High-rolling investors have positioned themselves bearish on GameStop GME, and it's important for retail traders to take note. \This activity came to our attention today through Benzinga's tracking of publicly available options data. The identities of these investors are uncertain, but such a significant move in GME often signals that someone has privileged information.

Today, Benzinga's options scanner spotted 18 options trades for GameStop. This is not a typical pattern.

The sentiment among these major traders is split, with 38% bullish and 50% bearish. Among all the options we identified, there was one put, amounting to $28,600, and 17 calls, totaling $1,007,697.

What's The Price Target?

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $10.0 and $65.0 for GameStop, spanning the last three months.

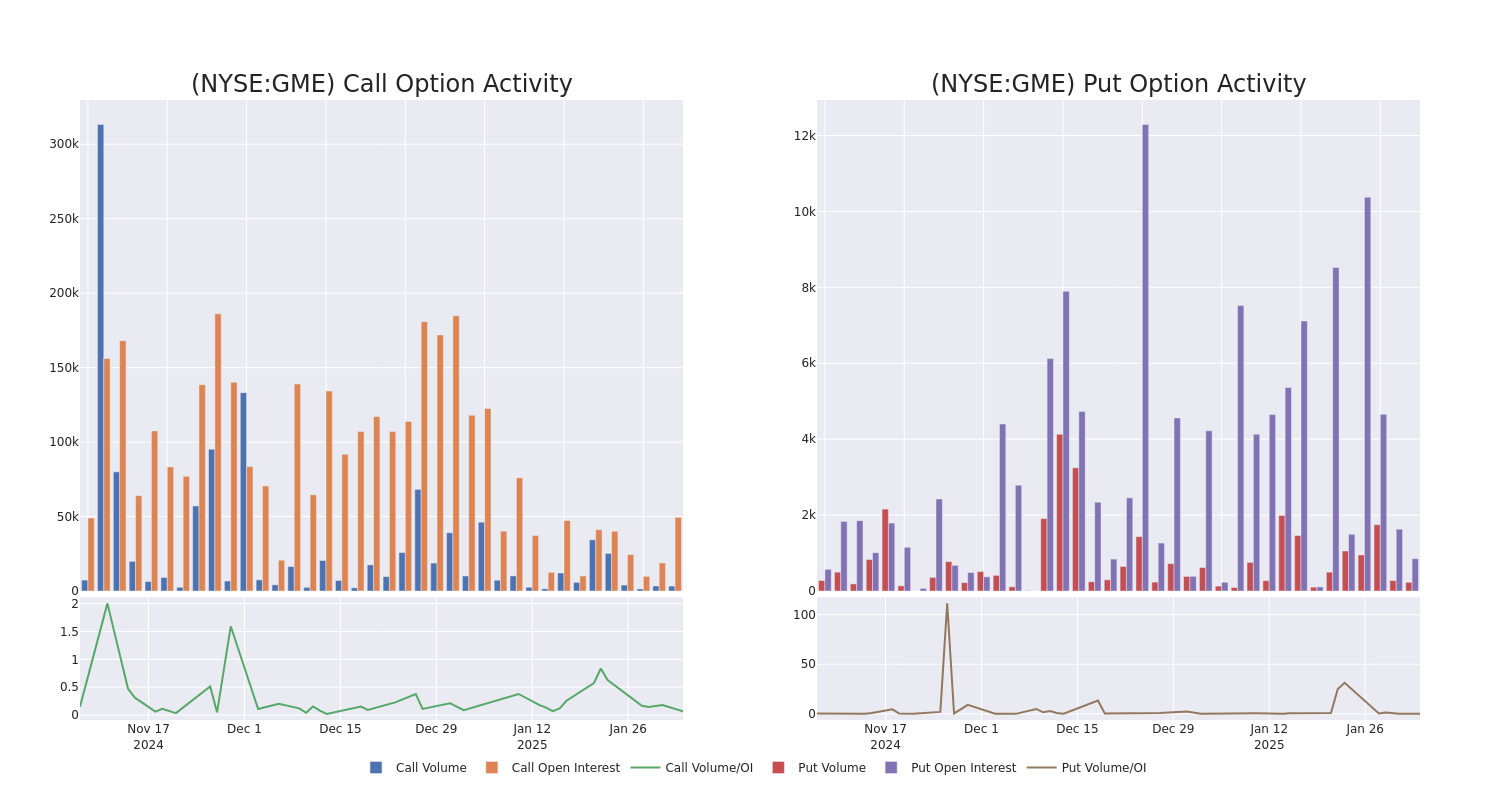

Volume & Open Interest Trends

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for GameStop's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of GameStop's whale trades within a strike price range from $10.0 to $65.0 in the last 30 days.

GameStop Option Activity Analysis: Last 30 Days

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| GME | CALL | SWEEP | BULLISH | 04/17/25 | $10.9 | $9.0 | $10.9 | $16.00 | $218.0K | 400 | 0 |

| GME | CALL | SWEEP | BULLISH | 01/16/26 | $17.0 | $16.45 | $16.99 | $10.00 | $186.9K | 4.2K | 212 |

| GME | CALL | SWEEP | NEUTRAL | 01/16/26 | $6.6 | $6.25 | $6.4 | $35.00 | $70.4K | 1.5K | 288 |

| GME | CALL | SWEEP | BEARISH | 04/17/25 | $6.95 | $6.75 | $6.75 | $20.00 | $70.2K | 4.4K | 300 |

| GME | CALL | SWEEP | BEARISH | 04/17/25 | $2.78 | $2.77 | $2.77 | $30.00 | $55.4K | 14.4K | 258 |

About GameStop

GameStop Corp is a U.S. multichannel video game, consumer electronics, and services retailer. The company operates across Europe, Canada, Australia, and the United States. GameStop sells new and second-hand video game hardware, physical and digital video game software, and video game accessories, mainly through GameStop, EB Games, and Micromania stores and international e-commerce sites. The majority of sales are from the United States.

Following our analysis of the options activities associated with GameStop, we pivot to a closer look at the company's own performance.

Present Market Standing of GameStop

- Currently trading with a volume of 3,325,876, the GME's price is down by -3.4%, now at $25.98.

- RSI readings suggest the stock is currently may be oversold.

- Anticipated earnings release is in 50 days.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for GameStop, Benzinga Pro gives you real-time options trades alerts.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.