Deep-pocketed investors have adopted a bearish approach towards Charter Communications CHTR, and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in CHTR usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga's options scanner highlighted 8 extraordinary options activities for Charter Communications. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 12% leaning bullish and 50% bearish. Among these notable options, 4 are puts, totaling $119,850, and 4 are calls, amounting to $630,000.

What's The Price Target?

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $330.0 to $400.0 for Charter Communications over the recent three months.

Insights into Volume & Open Interest

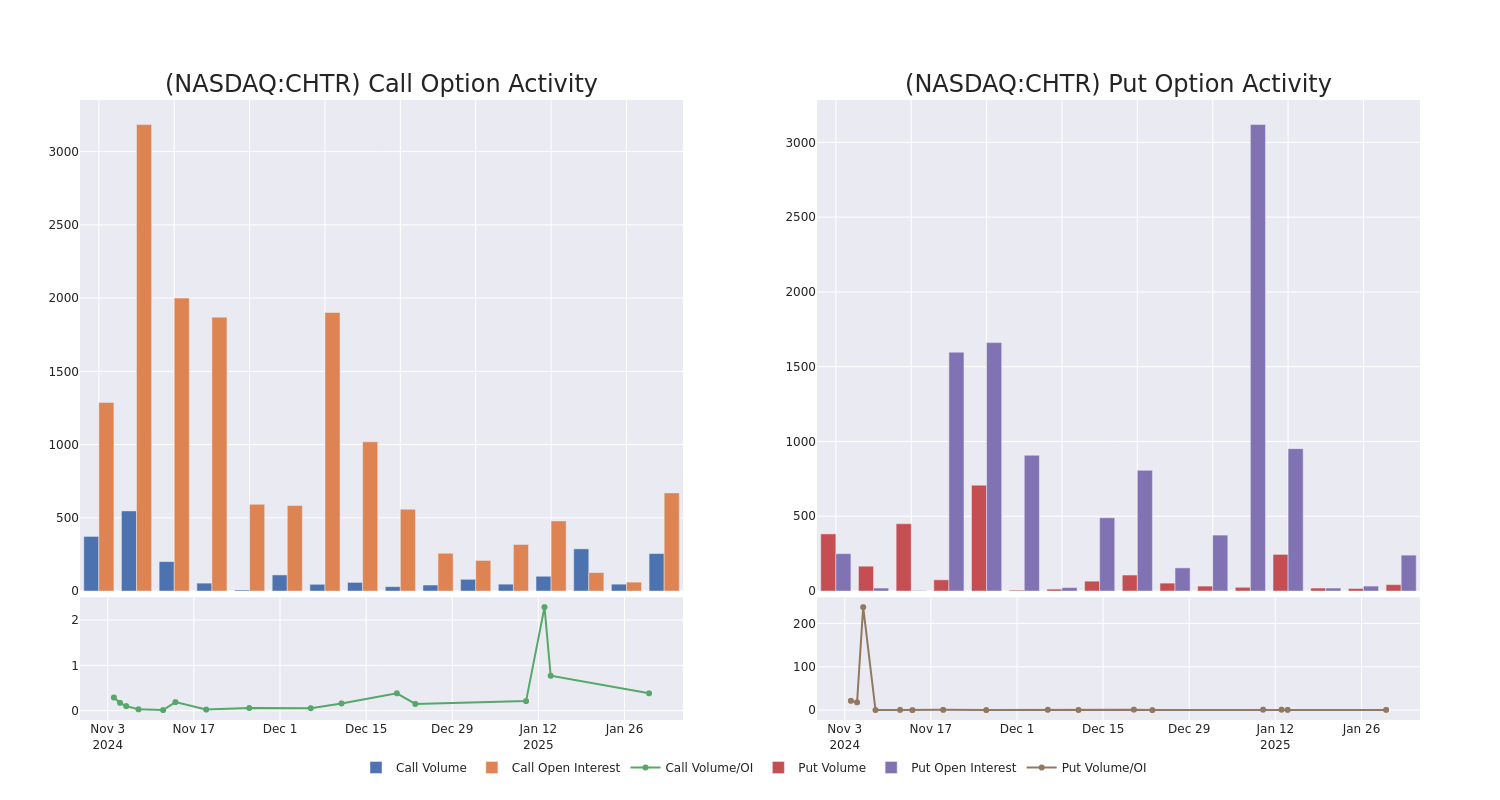

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for Charter Communications's options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Charter Communications's whale activity within a strike price range from $330.0 to $400.0 in the last 30 days.

Charter Communications Option Volume And Open Interest Over Last 30 Days

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CHTR | CALL | TRADE | NEUTRAL | 01/16/26 | $46.8 | $15.5 | $33.4 | $400.00 | $334.0K | 629 | 150 |

| CHTR | CALL | TRADE | BEARISH | 01/16/26 | $36.0 | $32.0 | $32.0 | $400.00 | $160.0K | 629 | 150 |

| CHTR | CALL | SWEEP | BULLISH | 01/31/25 | $11.0 | $10.1 | $11.0 | $350.00 | $110.0K | 40 | 101 |

| CHTR | PUT | TRADE | BEARISH | 01/16/26 | $54.2 | $53.3 | $53.9 | $360.00 | $32.3K | 117 | 28 |

| CHTR | PUT | TRADE | NEUTRAL | 01/16/26 | $53.9 | $52.6 | $53.3 | $360.00 | $31.9K | 117 | 6 |

About Charter Communications

Charter is the product of the 2016 merger of three cable companies, each with a decades-long history in the business: Legacy Charter, Time Warner Cable, and Bright House Networks. The firm now holds networks capable of providing television, internet access, and phone services to roughly 58 million US homes and businesses, around 35% of the country. Across this footprint, Charter serves 29 million residential and 2 million commercial customer accounts under the Spectrum brand, making it the second-largest US cable company behind Comcast. The firm also owns, in whole or in part, sports and news networks, including Spectrum SportsNet (long-term local rights to Los Angeles Lakers games), SportsNet LA (Los Angeles Dodgers), SportsNet New York (New York Mets), and Spectrum News NY1.

Present Market Standing of Charter Communications

- Currently trading with a volume of 720,636, the CHTR's price is down by -5.72%, now at $338.79.

- RSI readings suggest the stock is currently is currently neutral between overbought and oversold.

- Anticipated earnings release is in 1 days.

Expert Opinions on Charter Communications

In the last month, 1 experts released ratings on this stock with an average target price of $380.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access. * Maintaining their stance, an analyst from RBC Capital continues to hold a Sector Perform rating for Charter Communications, targeting a price of $380.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Charter Communications with Benzinga Pro for real-time alerts.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.