Financial giants have made a conspicuous bearish move on Citigroup. Our analysis of options history for Citigroup C revealed 19 unusual trades.

Delving into the details, we found 15% of traders were bullish, while 73% showed bearish tendencies. Out of all the trades we spotted, 8 were puts, with a value of $385,428, and 11 were calls, valued at $1,111,090.

What's The Price Target?

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $52.5 to $82.0 for Citigroup over the last 3 months.

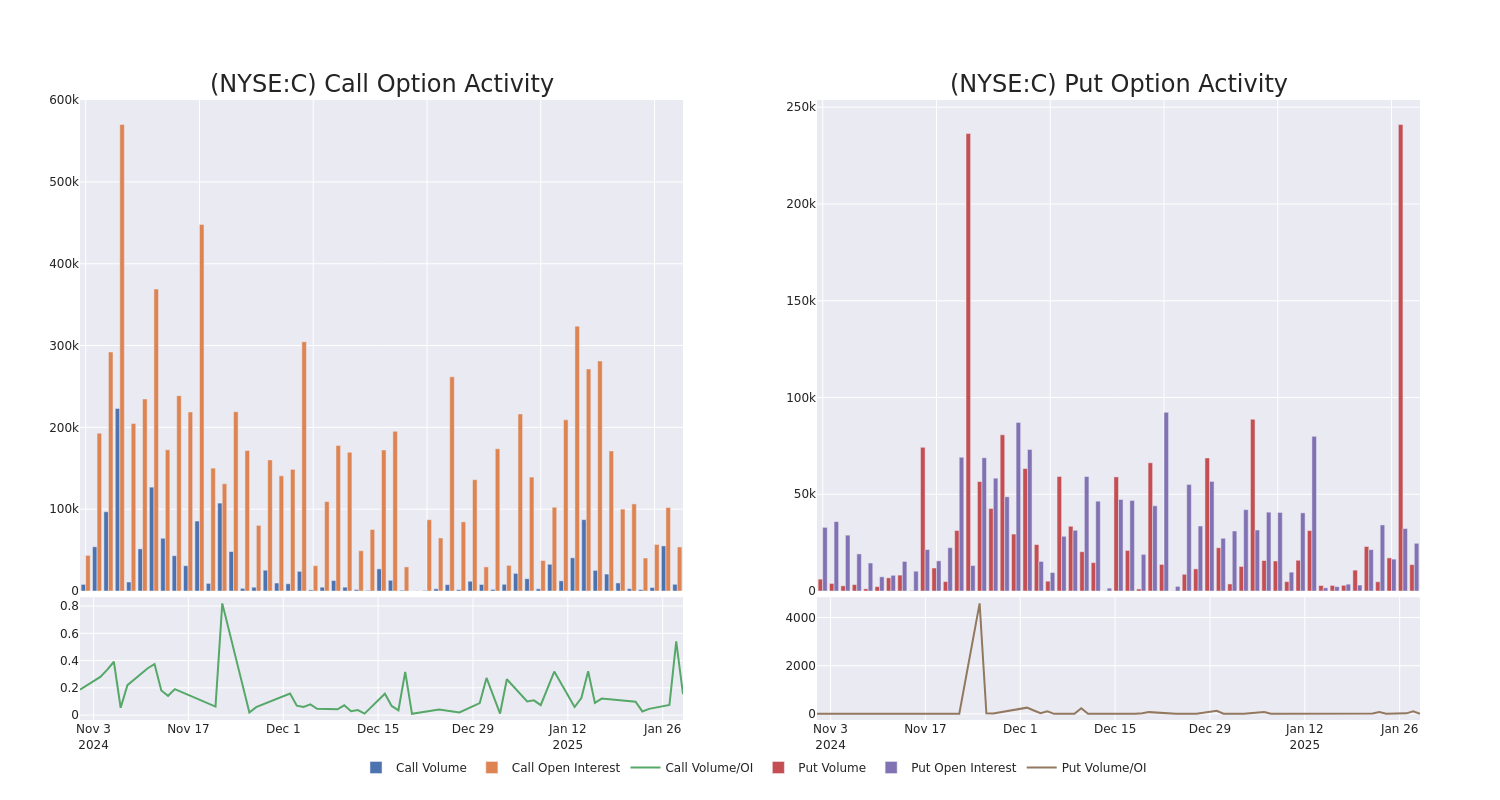

Volume & Open Interest Development

In terms of liquidity and interest, the mean open interest for Citigroup options trades today is 7133.64 with a total volume of 21,884.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for Citigroup's big money trades within a strike price range of $52.5 to $82.0 over the last 30 days.

Citigroup Option Activity Analysis: Last 30 Days

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| C | CALL | SWEEP | BULLISH | 05/16/25 | $4.95 | $4.85 | $4.95 | $80.00 | $424.3K | 23.5K | 2.0K |

| C | CALL | TRADE | NEUTRAL | 01/16/26 | $29.8 | $28.85 | $29.25 | $52.50 | $292.5K | 2.0K | 100 |

| C | PUT | SWEEP | BEARISH | 01/31/25 | $1.09 | $1.06 | $1.08 | $82.00 | $65.0K | 1.7K | 1.2K |

| C | PUT | SWEEP | BEARISH | 01/31/25 | $0.31 | $0.3 | $0.31 | $80.00 | $62.6K | 12.8K | 5.7K |

| C | CALL | SWEEP | BEARISH | 05/16/25 | $12.6 | $12.5 | $12.5 | $70.00 | $62.5K | 365 | 85 |

About Citigroup

Citigroup is a global financial-services company doing business in more than 100 countries and jurisdictions. Citigroup's operations are organized into five primary segments: services, markets, banking, US personal banking, and wealth management. The bank's primary services include cross-border banking needs for multinational corporates, investment banking and trading, and credit card services in the United States.

Following our analysis of the options activities associated with Citigroup, we pivot to a closer look at the company's own performance.

Present Market Standing of Citigroup

- With a trading volume of 3,003,461, the price of C is up by 1.85%, reaching $81.42.

- Current RSI values indicate that the stock is may be overbought.

- Next earnings report is scheduled for 76 days from now.

What The Experts Say On Citigroup

5 market experts have recently issued ratings for this stock, with a consensus target price of $91.6.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access. * An analyst from Piper Sandler has revised its rating downward to Overweight, adjusting the price target to $83. * An analyst from Morgan Stanley persists with their Overweight rating on Citigroup, maintaining a target price of $109. * Maintaining their stance, an analyst from Keefe, Bruyette & Woods continues to hold a Outperform rating for Citigroup, targeting a price of $85. * Maintaining their stance, an analyst from Goldman Sachs continues to hold a Buy rating for Citigroup, targeting a price of $86. * An analyst from B of A Securities persists with their Buy rating on Citigroup, maintaining a target price of $95.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Citigroup with Benzinga Pro for real-time alerts.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.