Whales with a lot of money to spend have taken a noticeably bullish stance on Fair Isaac.

Looking at options history for Fair Isaac FICO we detected 13 trades.

If we consider the specifics of each trade, it is accurate to state that 38% of the investors opened trades with bullish expectations and 23% with bearish.

From the overall spotted trades, 4 are puts, for a total amount of $182,016 and 9, calls, for a total amount of $438,050.

Predicted Price Range

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $1140.0 to $2500.0 for Fair Isaac over the recent three months.

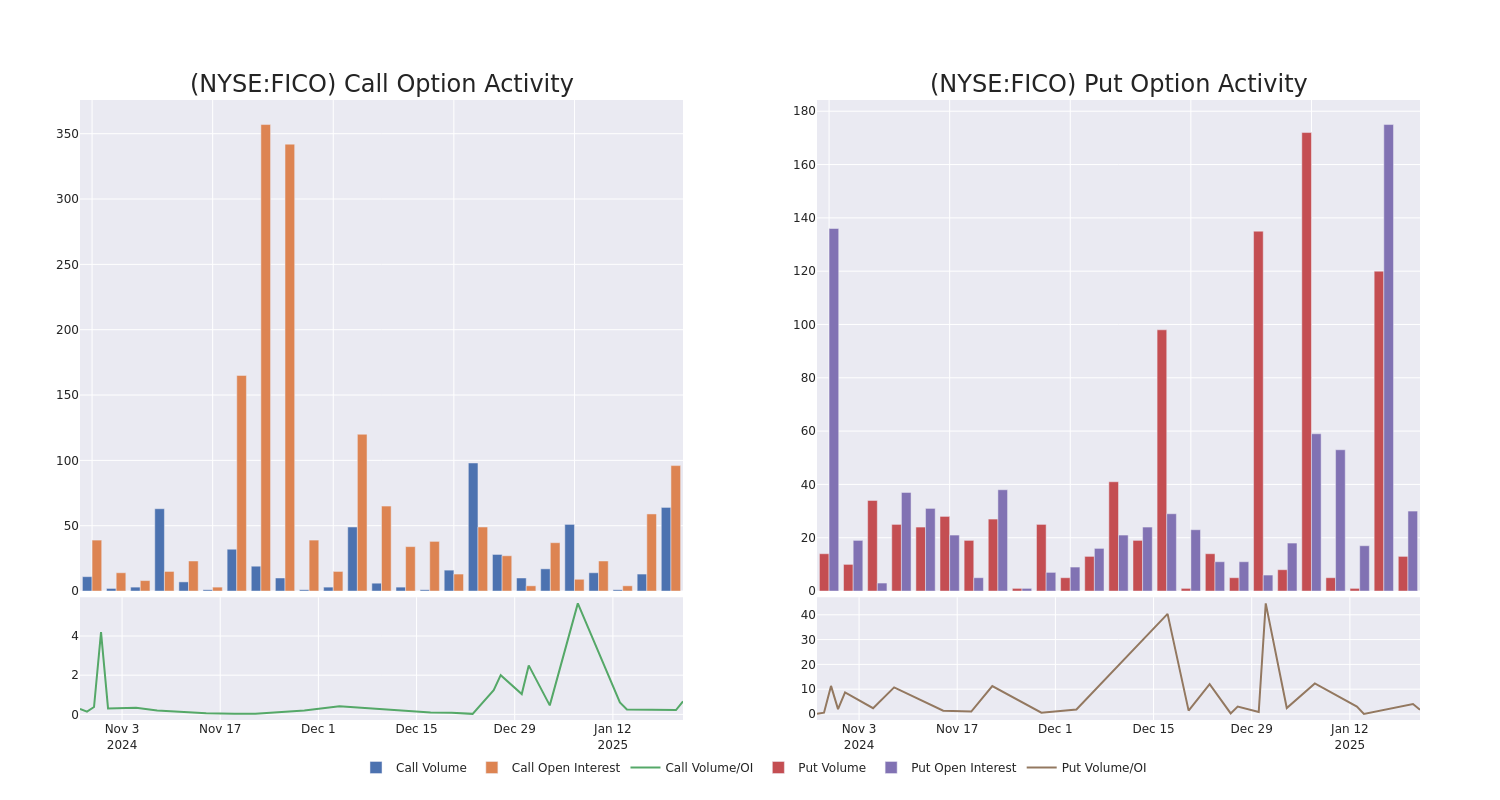

Insights into Volume & Open Interest

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for Fair Isaac's options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Fair Isaac's whale activity within a strike price range from $1140.0 to $2500.0 in the last 30 days.

Fair Isaac Call and Put Volume: 30-Day Overview

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| FICO | CALL | TRADE | BULLISH | 07/18/25 | $736.1 | $726.1 | $736.1 | $1140.00 | $73.6K | 0 | 1 |

| FICO | PUT | TRADE | BEARISH | 03/21/25 | $632.6 | $624.1 | $632.6 | $2500.00 | $63.2K | 0 | 1 |

| FICO | CALL | TRADE | NEUTRAL | 02/21/25 | $17.8 | $11.7 | $14.7 | $2100.00 | $55.8K | 40 | 90 |

| FICO | CALL | TRADE | NEUTRAL | 04/17/25 | $137.7 | $131.4 | $134.5 | $1850.00 | $53.8K | 4 | 8 |

| FICO | PUT | TRADE | BEARISH | 07/18/25 | $534.8 | $529.6 | $534.8 | $2370.00 | $53.4K | 0 | 1 |

About Fair Isaac

Founded in 1956, Fair Isaac Corporation is a leading applied analytics company. Fair Isaac is primarily known for its FICO credit scores, which is a widely used industry benchmark to determine the creditworthiness of an individual consumer. The firm's credit scores business accounts for most of the firm's profits and consists of business-to-business and business-to-consumer services. In addition to scores, Fair Isaac also sells software primarily to financial institutions for areas such as analytics, decision-making, customer workflows, and fraud.

In light of the recent options history for Fair Isaac, it's now appropriate to focus on the company itself. We aim to explore its current performance.

Fair Isaac's Current Market Status

- Trading volume stands at 251,848, with FICO's price down by -1.84%, positioned at $1845.77.

- RSI indicators show the stock to be may be oversold.

- Earnings announcement expected in 12 days.

Professional Analyst Ratings for Fair Isaac

Over the past month, 2 industry analysts have shared their insights on this stock, proposing an average target price of $2342.0.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access. * An analyst from Jefferies persists with their Buy rating on Fair Isaac, maintaining a target price of $2275. * An analyst from Oppenheimer persists with their Outperform rating on Fair Isaac, maintaining a target price of $2409.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Fair Isaac with Benzinga Pro for real-time alerts.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.