Investors with a lot of money to spend have taken a bullish stance on United Airlines Holdings UAL.

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with UAL, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga's options scanner spotted 11 uncommon options trades for United Airlines Holdings.

This isn't normal.

The overall sentiment of these big-money traders is split between 45% bullish and 27%, bearish.

Out of all of the special options we uncovered, 9 are puts, for a total amount of $1,339,920, and 2 are calls, for a total amount of $63,950.

Projected Price Targets

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $42.0 and $85.0 for United Airlines Holdings, spanning the last three months.

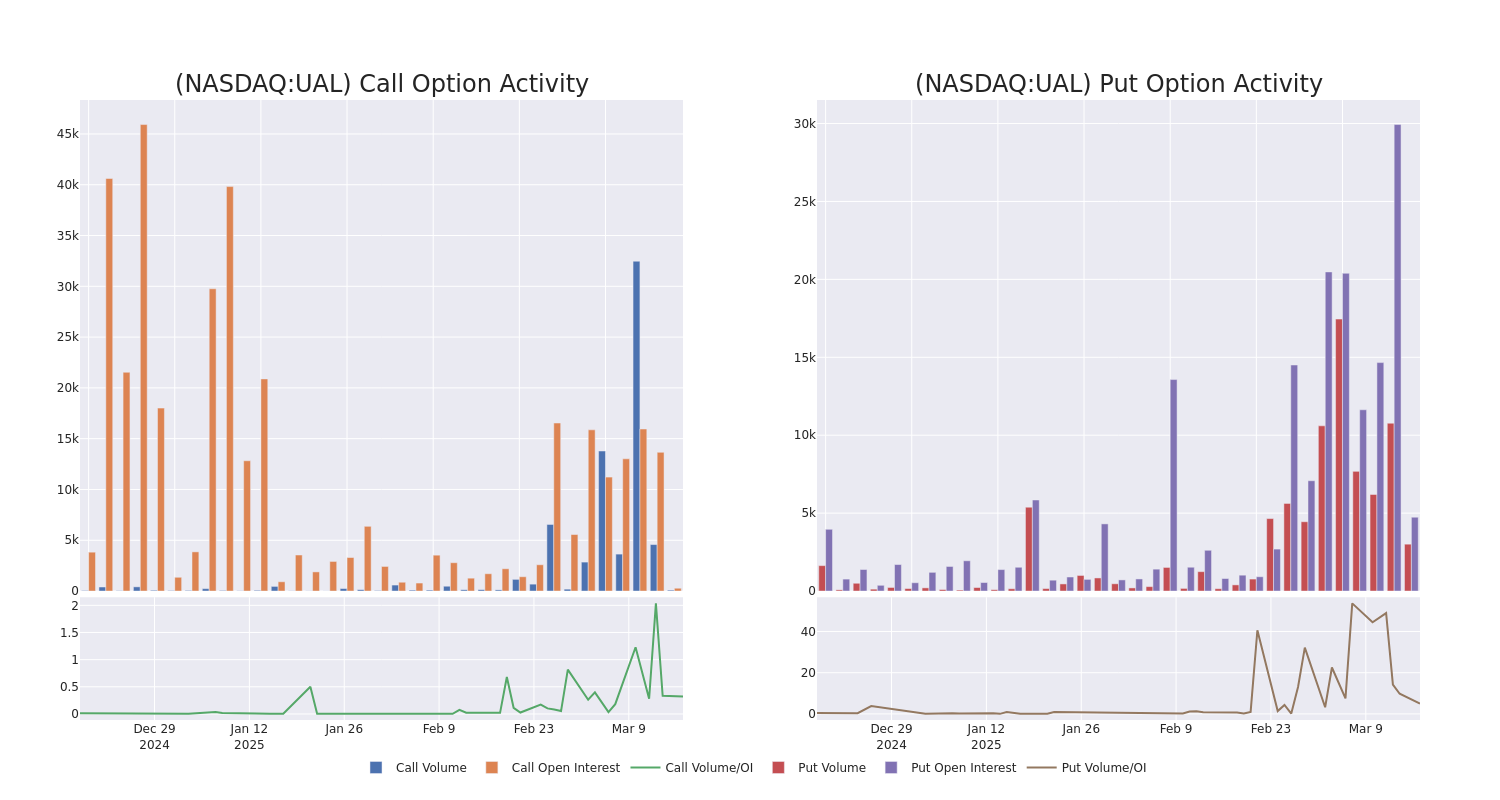

Volume & Open Interest Development

In today's trading context, the average open interest for options of United Airlines Holdings stands at 1002.8, with a total volume reaching 3,097.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in United Airlines Holdings, situated within the strike price corridor from $42.0 to $85.0, throughout the last 30 days.

United Airlines Holdings Option Activity Analysis: Last 30 Days

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| UAL | PUT | TRADE | NEUTRAL | 09/19/25 | $17.75 | $16.9 | $17.35 | $85.00 | $173.5K | 606 | 200 |

| UAL | PUT | TRADE | BULLISH | 09/19/25 | $17.6 | $17.2 | $17.2 | $85.00 | $172.0K | 606 | 100 |

| UAL | PUT | SWEEP | NEUTRAL | 09/19/25 | $17.15 | $16.75 | $17.15 | $85.00 | $171.3K | 606 | 500 |

| UAL | PUT | TRADE | BULLISH | 09/19/25 | $17.25 | $17.1 | $17.1 | $85.00 | $171.0K | 606 | 300 |

| UAL | PUT | TRADE | BULLISH | 09/19/25 | $17.2 | $16.9 | $16.98 | $85.00 | $169.8K | 606 | 700 |

About United Airlines Holdings

United Airlines is a major us network carrier with hubs in San Francisco, Chicago, Houston, Denver, Los Angeles, New York/Newark, and Washington, D.C. United operates a hub-and-spoke system that is more focused on international and long-haul travel than its large us peers.

Current Position of United Airlines Holdings

- With a volume of 1,484,803, the price of UAL is up 0.21% at $73.82.

- RSI indicators hint that the underlying stock may be oversold.

- Next earnings are expected to be released in 29 days.

Expert Opinions on United Airlines Holdings

A total of 2 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $125.0.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access. * An analyst from B of A Securities persists with their Buy rating on United Airlines Holdings, maintaining a target price of $110. * Consistent in their evaluation, an analyst from Barclays keeps a Overweight rating on United Airlines Holdings with a target price of $140.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for United Airlines Holdings, Benzinga Pro gives you real-time options trades alerts.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.