Financial giants have made a conspicuous bullish move on ASML Holding. Our analysis of options history for ASML Holding ASML revealed 19 unusual trades.

Delving into the details, we found 47% of traders were bullish, while 42% showed bearish tendencies. Out of all the trades we spotted, 5 were puts, with a value of $254,980, and 14 were calls, valued at $832,976.

Expected Price Movements

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $500.0 to $840.0 for ASML Holding over the recent three months.

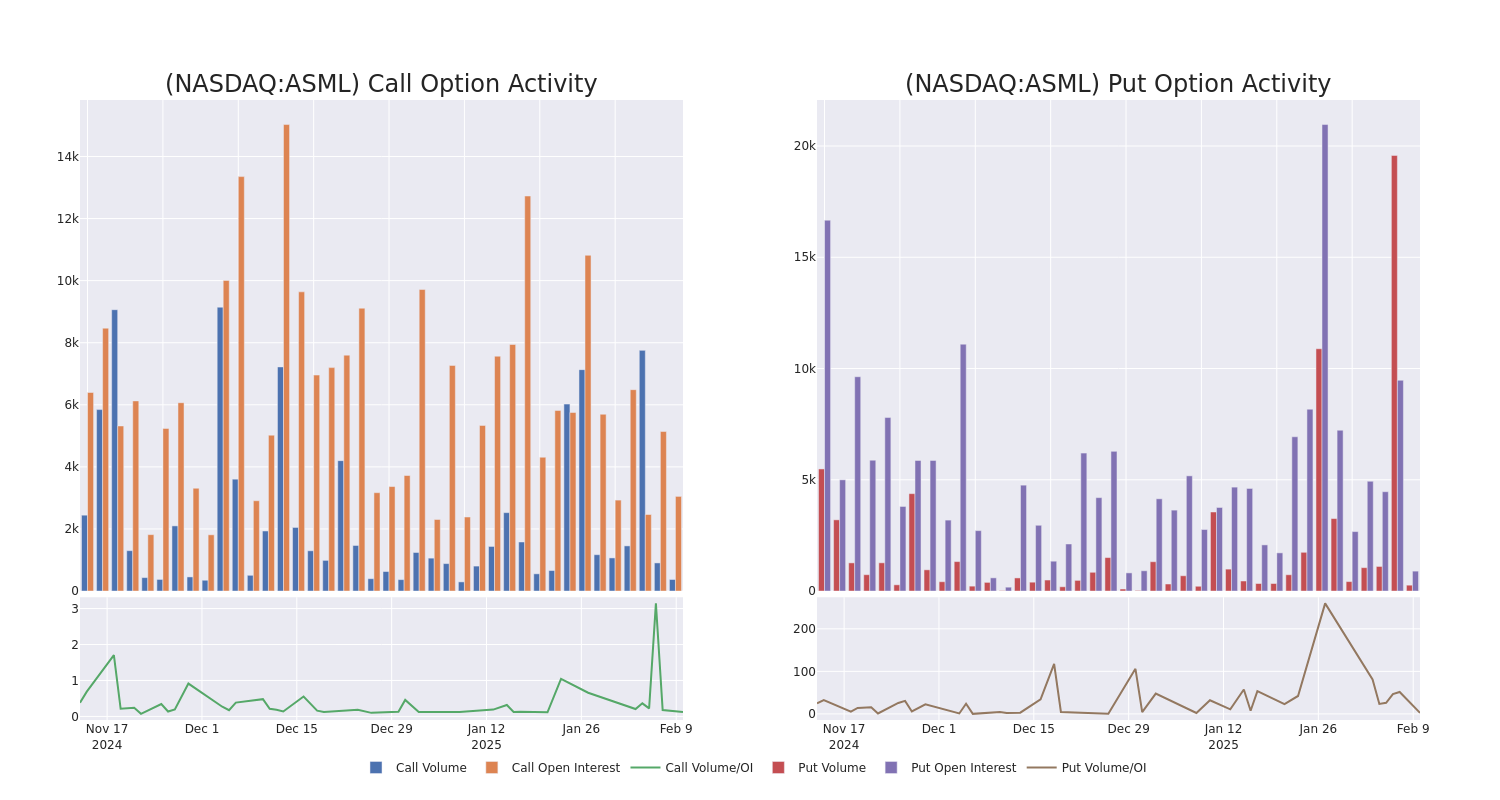

Volume & Open Interest Development

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for ASML Holding's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of ASML Holding's whale trades within a strike price range from $500.0 to $840.0 in the last 30 days.

ASML Holding Option Volume And Open Interest Over Last 30 Days

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ASML | CALL | TRADE | BULLISH | 06/20/25 | $89.0 | $87.5 | $89.0 | $700.00 | $178.0K | 145 | 22 |

| ASML | CALL | TRADE | BEARISH | 03/21/25 | $34.7 | $34.2 | $34.2 | $740.00 | $112.8K | 601 | 34 |

| ASML | PUT | TRADE | BULLISH | 05/16/25 | $34.8 | $34.2 | $34.2 | $700.00 | $112.8K | 285 | 0 |

| ASML | CALL | SWEEP | BULLISH | 02/28/25 | $56.4 | $54.9 | $56.25 | $690.00 | $90.1K | 33 | 16 |

| ASML | CALL | SWEEP | NEUTRAL | 02/21/25 | $17.9 | $17.1 | $17.5 | $740.00 | $87.5K | 440 | 9 |

About ASML Holding

ASML is the leader in photolithography systems used in manufacturing semiconductors. Photolithography is the process in which a light source is used to expose circuit patterns from a photo mask onto a semiconductor wafer. The latest technological advances in this segment allow chipmakers to continually increase the number of transistors on the same area of silicon, with lithography historically representing a high portion of the cost of making cutting-edge chips. ASML outsources the manufacturing of most of its parts, acting like an assembler. ASML's main clients are TSMC, Samsung, and Intel.

Following our analysis of the options activities associated with ASML Holding, we pivot to a closer look at the company's own performance.

Present Market Standing of ASML Holding

- With a trading volume of 295,767, the price of ASML is up by 1.68%, reaching $739.93.

- Current RSI values indicate that the stock is may be approaching overbought.

- Next earnings report is scheduled for 65 days from now.

Expert Opinions on ASML Holding

A total of 2 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $980.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access. * Maintaining their stance, an analyst from JP Morgan continues to hold a Overweight rating for ASML Holding, targeting a price of $1100. * An analyst from Wells Fargo has decided to maintain their Overweight rating on ASML Holding, which currently sits at a price target of $860.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest ASML Holding options trades with real-time alerts from Benzinga Pro.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.