Investors with a lot of money to spend have taken a bearish stance on United Parcel Service UPS.

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with UPS, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga's options scanner spotted 11 uncommon options trades for United Parcel Service.

This isn't normal.

The overall sentiment of these big-money traders is split between 36% bullish and 45%, bearish.

Out of all of the special options we uncovered, 6 are puts, for a total amount of $281,377, and 5 are calls, for a total amount of $168,262.

Expected Price Movements

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $90.0 to $140.0 for United Parcel Service over the recent three months.

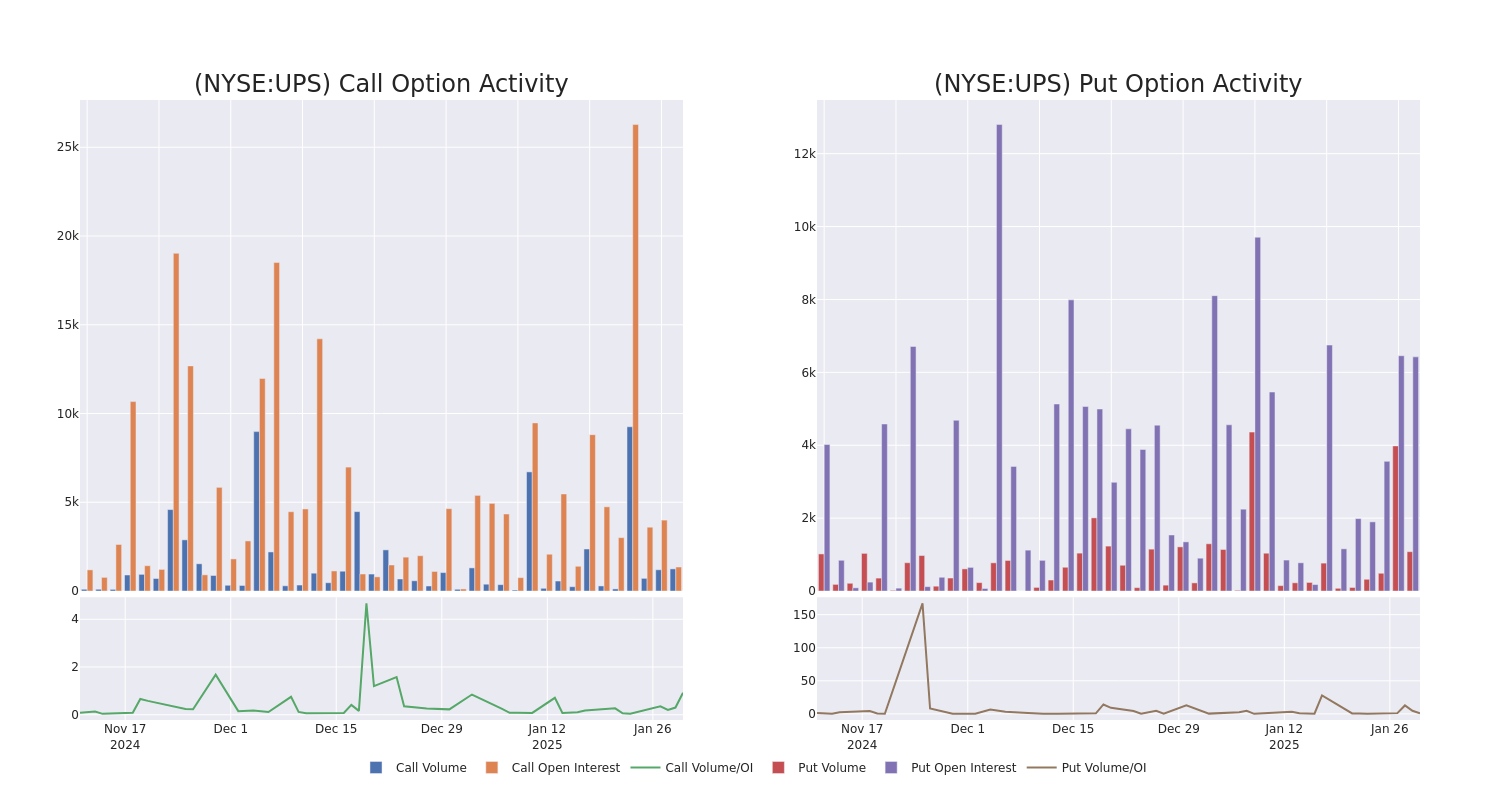

Volume & Open Interest Trends

In terms of liquidity and interest, the mean open interest for United Parcel Service options trades today is 707.18 with a total volume of 2,328.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for United Parcel Service's big money trades within a strike price range of $90.0 to $140.0 over the last 30 days.

United Parcel Service 30-Day Option Volume & Interest Snapshot

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| UPS | PUT | TRADE | BEARISH | 01/16/26 | $27.05 | $25.95 | $27.05 | $140.00 | $81.1K | 959 | 0 |

| UPS | PUT | TRADE | BULLISH | 03/21/25 | $3.55 | $3.3 | $3.35 | $110.00 | $50.2K | 2.0K | 628 |

| UPS | CALL | TRADE | NEUTRAL | 01/15/27 | $9.85 | $8.0 | $9.0 | $130.00 | $45.0K | 954 | 30 |

| UPS | CALL | TRADE | BEARISH | 01/16/26 | $22.95 | $21.65 | $21.98 | $95.00 | $43.9K | 113 | 31 |

| UPS | PUT | SWEEP | BEARISH | 01/31/25 | $21.1 | $20.2 | $21.15 | $134.00 | $42.3K | 1.5K | 236 |

About United Parcel Service

As the world's largest parcel delivery company, UPS manages a massive fleet of more than 500 planes and 100,000 vehicles, along with many hundreds of sorting facilities, to deliver an average of about 22 million packages per day to residences and businesses across the globe. UPS' domestic US package operations generate around 64% of total revenue while international package makes up 20%. Air and ocean freight forwarding and contract logistics make up the remainder.

After a thorough review of the options trading surrounding United Parcel Service, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Present Market Standing of United Parcel Service

- Trading volume stands at 8,635,695, with UPS's price down by -14.98%, positioned at $113.75.

- RSI indicators show the stock to be may be approaching oversold.

- Earnings announcement expected in 0 days.

Professional Analyst Ratings for United Parcel Service

In the last month, 5 experts released ratings on this stock with an average target price of $147.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access. * An analyst from JP Morgan persists with their Neutral rating on United Parcel Service, maintaining a target price of $135. * An analyst from Evercore ISI Group persists with their In-Line rating on United Parcel Service, maintaining a target price of $147. * Consistent in their evaluation, an analyst from Wells Fargo keeps a Overweight rating on United Parcel Service with a target price of $150. * In a positive move, an analyst from B of A Securities has upgraded their rating to Buy and adjusted the price target to $150. * An analyst from Stifel has decided to maintain their Buy rating on United Parcel Service, which currently sits at a price target of $153.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for United Parcel Service with Benzinga Pro for real-time alerts.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.