Whales with a lot of money to spend have taken a noticeably bearish stance on Royal Caribbean Gr.

Looking at options history for Royal Caribbean Gr RCL we detected 12 trades.

If we consider the specifics of each trade, it is accurate to state that 33% of the investors opened trades with bullish expectations and 58% with bearish.

From the overall spotted trades, 8 are puts, for a total amount of $427,970 and 4, calls, for a total amount of $121,910.

What's The Price Target?

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $160.0 to $280.0 for Royal Caribbean Gr over the recent three months.

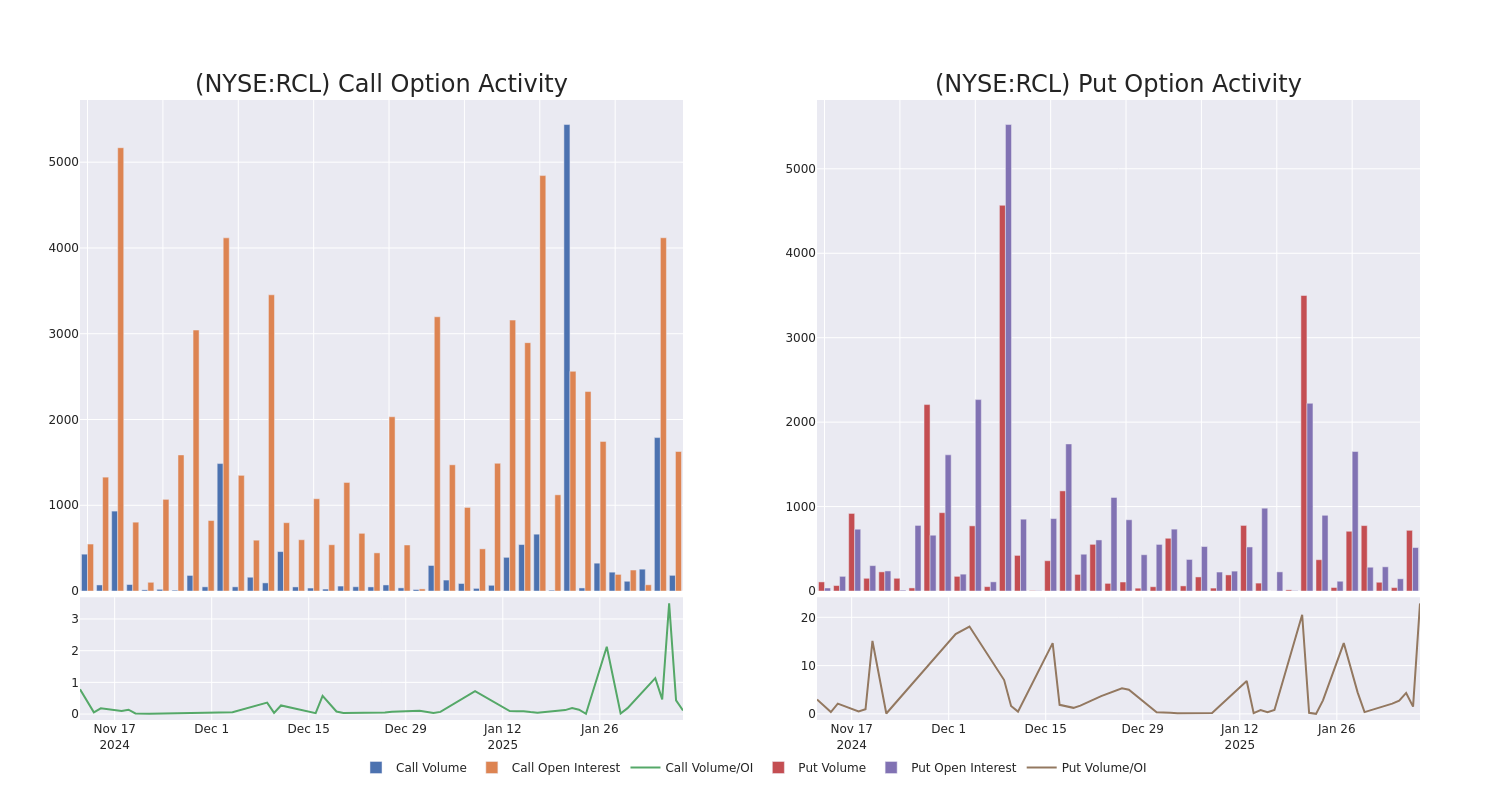

Volume & Open Interest Development

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for Royal Caribbean Gr's options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Royal Caribbean Gr's whale activity within a strike price range from $160.0 to $280.0 in the last 30 days.

Royal Caribbean Gr Option Activity Analysis: Last 30 Days

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| RCL | PUT | SWEEP | BEARISH | 04/17/25 | $19.9 | $19.2 | $19.9 | $280.00 | $69.6K | 29 | 69 |

| RCL | PUT | SWEEP | BEARISH | 04/17/25 | $19.9 | $19.6 | $19.6 | $280.00 | $66.8K | 29 | 34 |

| RCL | PUT | TRADE | BULLISH | 04/17/25 | $19.9 | $19.55 | $19.55 | $280.00 | $66.4K | 29 | 103 |

| RCL | PUT | SWEEP | BEARISH | 04/17/25 | $22.1 | $21.65 | $22.1 | $280.00 | $50.8K | 29 | 126 |

| RCL | PUT | SWEEP | BEARISH | 04/17/25 | $17.0 | $16.55 | $16.89 | $270.00 | $50.7K | 323 | 34 |

About Royal Caribbean Gr

Royal Caribbean is the world's second-largest cruise company, operating 66 ships across five global and partner brands in the cruise vacation industry. Brands the company operates include Royal Caribbean International, Celebrity Cruises, and Silversea. The company also has a 50% investment in a joint venture that operates TUI Cruises and Hapag-Lloyd Cruises. The selection of brands in the portfolio allows Royal to compete on the basis of innovation, quality of ships and service, variety of itineraries, choice of destinations, and price. The company completed the divestiture of its Azamara brand in 2021 and plans to launch its new Celebrity River Cruise brand in 2027.

After a thorough review of the options trading surrounding Royal Caribbean Gr, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Present Market Standing of Royal Caribbean Gr

- Trading volume stands at 758,880, with RCL's price down by -1.26%, positioned at $266.78.

- RSI indicators show the stock to be is currently neutral between overbought and oversold.

- Earnings announcement expected in 76 days.

Professional Analyst Ratings for Royal Caribbean Gr

Over the past month, 5 industry analysts have shared their insights on this stock, proposing an average target price of $293.2.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access. * Consistent in their evaluation, an analyst from Argus Research keeps a Buy rating on Royal Caribbean Gr with a target price of $305. * An analyst from Susquehanna persists with their Positive rating on Royal Caribbean Gr, maintaining a target price of $305. * An analyst from Loop Capital has revised its rating downward to Hold, adjusting the price target to $250. * An analyst from UBS persists with their Buy rating on Royal Caribbean Gr, maintaining a target price of $301. * An analyst from Goldman Sachs persists with their Buy rating on Royal Caribbean Gr, maintaining a target price of $305.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Royal Caribbean Gr, Benzinga Pro gives you real-time options trades alerts.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.