8.65 | $8.55 | $8.61 | $220.00 | $215.2K | 4.7K | 923 |

| TSM | CALL | SWEEP | BULLISH | 01/16/26 | $32.65 | $31.85 | $32.65 | $210.00 | $156.7K | 5.7K | 138 |

| TSM | CALL | TRADE | BEARISH | 04/17/25 | $15.35 | $15.25 | $15.25 | $210.00 | $152.5K | 1.8K | 402 |

About Taiwan Semiconductor

Taiwan Semiconductor Manufacturing Co. is the world's largest dedicated chip foundry, with over 60% market share. TSMC was founded in 1987 as a joint venture of Philips, the government of Taiwan, and private investors. It went public as an ADR in the us in 1997. TSMC's scale and high-quality technology allow the firm to generate solid operating margins, even in the highly competitive foundry business. Furthermore, the shift to the fabless business model has created tailwinds for TSMC. The foundry leader has an illustrious customer base, including Apple, AMD, and Nvidia, that looks to apply cutting-edge process technologies to its semiconductor designs. TSMC employs more than 73,000 people.

Present Market Standing of Taiwan Semiconductor

- With a trading volume of 10,079,884, the price of TSM is up by 0.52%, reaching $202.49.

- Current RSI values indicate that the stock is may be approaching overbought.

- Next earnings report is scheduled for 1 days from now.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Taiwan Semiconductor, Benzinga Pro gives you real-time options trades alerts.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.