High-rolling investors have positioned themselves bullish on Cleveland-Cliffs CLF, and it's important for retail traders to take note. \This activity came to our attention today through Benzinga's tracking of publicly available options data. The identities of these investors are uncertain, but such a significant move in CLF often signals that someone has privileged information.

Today, Benzinga's options scanner spotted 9 options trades for Cleveland-Cliffs. This is not a typical pattern.

The sentiment among these major traders is split, with 77% bullish and 11% bearish. Among all the options we identified, there was one put, amounting to $72,828, and 8 calls, totaling $315,324.

Predicted Price Range

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $7.0 and $20.0 for Cleveland-Cliffs, spanning the last three months.

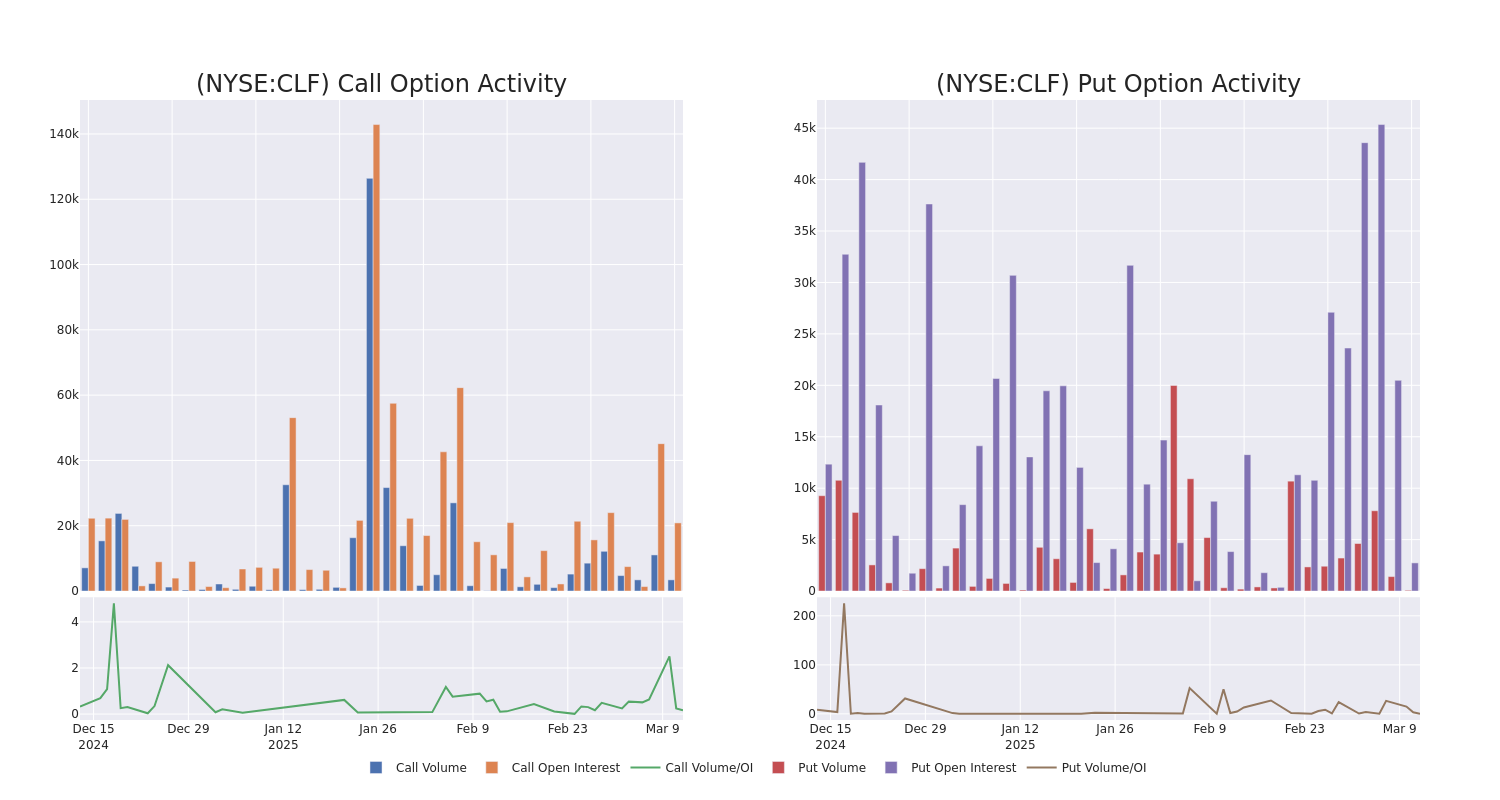

Volume & Open Interest Trends

In terms of liquidity and interest, the mean open interest for Cleveland-Cliffs options trades today is 2623.0 with a total volume of 3,496.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for Cleveland-Cliffs's big money trades within a strike price range of $7.0 to $20.0 over the last 30 days.

Cleveland-Cliffs Option Activity Analysis: Last 30 Days

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CLF | CALL | TRADE | BULLISH | 04/11/25 | $1.0 | $0.97 | $1.0 | $9.50 | $100.0K | 108 | 1.0K |

| CLF | PUT | SWEEP | BULLISH | 06/20/25 | $10.45 | $10.4 | $10.4 | $20.00 | $72.8K | 2.7K | 70 |

| CLF | CALL | SWEEP | BULLISH | 04/17/25 | $0.42 | $0.42 | $0.42 | $11.00 | $42.0K | 11.0K | 1.3K |

| CLF | CALL | SWEEP | BEARISH | 12/19/25 | $1.21 | $1.16 | $1.16 | $13.00 | $32.9K | 4.2K | 334 |

| CLF | CALL | SWEEP | BULLISH | 01/15/27 | $3.1 | $3.05 | $3.1 | $10.00 | $31.0K | 3.9K | 112 |

About Cleveland-Cliffs

Cleveland-Cliffs Inc is a flat-rolled steel producer and manufacturer of iron ore pellets in North America. It is organized into four operating segments based on differentiated products, Steelmaking, Tubular, Tooling and Stamping and European Operations, but operates through one reportable segment -Steelmaking. It is vertically integrated from mined raw materials, direct reduced iron, and ferrous scrap to primary steelmaking and downstream finishing, stamping, tooling and tubing. It serves a diverse range of other markets due to its comprehensive offering of flat-rolled steel products. Geographically, it operates in the United States, Canada and other countries. The majority of revenue is from the United States. It is a supplier of steel to the automotive industry in North America.

After a thorough review of the options trading surrounding Cleveland-Cliffs, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Cleveland-Cliffs's Current Market Status

- Currently trading with a volume of 13,423,034, the CLF's price is up by 7.26%, now at $9.68.

- RSI readings suggest the stock is currently is currently neutral between overbought and oversold.

- Anticipated earnings release is in 40 days.

What The Experts Say On Cleveland-Cliffs

2 market experts have recently issued ratings for this stock, with a consensus target price of $13.95.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access. * An analyst from GLJ Research persists with their Buy rating on Cleveland-Cliffs, maintaining a target price of $12. * Maintaining their stance, an analyst from Goldman Sachs continues to hold a Buy rating for Cleveland-Cliffs, targeting a price of $15.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Cleveland-Cliffs options trades with real-time alerts from Benzinga Pro.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.