Financial giants have made a conspicuous bullish move on CVS Health. Our analysis of options history for CVS Health CVS revealed 28 unusual trades.

Delving into the details, we found 42% of traders were bullish, while 39% showed bearish tendencies. Out of all the trades we spotted, 7 were puts, with a value of $260,007, and 21 were calls, valued at $948,483.

Projected Price Targets

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $40.0 to $75.0 for CVS Health over the last 3 months.

Volume & Open Interest Development

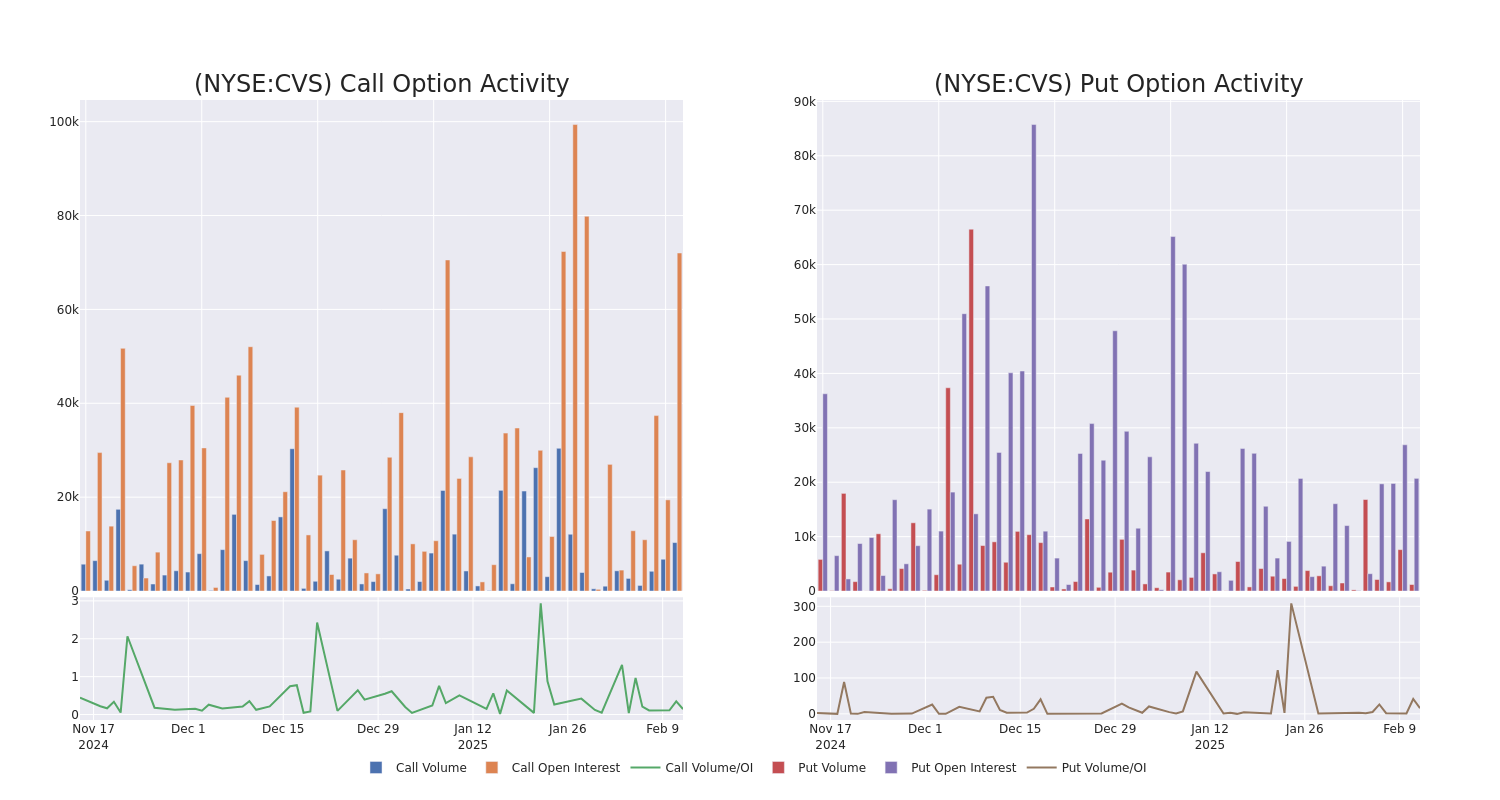

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for CVS Health's options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of CVS Health's whale activity within a strike price range from $40.0 to $75.0 in the last 30 days.

CVS Health 30-Day Option Volume & Interest Snapshot

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CVS | CALL | SWEEP | BULLISH | 09/19/25 | $2.35 | $2.13 | $2.35 | $75.00 | $116.7K | 1.0K | 1.1K |

| CVS | CALL | TRADE | NEUTRAL | 01/16/26 | $23.85 | $20.0 | $21.85 | $40.00 | $109.2K | 761 | 0 |

| CVS | CALL | SWEEP | BEARISH | 03/21/25 | $6.85 | $6.65 | $6.65 | $57.50 | $66.5K | 5.0K | 132 |

| CVS | CALL | TRADE | BULLISH | 09/19/25 | $9.6 | $9.55 | $9.6 | $57.50 | $66.2K | 1.9K | 1.0K |

| CVS | CALL | SWEEP | NEUTRAL | 06/20/25 | $3.75 | $3.1 | $3.1 | $65.00 | $64.8K | 2.2K | 0 |

About CVS Health

CVS Health offers a diverse set of healthcare services. Its roots are in its retail pharmacy operations, where it operates over 9,000 stores primarily in the us. CVS is also a large pharmacy benefit manager (acquired through Caremark), processing about 2 billion adjusted claims annually. It also operates a top-tier health insurer (acquired through Aetna) where it serves about 26 million medical members. The company's recent acquisition of Oak Street adds primary care services to the mix, which could have significant synergies with all its existing business lines.

Current Position of CVS Health

- With a volume of 20,524,948, the price of CVS is up 15.18% at $63.35.

- RSI indicators hint that the underlying stock may be overbought.

- Next earnings are expected to be released in 0 days.

Professional Analyst Ratings for CVS Health

Over the past month, 1 industry analysts have shared their insights on this stock, proposing an average target price of $65.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access. * Consistent in their evaluation, an analyst from Evercore ISI Group keeps a Outperform rating on CVS Health with a target price of $65.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for CVS Health, Benzinga Pro gives you real-time options trades alerts.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.