Financial giants have made a conspicuous bearish move on Blackstone. Our analysis of options history for Blackstone BX revealed 12 unusual trades.

Delving into the details, we found 33% of traders were bullish, while 58% showed bearish tendencies. Out of all the trades we spotted, 8 were puts, with a value of $337,789, and 4 were calls, valued at $370,638.

Expected Price Movements

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $130.0 to $190.0 for Blackstone during the past quarter.

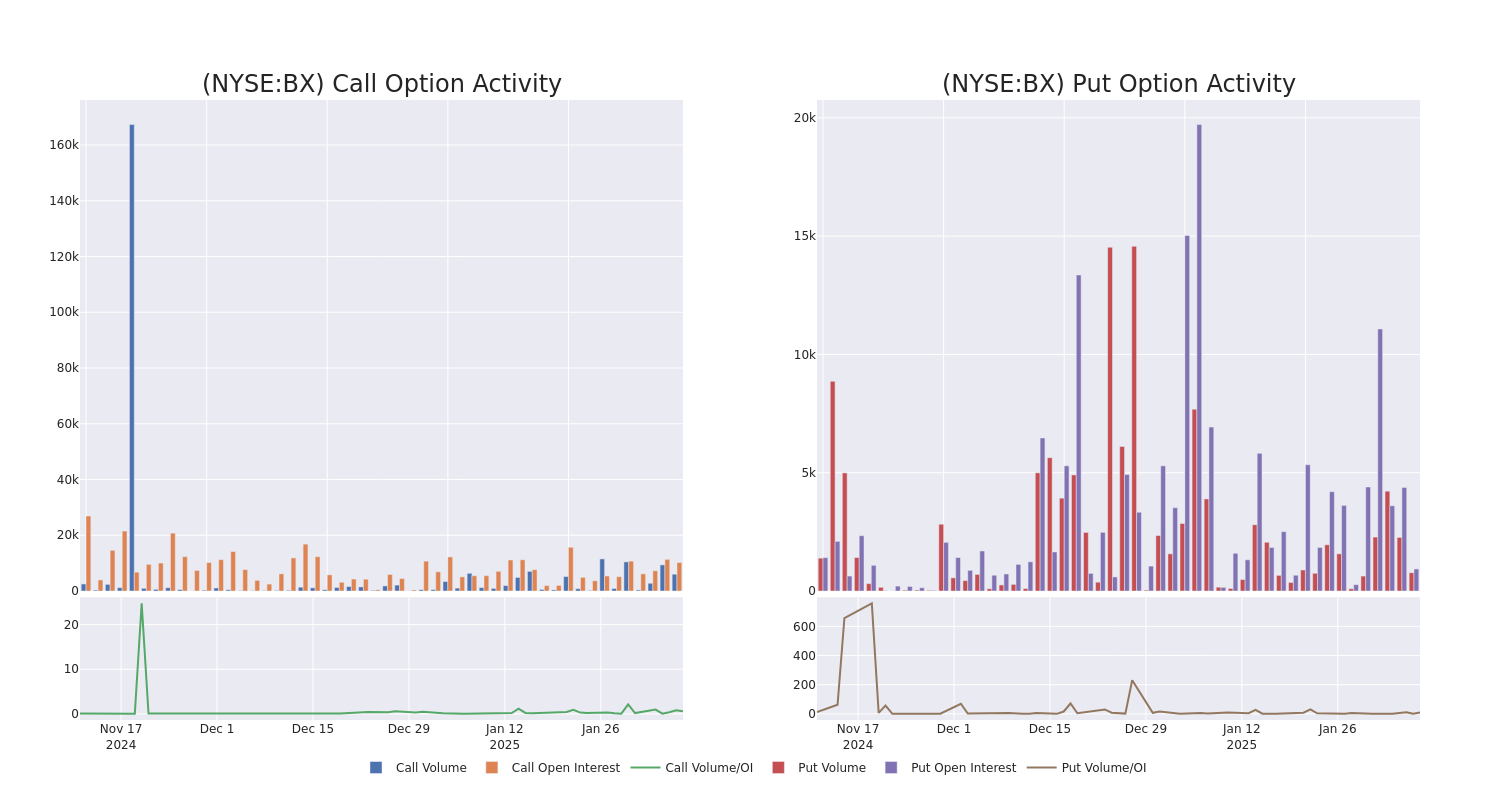

Volume & Open Interest Development

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Blackstone's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Blackstone's substantial trades, within a strike price spectrum from $130.0 to $190.0 over the preceding 30 days.

Blackstone Option Volume And Open Interest Over Last 30 Days

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| BX | CALL | TRADE | BULLISH | 01/16/26 | $41.85 | $41.85 | $41.85 | $140.00 | $142.2K | 882 | 34 |

| BX | CALL | SWEEP | BULLISH | 03/21/25 | $2.37 | $2.29 | $2.37 | $185.00 | $118.5K | 3.3K | 1.0K |

| BX | CALL | SWEEP | BEARISH | 02/07/25 | $0.2 | $0.1 | $0.13 | $177.50 | $75.0K | 5.4K | 5.0K |

| BX | PUT | SWEEP | BULLISH | 02/28/25 | $3.15 | $2.91 | $2.91 | $165.00 | $62.8K | 39 | 223 |

| BX | PUT | TRADE | BEARISH | 05/16/25 | $15.6 | $15.1 | $15.46 | $180.00 | $51.0K | 501 | 164 |

About Blackstone

Blackstone is the world's largest alternative-asset manager with $1.108 trillion in total asset under management, including $820.5 billion in fee-earning assets under management, at the end of September 2024. The company has four core business segments: private equity (25% of fee-earning AUM and 30% of base management fees), real estate (35% and 39%), credit and insurance (31% and 24%), and multi-asset investing (9% and 7%). While the firm primarily serves institutional investors (87% of AUM), it also caters to clients in the high-net-worth channel (13%). Blackstone operates through 25 offices in the Americas (8), Europe and the Middle East (9), and the Asia-Pacific region (8).

Having examined the options trading patterns of Blackstone, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Blackstone's Current Market Status

- Trading volume stands at 1,397,639, with BX's price down by -1.21%, positioned at $172.44.

- RSI indicators show the stock to be may be approaching overbought.

- Earnings announcement expected in 69 days.

What The Experts Say On Blackstone

Over the past month, 5 industry analysts have shared their insights on this stock, proposing an average target price of $180.4.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access. * An analyst from JP Morgan persists with their Neutral rating on Blackstone, maintaining a target price of $154. * An analyst from UBS has decided to maintain their Neutral rating on Blackstone, which currently sits at a price target of $180. * Maintaining their stance, an analyst from Barclays continues to hold a Equal-Weight rating for Blackstone, targeting a price of $186. * Maintaining their stance, an analyst from Citigroup continues to hold a Neutral rating for Blackstone, targeting a price of $190. * An analyst from Barclays has decided to maintain their Equal-Weight rating on Blackstone, which currently sits at a price target of $192.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Blackstone with Benzinga Pro for real-time alerts.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.