Deep-pocketed investors have adopted a bullish approach towards Uber Technologies UBER, and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in UBER usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga's options scanner highlighted 10 extraordinary options activities for Uber Technologies. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 50% leaning bullish and 50% bearish. Among these notable options, 3 are puts, totaling $177,200, and 7 are calls, amounting to $349,980.

Predicted Price Range

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $58.0 and $105.0 for Uber Technologies, spanning the last three months.

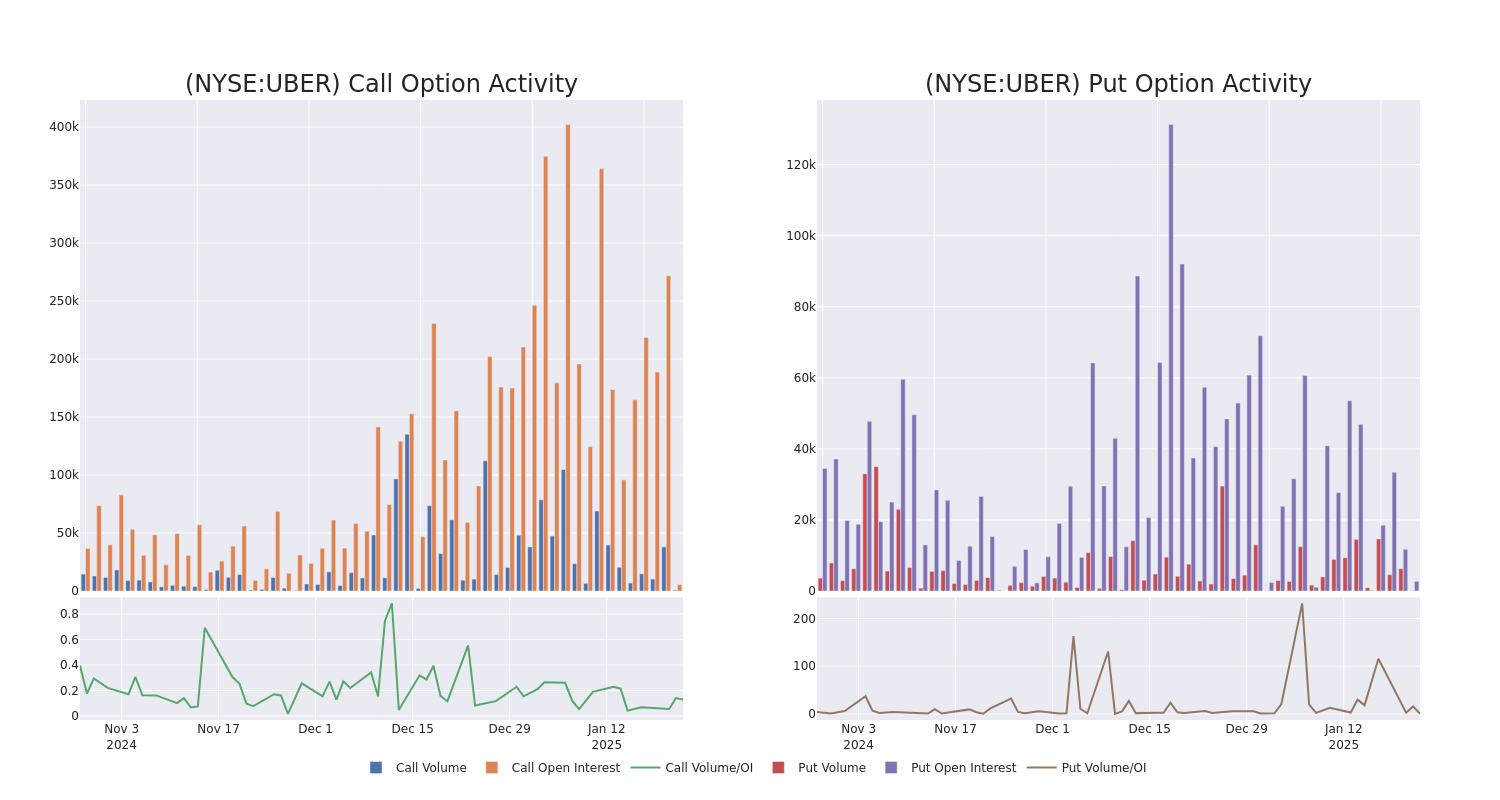

Volume & Open Interest Development

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for Uber Technologies's options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Uber Technologies's whale activity within a strike price range from $58.0 to $105.0 in the last 30 days.

Uber Technologies Call and Put Volume: 30-Day Overview

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| UBER | PUT | SWEEP | BEARISH | 01/16/26 | $8.75 | $8.65 | $8.75 | $67.50 | $80.5K | 2.6K | 93 |

| UBER | PUT | TRADE | BULLISH | 02/21/25 | $0.46 | $0.43 | $0.44 | $58.00 | $62.7K | 31 | 0 |

| UBER | CALL | SWEEP | BULLISH | 01/31/25 | $3.85 | $3.7 | $3.79 | $64.00 | $60.7K | 600 | 162 |

| UBER | CALL | SWEEP | BULLISH | 12/18/26 | $5.55 | $5.0 | $5.52 | $105.00 | $55.2K | 763 | 100 |

| UBER | CALL | SWEEP | BULLISH | 12/18/26 | $5.55 | $5.05 | $5.55 | $105.00 | $54.3K | 763 | 198 |

About Uber Technologies

Uber Technologies is a technology provider that matches riders with drivers, hungry people with restaurants and food couriers, and shippers with carriers. The firm's on-demand technology platform is currently utilized by traditional cars as well as autonomous vehicles, but could eventually be used for additional products and services, such as delivery via drones or electronic vehicle take-off and landing technology. Uber operates in more than 70 countries, with more than 161 million users who order rides or food at least once a month.

Having examined the options trading patterns of Uber Technologies, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Current Position of Uber Technologies

- Currently trading with a volume of 3,037,562, the UBER's price is down by -0.53%, now at $67.46.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 13 days.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Uber Technologies options trades with real-time alerts from Benzinga Pro.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.