Whales with a lot of money to spend have taken a noticeably bullish stance on Nike.

Looking at options history for Nike NKE we detected 26 trades.

If we consider the specifics of each trade, it is accurate to state that 53% of the investors opened trades with bullish expectations and 38% with bearish.

From the overall spotted trades, 14 are puts, for a total amount of $2,030,410 and 12, calls, for a total amount of $571,236.

Projected Price Targets

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $50.0 and $120.0 for Nike, spanning the last three months.

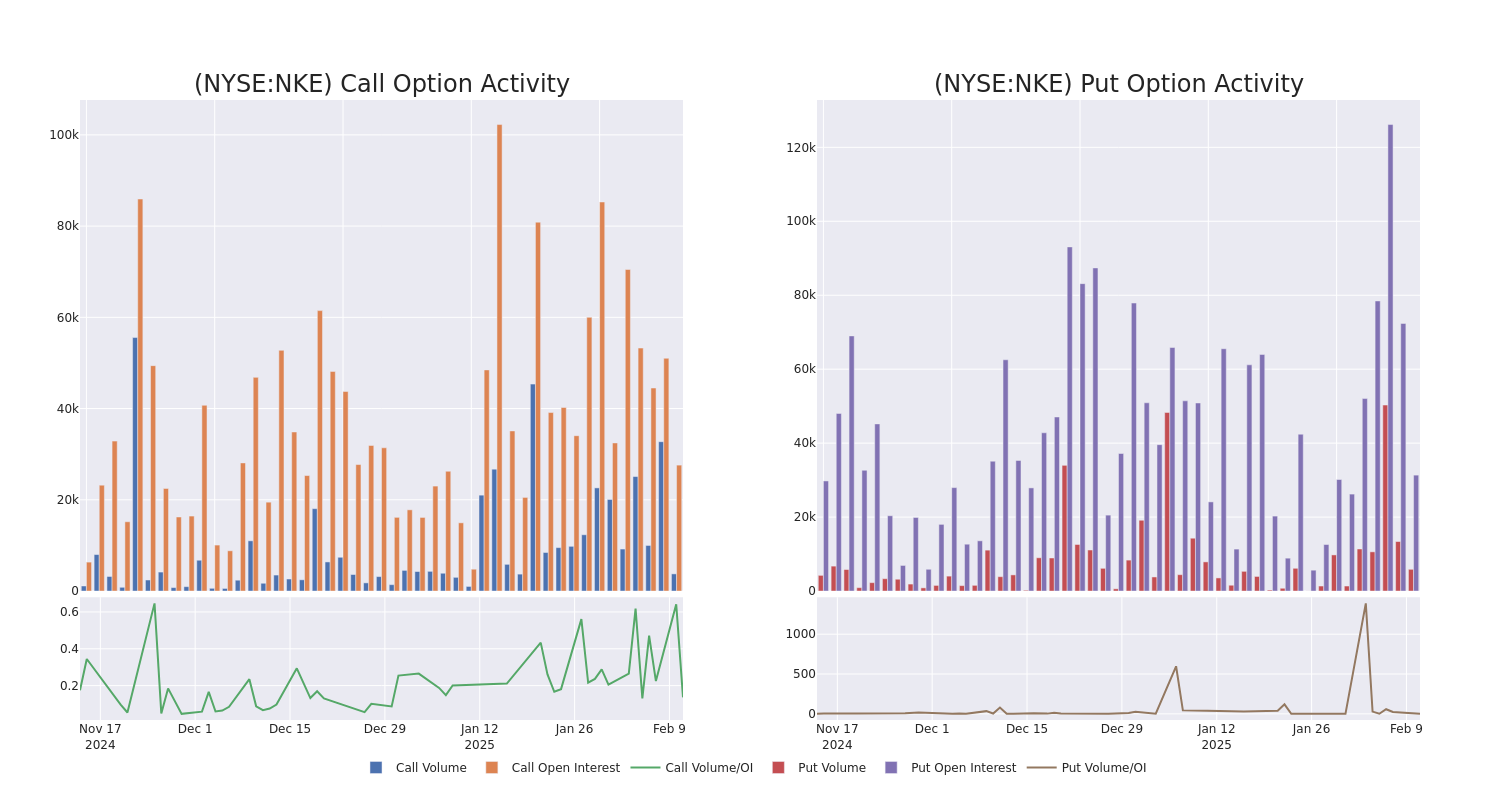

Volume & Open Interest Trends

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Nike's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Nike's whale trades within a strike price range from $50.0 to $120.0 in the last 30 days.

Nike Call and Put Volume: 30-Day Overview

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| NKE | PUT | TRADE | BEARISH | 01/15/27 | $9.35 | $8.35 | $9.02 | $67.50 | $1.3M | 2.3K | 1.5K |

| NKE | CALL | TRADE | NEUTRAL | 01/15/27 | $15.5 | $14.9 | $15.2 | $70.00 | $91.2K | 1.0K | 81 |

| NKE | PUT | SWEEP | BULLISH | 04/17/25 | $6.3 | $6.2 | $6.2 | $75.00 | $74.4K | 5.7K | 805 |

| NKE | PUT | SWEEP | BULLISH | 04/17/25 | $6.3 | $6.2 | $6.2 | $75.00 | $74.4K | 5.7K | 925 |

| NKE | CALL | SWEEP | BULLISH | 04/17/25 | $3.05 | $3.0 | $3.05 | $75.00 | $71.5K | 4.2K | 1.2K |

About Nike

Nike is the largest athletic footwear and apparel brand in the world. Key categories include basketball, running, and football (soccer). Footwear generates about two thirds of its sales. Its brands include Nike, Jordan (premium athletic footwear and clothing), and Converse (casual footwear). Nike sells products worldwide through company-owned stores, franchised stores, and third-party retailers. The firm also operates e-commerce platforms in more than 40 countries. Nearly all its production is outsourced to contract manufacturers in more than 30 countries. Nike was founded in 1964 and is based in Beaverton, Oregon.

Nike's Current Market Status

- With a volume of 3,534,698, the price of NKE is down -0.62% at $70.5.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 37 days.

Professional Analyst Ratings for Nike

Over the past month, 4 industry analysts have shared their insights on this stock, proposing an average target price of $82.75.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access. * In a cautious move, an analyst from Citigroup downgraded its rating to Neutral, setting a price target of $72. * In a cautious move, an analyst from Needham downgraded its rating to Buy, setting a price target of $84. * Maintaining their stance, an analyst from Telsey Advisory Group continues to hold a Market Perform rating for Nike, targeting a price of $80. * An analyst from BMO Capital persists with their Outperform rating on Nike, maintaining a target price of $95.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Nike, Benzinga Pro gives you real-time options trades alerts.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.