Whales with a lot of money to spend have taken a noticeably bearish stance on Snowflake.

Looking at options history for Snowflake SNOW we detected 13 trades.

If we consider the specifics of each trade, it is accurate to state that 30% of the investors opened trades with bullish expectations and 53% with bearish.

From the overall spotted trades, 4 are puts, for a total amount of $217,803 and 9, calls, for a total amount of $418,871.

Predicted Price Range

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $120.0 to $180.0 for Snowflake over the last 3 months.

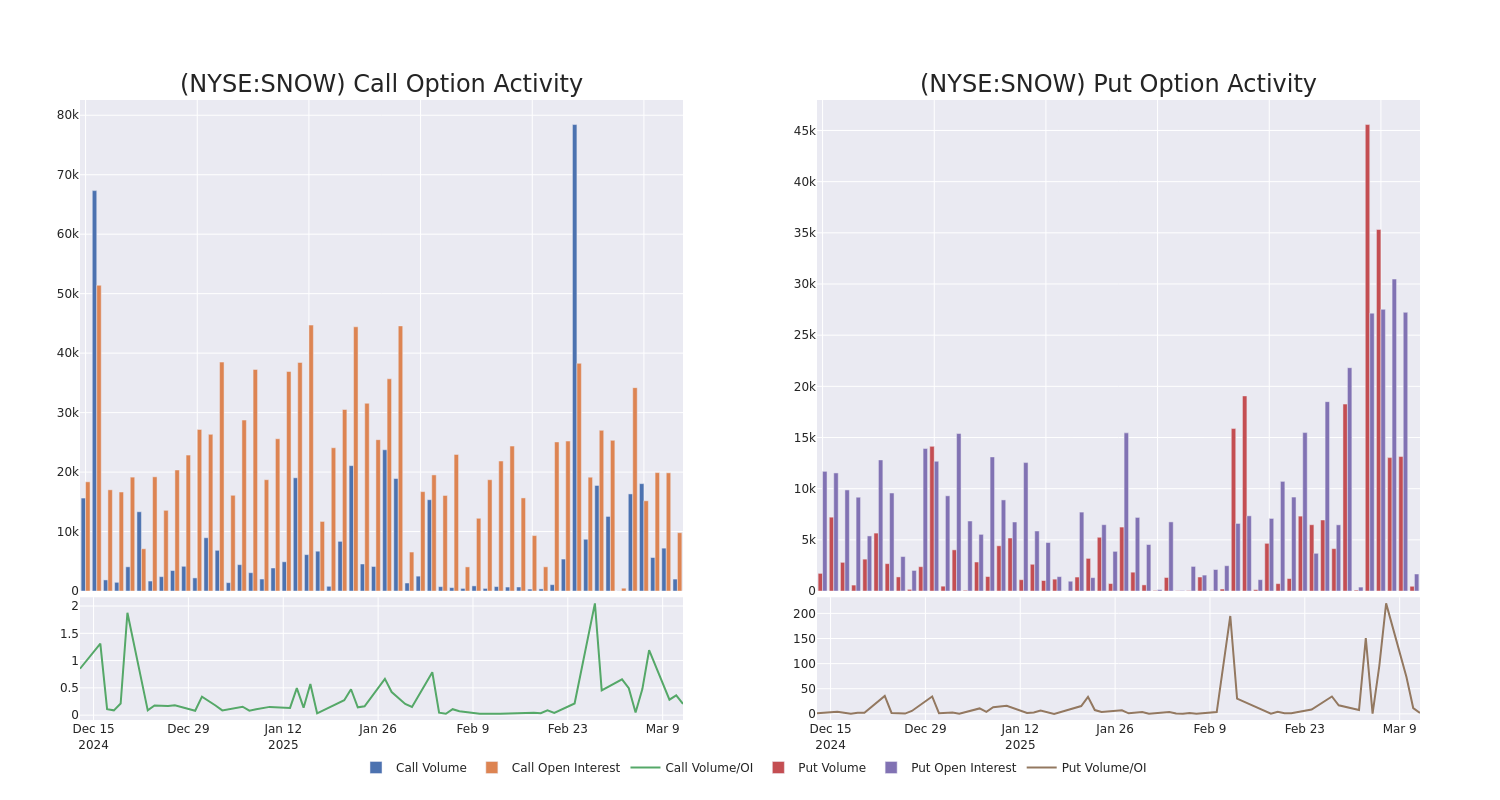

Volume & Open Interest Trends

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Snowflake's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Snowflake's significant trades, within a strike price range of $120.0 to $180.0, over the past month.

Snowflake 30-Day Option Volume & Interest Snapshot

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| SNOW | CALL | SWEEP | NEUTRAL | 05/16/25 | $7.3 | $7.1 | $7.3 | $170.00 | $104.3K | 1.2K | 145 |

| SNOW | PUT | TRADE | BULLISH | 06/18/26 | $37.75 | $32.75 | $34.73 | $160.00 | $86.8K | 26 | 25 |

| SNOW | CALL | TRADE | BEARISH | 08/15/25 | $42.65 | $41.65 | $41.65 | $120.00 | $83.3K | 181 | 20 |

| SNOW | PUT | SWEEP | BEARISH | 03/14/25 | $4.0 | $3.85 | $4.0 | $155.00 | $58.8K | 394 | 188 |

| SNOW | PUT | SWEEP | BULLISH | 03/14/25 | $2.25 | $2.2 | $2.2 | $150.00 | $41.3K | 1.2K | 115 |

About Snowflake

Founded in 2012, Snowflake is a data lake, warehousing, and sharing company that went public in 2020. To date, the company has over 3,000 customers, including nearly 30% of the Fortune 500. Snowflake's data lake stores unstructured and semistructured data that can then be used in analytics to create insights stored in its data warehouse. Snowflake's data sharing capability allows enterprises to buy and ingest data, while its data solutions can be hosted on various public clouds.

Having examined the options trading patterns of Snowflake, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Snowflake's Current Market Status

- With a trading volume of 1,872,371, the price of SNOW is up by 1.56%, reaching $152.24.

- Current RSI values indicate that the stock is may be approaching oversold.

- Next earnings report is scheduled for 70 days from now.

What Analysts Are Saying About Snowflake

Over the past month, 5 industry analysts have shared their insights on this stock, proposing an average target price of $216.6.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access. * Showing optimism, an analyst from Wolfe Research upgrades its rating to Outperform with a revised price target of $235. * Consistent in their evaluation, an analyst from UBS keeps a Neutral rating on Snowflake with a target price of $190. * An analyst from Piper Sandler has decided to maintain their Overweight rating on Snowflake, which currently sits at a price target of $215. * An analyst from Cantor Fitzgerald has decided to maintain their Overweight rating on Snowflake, which currently sits at a price target of $228. * An analyst from Loop Capital persists with their Buy rating on Snowflake, maintaining a target price of $215.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Snowflake, Benzinga Pro gives you real-time options trades alerts.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.