Financial giants have made a conspicuous bearish move on ON Semiconductor. Our analysis of options history for ON Semiconductor ON revealed 17 unusual trades.

Delving into the details, we found 11% of traders were bullish, while 82% showed bearish tendencies. Out of all the trades we spotted, 14 were puts, with a value of $1,380,883, and 3 were calls, valued at $175,726.

Projected Price Targets

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $50.0 to $75.0 for ON Semiconductor over the recent three months.

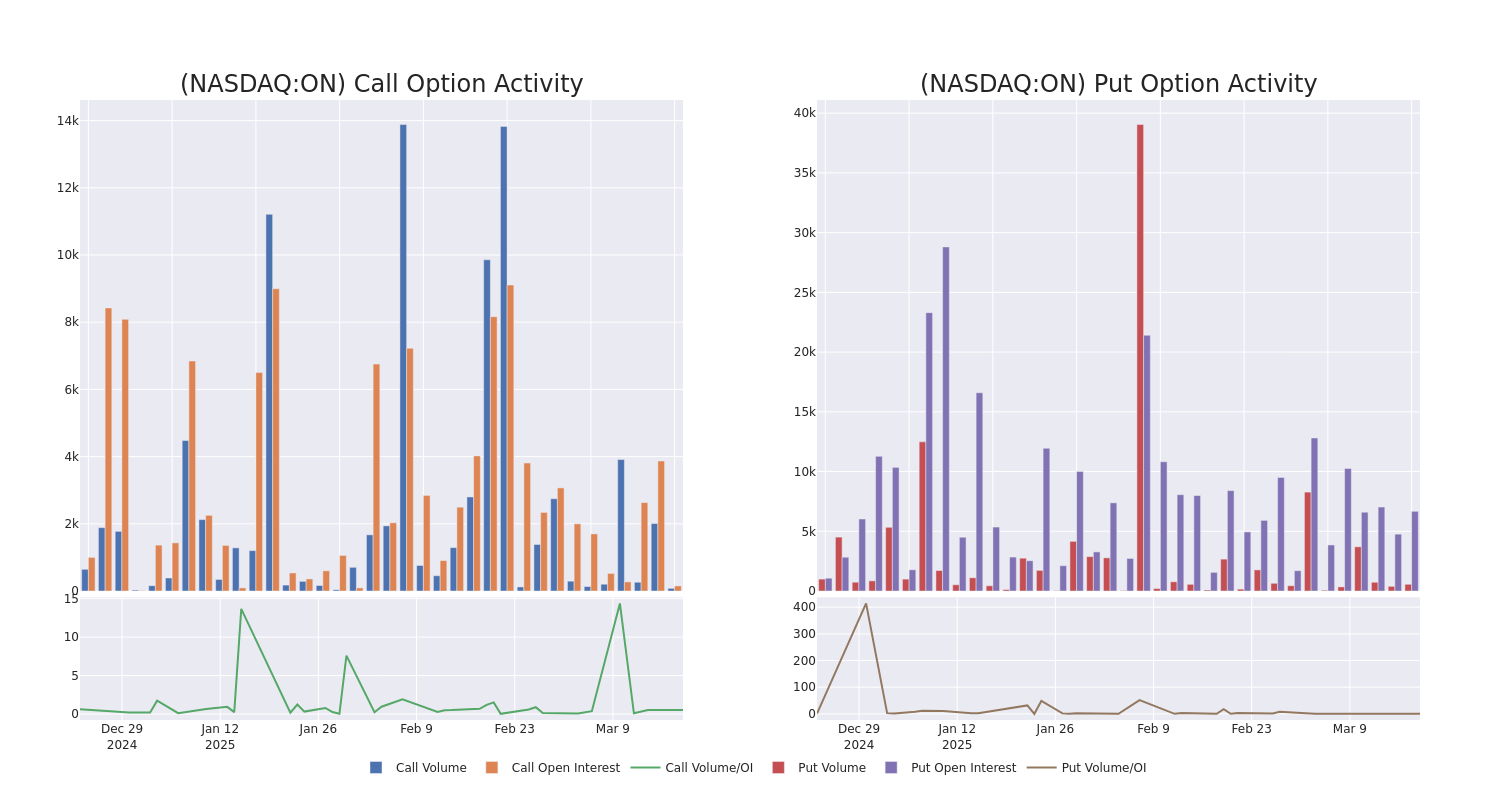

Analyzing Volume & Open Interest

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in ON Semiconductor's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to ON Semiconductor's substantial trades, within a strike price spectrum from $50.0 to $75.0 over the preceding 30 days.

ON Semiconductor Option Activity Analysis: Last 30 Days

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ON | PUT | SWEEP | BEARISH | 06/18/26 | $12.6 | $12.5 | $12.57 | $50.00 | $339.2K | 0 | 612 |

| ON | PUT | SWEEP | NEUTRAL | 06/18/26 | $12.55 | $12.5 | $12.55 | $50.00 | $199.4K | 0 | 302 |

| ON | PUT | SWEEP | BEARISH | 06/18/26 | $12.55 | $12.45 | $12.53 | $50.00 | $163.0K | 0 | 130 |

| ON | PUT | SWEEP | BEARISH | 06/18/26 | $12.55 | $12.5 | $12.53 | $50.00 | $145.4K | 0 | 768 |

| ON | PUT | SWEEP | BEARISH | 06/18/26 | $12.6 | $11.55 | $12.53 | $50.00 | $116.6K | 0 | 951 |

About ON Semiconductor

Onsemi is a supplier of power semiconductors and sensors focused on the automotive and industrial markets. Onsemi is the second-largest power chipmaker in the world and the largest supplier of image sensors to the automotive market. While the firm used to be highly vertically integrated, it now pursues a hybrid manufacturing strategy for flexible capacity. Onsemi is pivoting to focus on emerging applications like electric vehicles, autonomous vehicles, industrial automation, and renewable energy.

After a thorough review of the options trading surrounding ON Semiconductor, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Present Market Standing of ON Semiconductor

- Trading volume stands at 3,610,104, with ON's price down by -2.13%, positioned at $42.28.

- RSI indicators show the stock to be may be oversold.

- Earnings announcement expected in 38 days.

Expert Opinions on ON Semiconductor

In the last month, 2 experts released ratings on this stock with an average target price of $53.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access. * In a cautious move, an analyst from Needham downgraded its rating to Buy, setting a price target of $57. * Maintaining their stance, an analyst from Rosenblatt continues to hold a Neutral rating for ON Semiconductor, targeting a price of $49.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for ON Semiconductor, Benzinga Pro gives you real-time options trades alerts.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.