Investors with significant funds have taken a bearish position in DexCom DXCM, a development that retail traders should be aware of.

This was brought to our attention today through our monitoring of publicly accessible options data at Benzinga. The exact nature of these investors remains a mystery, but such a major move in DXCM usually indicates foreknowledge of upcoming events.

Today, Benzinga's options scanner identified 8 options transactions for DexCom. This is an unusual occurrence. The sentiment among these large-scale traders is mixed, with 37% being bullish and 62% bearish. Of all the options we discovered, 7 are puts, valued at $421,287, and there was a single call, worth $49,500.

What's The Price Target?

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $80.0 to $87.5 for DexCom over the last 3 months.

Volume & Open Interest Trends

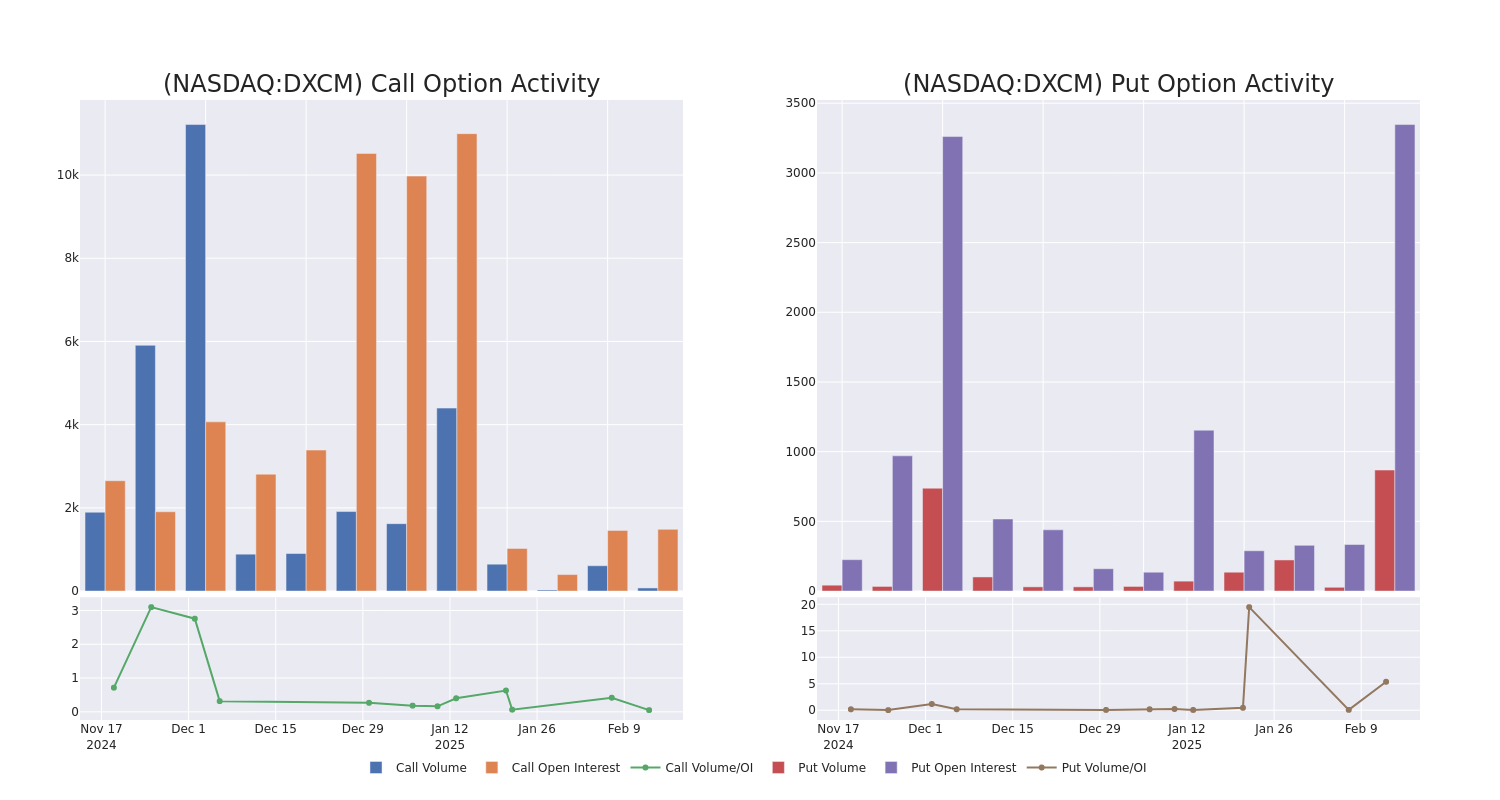

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for DexCom's options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of DexCom's whale activity within a strike price range from $80.0 to $87.5 in the last 30 days.

DexCom Option Activity Analysis: Last 30 Days

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| DXCM | PUT | SWEEP | BEARISH | 02/14/25 | $3.7 | $3.5 | $3.66 | $84.00 | $145.8K | 83 | 415 |

| DXCM | PUT | TRADE | BULLISH | 03/07/25 | $5.3 | $5.0 | $5.1 | $85.00 | $86.6K | 172 | 0 |

| DXCM | PUT | SWEEP | BEARISH | 06/18/26 | $15.4 | $15.3 | $15.4 | $85.00 | $53.9K | 1.2K | 76 |

| DXCM | CALL | SWEEP | BULLISH | 06/20/25 | $11.1 | $10.9 | $11.0 | $80.00 | $49.5K | 1.4K | 74 |

| DXCM | PUT | TRADE | BULLISH | 03/21/25 | $3.3 | $3.2 | $3.2 | $80.00 | $48.0K | 1.5K | 169 |

About DexCom

Dexcom designs and commercializes continuous glucose monitoring systems for diabetic patients. CGM systems serve as an alternative to the traditional blood glucose meter process, and the company is evolving its CGM systems to provide integration with insulin pumps from Insulet and Tandem for automatic insulin delivery.

Present Market Standing of DexCom

- Currently trading with a volume of 3,574,013, the DXCM's price is up by 0.13%, now at $83.98.

- RSI readings suggest the stock is currently is currently neutral between overbought and oversold.

- Anticipated earnings release is in 0 days.

Expert Opinions on DexCom

A total of 2 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $109.5.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access. * An analyst from Baird upgraded its action to Outperform with a price target of $104. * An analyst from Redburn Atlantic has elevated its stance to Buy, setting a new price target at $115.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for DexCom with Benzinga Pro for real-time alerts.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.