Investors with a lot of money to spend have taken a bearish stance on Abbott Laboratories ABT.

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with ABT, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga's options scanner spotted 10 uncommon options trades for Abbott Laboratories.

This isn't normal.

The overall sentiment of these big-money traders is split between 30% bullish and 60%, bearish.

Out of all of the special options we uncovered, 2 are puts, for a total amount of $305,520, and 8 are calls, for a total amount of $280,024.

Predicted Price Range

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $75.0 to $135.0 for Abbott Laboratories over the recent three months.

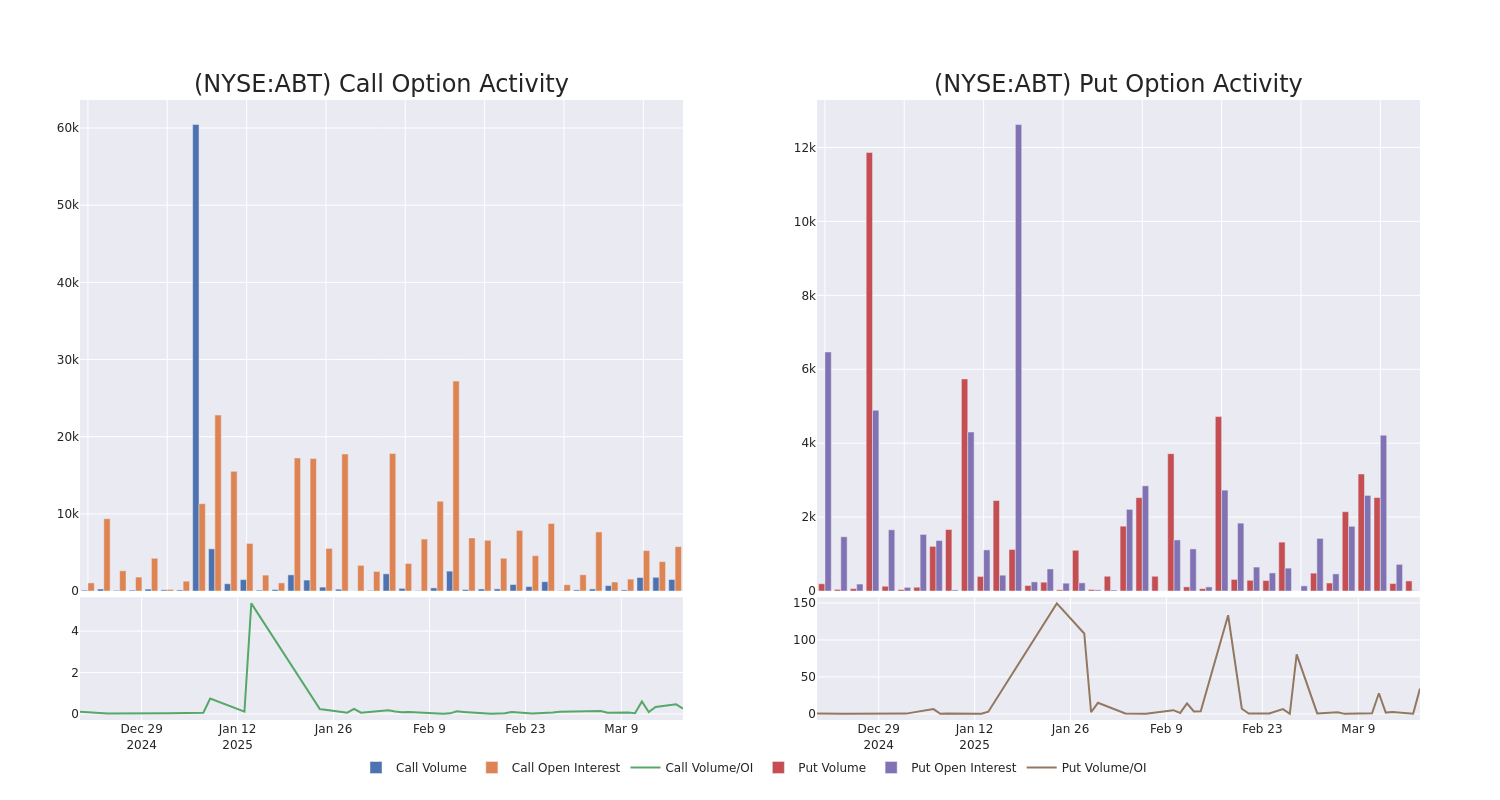

Volume & Open Interest Development

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Abbott Laboratories's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Abbott Laboratories's substantial trades, within a strike price spectrum from $75.0 to $135.0 over the preceding 30 days.

Abbott Laboratories Option Activity Analysis: Last 30 Days

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ABT | PUT | SWEEP | BULLISH | 06/18/26 | $13.9 | $13.4 | $13.4 | $130.00 | $245.2K | 8 | 228 |

| ABT | PUT | SWEEP | BULLISH | 06/18/26 | $14.25 | $13.4 | $13.4 | $130.00 | $60.3K | 8 | 45 |

| ABT | CALL | SWEEP | BEARISH | 09/19/25 | $5.75 | $5.65 | $5.65 | $135.00 | $47.4K | 456 | 325 |

| ABT | CALL | SWEEP | BEARISH | 08/15/25 | $4.9 | $4.85 | $4.9 | $135.00 | $39.2K | 507 | 174 |

| ABT | CALL | TRADE | BEARISH | 08/15/25 | $4.85 | $4.8 | $4.8 | $135.00 | $36.9K | 507 | 352 |

About Abbott Laboratories

Abbott manufactures and markets cardiovascular and diabetes devices, adult and pediatric nutritional products, diagnostic equipment and testing kits, and branded generic drugs. Products include pacemakers, implantable cardioverter defibrillators, neuromodulation devices, coronary stents, catheters, infant formula, nutritional liquids for adults, continuous glucose monitors, and immunoassays and point-of-care diagnostic equipment. Abbott derives approximately 60% of sales outside the United States.

Having examined the options trading patterns of Abbott Laboratories, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Current Position of Abbott Laboratories

- Trading volume stands at 2,698,821, with ABT's price down by -1.06%, positioned at $126.28.

- RSI indicators show the stock to be is currently neutral between overbought and oversold.

- Earnings announcement expected in 29 days.

Professional Analyst Ratings for Abbott Laboratories

3 market experts have recently issued ratings for this stock, with a consensus target price of $154.67.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access. * An analyst from Goldman Sachs has decided to maintain their Buy rating on Abbott Laboratories, which currently sits at a price target of $154. * An analyst from Citigroup persists with their Buy rating on Abbott Laboratories, maintaining a target price of $160. * An analyst from B of A Securities has decided to maintain their Buy rating on Abbott Laboratories, which currently sits at a price target of $150.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Abbott Laboratories with Benzinga Pro for real-time alerts.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.