Deep-pocketed investors have adopted a bullish approach towards Walt Disney DIS, and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in DIS usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga's options scanner highlighted 12 extraordinary options activities for Walt Disney. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 66% leaning bullish and 25% bearish. Among these notable options, 3 are puts, totaling $109,100, and 9 are calls, amounting to $407,377.

Projected Price Targets

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $85.0 and $130.0 for Walt Disney, spanning the last three months.

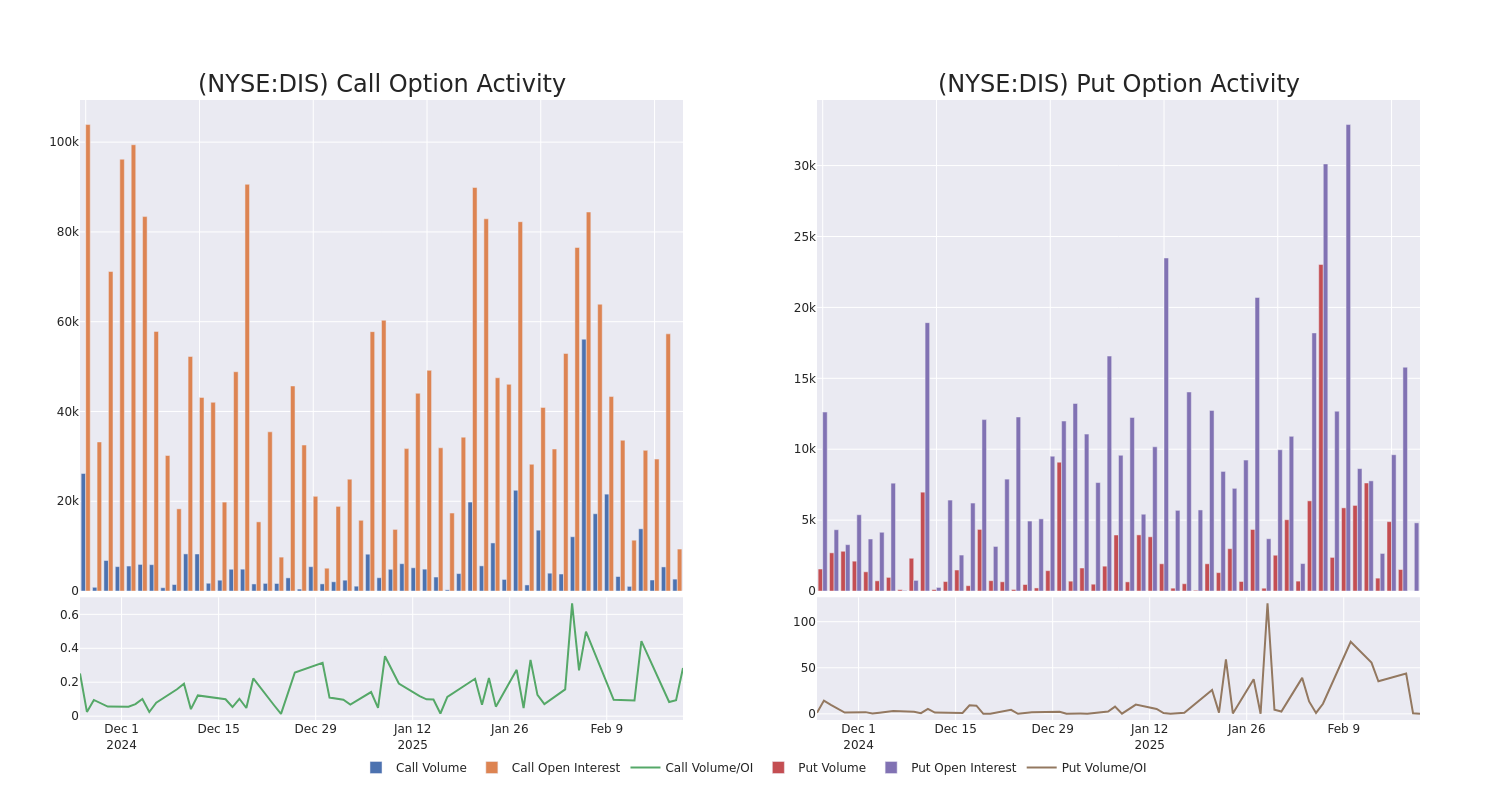

Volume & Open Interest Development

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Walt Disney's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Walt Disney's whale trades within a strike price range from $85.0 to $130.0 in the last 30 days.

Walt Disney 30-Day Option Volume & Interest Snapshot

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| DIS | CALL | SWEEP | BULLISH | 03/21/25 | $3.1 | $3.0 | $3.05 | $110.00 | $73.2K | 7.3K | 558 |

| DIS | CALL | TRADE | BEARISH | 12/18/26 | $28.05 | $27.85 | $27.85 | $95.00 | $61.2K | 1.1K | 0 |

| DIS | CALL | SWEEP | BULLISH | 03/21/25 | $3.05 | $3.05 | $3.05 | $110.00 | $49.1K | 7.3K | 261 |

| DIS | CALL | SWEEP | BEARISH | 09/19/25 | $3.9 | $3.8 | $3.8 | $125.00 | $49.0K | 867 | 0 |

| DIS | CALL | SWEEP | BULLISH | 03/21/25 | $3.1 | $3.0 | $3.05 | $110.00 | $41.4K | 7.3K | 261 |

About Walt Disney

Disney operates in three global business segments: entertainment, sports, and experiences. Entertainment and experiences both benefit from the firm's ownership of iconic franchises and characters. Entertainment includes the ABC broadcast network, several cable television networks, and the Disney+ and Hulu streaming services. Within the segment, Disney also engages in movie and television production and distribution, with content licensed to movie theaters, other content providers, or, increasingly, kept in-house for use on Disney's own streaming platform and television networks. The sports segment houses ESPN and the ESPN+ streaming service. Experiences contains Disney's theme parks and vacation destinations, and also benefits from merchandise licensing.

Present Market Standing of Walt Disney

- With a trading volume of 1,065,563, the price of DIS is down by -0.62%, reaching $110.67.

- Current RSI values indicate that the stock is is currently neutral between overbought and oversold.

- Next earnings report is scheduled for 75 days from now.

Professional Analyst Ratings for Walt Disney

4 market experts have recently issued ratings for this stock, with a consensus target price of $130.0.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access. * Consistent in their evaluation, an analyst from Rosenblatt keeps a Buy rating on Walt Disney with a target price of $135. * An analyst from Citigroup has revised its rating downward to Buy, adjusting the price target to $125. * An analyst from Needham downgraded its action to Buy with a price target of $130. * Maintaining their stance, an analyst from Morgan Stanley continues to hold a Overweight rating for Walt Disney, targeting a price of $130.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Walt Disney with Benzinga Pro for real-time alerts.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.