Whales with a lot of money to spend have taken a noticeably bullish stance on MicroStrategy.

Looking at options history for MicroStrategy MSTR we detected 247 trades.

If we consider the specifics of each trade, it is accurate to state that 44% of the investors opened trades with bullish expectations and 32% with bearish.

From the overall spotted trades, 67 are puts, for a total amount of $4,399,689 and 180, calls, for a total amount of $11,016,412.

Projected Price Targets

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $0.5 to $1080.0 for MicroStrategy during the past quarter.

Analyzing Volume & Open Interest

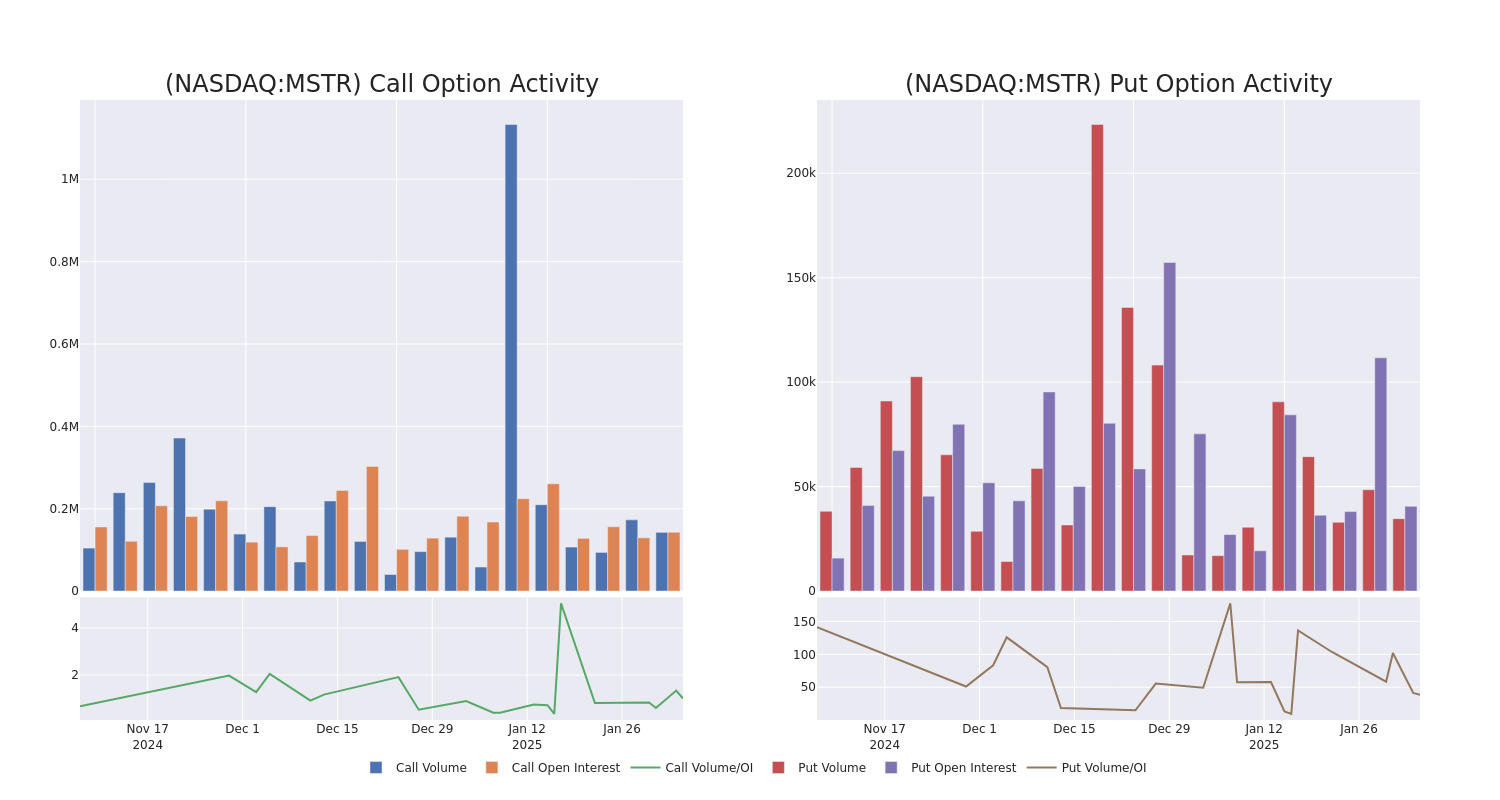

In today's trading context, the average open interest for options of MicroStrategy stands at 1416.88, with a total volume reaching 176,809.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in MicroStrategy, situated within the strike price corridor from $0.5 to $1080.0, throughout the last 30 days.

MicroStrategy 30-Day Option Volume & Interest Snapshot

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| MSTR | CALL | SWEEP | BULLISH | 02/28/25 | $4.3 | $4.2 | $4.3 | $500.00 | $187.9K | 2.3K | 947 |

| MSTR | CALL | TRADE | BEARISH | 02/07/25 | $16.7 | $16.35 | $16.35 | $345.00 | $163.5K | 1.4K | 2.5K |

| MSTR | CALL | TRADE | NEUTRAL | 04/17/25 | $21.25 | $20.7 | $20.97 | $510.00 | $125.8K | 3.6K | 73 |

| MSTR | PUT | TRADE | BEARISH | 02/07/25 | $5.65 | $5.6 | $5.65 | $330.00 | $113.0K | 1.7K | 3.3K |

| MSTR | PUT | TRADE | NEUTRAL | 06/20/25 | $227.2 | $224.45 | $225.81 | $550.00 | $112.9K | 31 | 5 |

About MicroStrategy

MicroStrategy Inc is a provider of enterprise analytics and mobility software. It offers MicroStrategy Analytics platform that delivers reports and dashboards and enables users to conduct ad hoc analysis and share insights through mobile devices or the Web; MicroStrategy Server, which provides analytical processing and job management. The company's reportable operating segment is engaged in the design, development, marketing, and sales of its software platform through licensing arrangements and cloud-based subscriptions and related services.

Having examined the options trading patterns of MicroStrategy, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Present Market Standing of MicroStrategy

- With a volume of 9,022,359, the price of MSTR is up 0.08% at $347.38.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 1 days.

What The Experts Say On MicroStrategy

3 market experts have recently issued ratings for this stock, with a consensus target price of $605.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access. * An analyst from Benchmark has revised its rating downward to Buy, adjusting the price target to $650. * Reflecting concerns, an analyst from Mizuho lowers its rating to Outperform with a new price target of $515. * In a cautious move, an analyst from Benchmark downgraded its rating to Buy, setting a price target of $650.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for MicroStrategy with Benzinga Pro for real-time alerts.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.