Investors with a lot of money to spend have taken a bearish stance on Roku ROKU.

And retail traders should know.

We noticed this today when the positions showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with ROKU, it often means somebody knows something is about to happen.

Today, Benzinga's options scanner spotted 22 options trades for Roku.

This isn't normal.

The overall sentiment of these big-money traders is split between 22% bullish and 63%, bearish.

Out of all of the options we uncovered, there was 1 put, for a total amount of $25,200, and 21, calls, for a total amount of $1,601,305.

Predicted Price Range

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $75.0 and $125.0 for Roku, spanning the last three months.

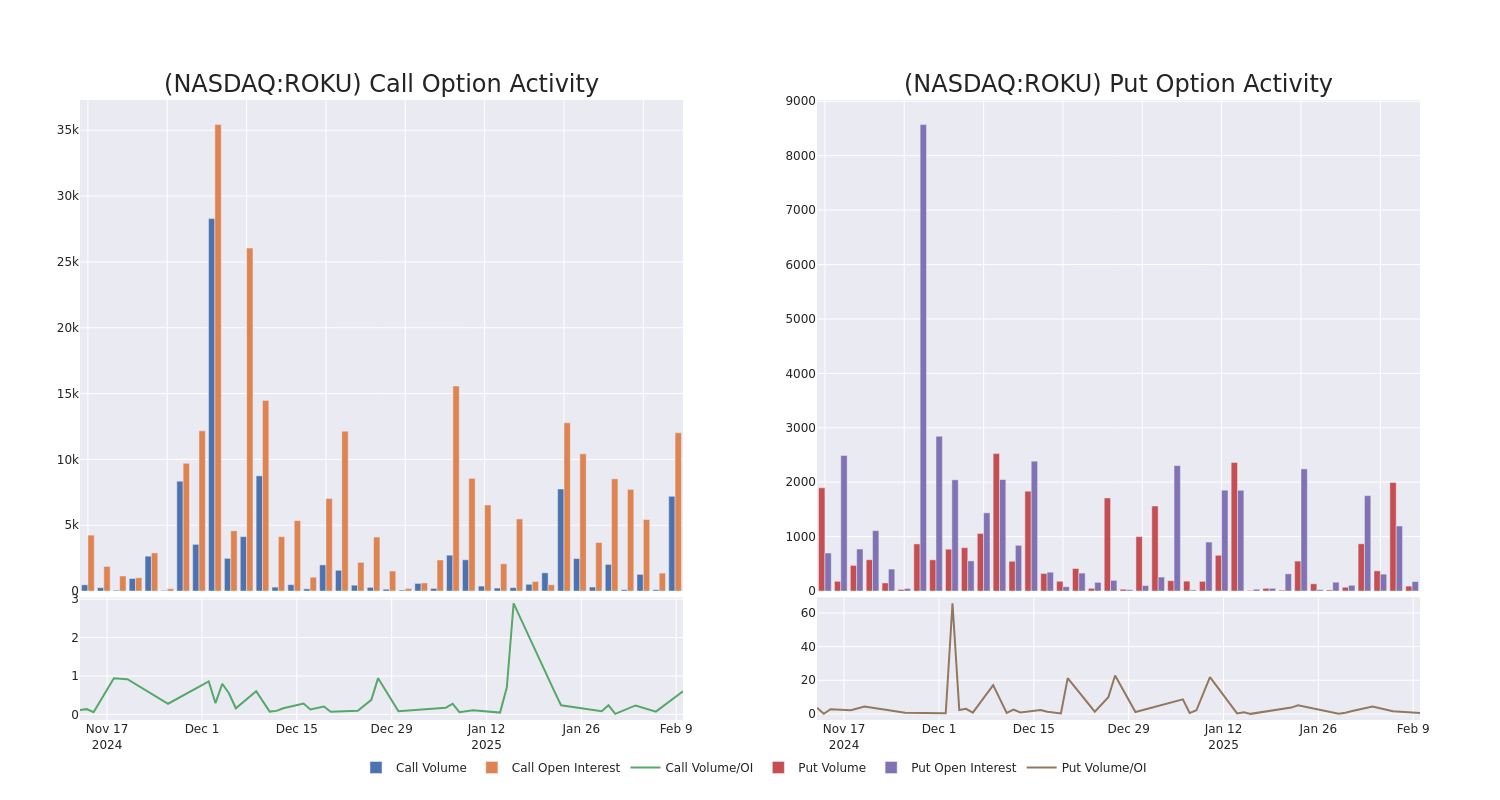

Volume & Open Interest Development

In today's trading context, the average open interest for options of Roku stands at 937.46, with a total volume reaching 7,289.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Roku, situated within the strike price corridor from $75.0 to $125.0, throughout the last 30 days.

Roku Call and Put Volume: 30-Day Overview

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ROKU | CALL | TRADE | BULLISH | 06/20/25 | $13.75 | $13.15 | $13.55 | $90.00 | $308.9K | 739 | 277 |

| ROKU | CALL | SWEEP | BEARISH | 03/21/25 | $5.35 | $5.3 | $5.3 | $100.00 | $248.0K | 2.6K | 178 |

| ROKU | CALL | TRADE | BULLISH | 02/14/25 | $11.55 | $11.3 | $11.5 | $80.00 | $115.0K | 1.3K | 18 |

| ROKU | CALL | TRADE | NEUTRAL | 03/21/25 | $19.25 | $18.4 | $18.75 | $75.00 | $110.6K | 1.6K | 67 |

| ROKU | CALL | SWEEP | BEARISH | 02/21/25 | $9.6 | $9.05 | $9.06 | $85.00 | $93.6K | 3.0K | 349 |

About Roku

Roku enables consumers to stream television programming. It has more than 80 million streaming households and provided well over 100 billion streaming hours in 2023. Roku is the top streaming operating system in the US, reaching more than half of broadband households, according to the company. Roku's OS is built into streaming devices and televisions that Roku sells and on connected televisions from other manufacturers that license Roku's name and software. Roku also operates the Roku Channel, a free, ad-supported streaming television platform that offers a mix of on-demand and live television programming. Roku generates revenue primarily from selling devices, licensing, and advertising, and it receives fees from subscription streaming platforms that sell subscriptions through Roku.

Having examined the options trading patterns of Roku, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Present Market Standing of Roku

- Currently trading with a volume of 3,524,352, the ROKU's price is up by 3.92%, now at $88.33.

- RSI readings suggest the stock is currently is currently neutral between overbought and oversold.

- Anticipated earnings release is in 3 days.

Expert Opinions on Roku

A total of 2 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $95.0.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access. * An analyst from JMP Securities has revised its rating downward to Market Outperform, adjusting the price target to $95. * In a cautious move, an analyst from JMP Securities downgraded its rating to Market Outperform, setting a price target of $95.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Roku with Benzinga Pro for real-time alerts.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.