Whales with a lot of money to spend have taken a noticeably bullish stance on Intuit.

Looking at options history for Intuit INTU we detected 13 trades.

If we consider the specifics of each trade, it is accurate to state that 53% of the investors opened trades with bullish expectations and 30% with bearish.

From the overall spotted trades, 8 are puts, for a total amount of $351,320 and 5, calls, for a total amount of $362,470.

Projected Price Targets

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $530.0 and $670.0 for Intuit, spanning the last three months.

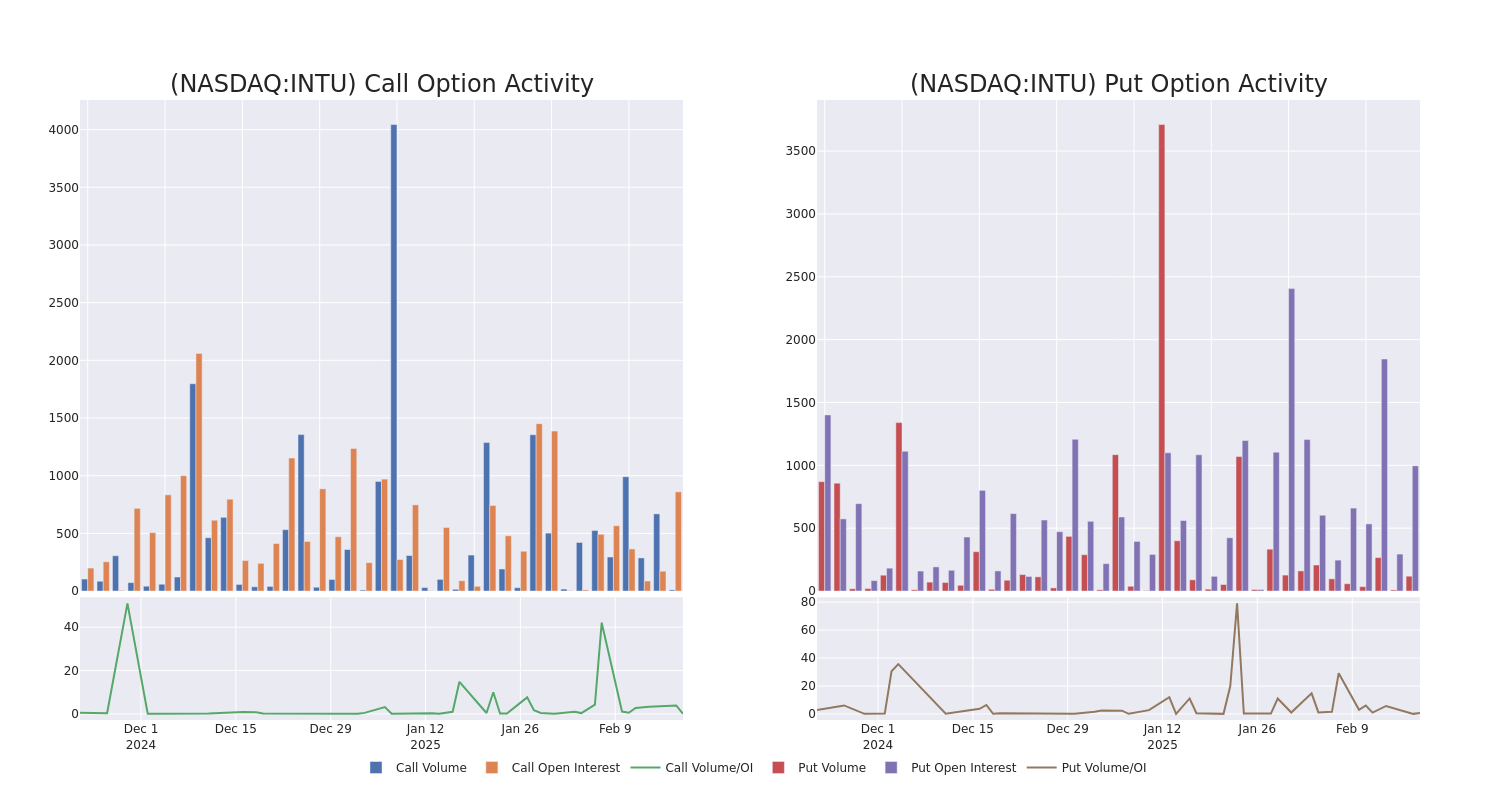

Volume & Open Interest Development

In terms of liquidity and interest, the mean open interest for Intuit options trades today is 185.6 with a total volume of 128.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for Intuit's big money trades within a strike price range of $530.0 to $670.0 over the last 30 days.

Intuit Option Activity Analysis: Last 30 Days

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| INTU | CALL | SWEEP | BEARISH | 02/21/25 | $19.8 | $18.0 | $18.0 | $565.00 | $173.0K | 147 | 10 |

| INTU | PUT | TRADE | BEARISH | 01/16/26 | $72.4 | $64.4 | $70.0 | $600.00 | $126.0K | 303 | 0 |

| INTU | CALL | TRADE | BEARISH | 01/15/27 | $104.0 | $99.0 | $99.0 | $610.00 | $99.0K | 20 | 10 |

| INTU | PUT | SWEEP | BULLISH | 03/21/25 | $25.8 | $24.9 | $25.8 | $580.00 | $38.7K | 387 | 48 |

| INTU | PUT | TRADE | BULLISH | 03/21/25 | $24.8 | $24.5 | $24.5 | $580.00 | $36.7K | 387 | 0 |

About Intuit

Intuit is a provider of small-business accounting software (QuickBooks), personal tax solutions (TurboTax), and professional tax offerings (Lacerte). Founded in the mid-1980s, Intuit controls the majority of US market share for small-business accounting and do-it-yourself tax-filing software.

Where Is Intuit Standing Right Now?

- With a volume of 914,340, the price of INTU is down -0.59% at $576.52.

- RSI indicators hint that the underlying stock may be approaching oversold.

- Next earnings are expected to be released in 6 days.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Intuit with Benzinga Pro for real-time alerts.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.