Financial giants have made a conspicuous bullish move on Ford Motor. Our analysis of options history for Ford Motor F revealed 18 unusual trades.

Delving into the details, we found 61% of traders were bullish, while 33% showed bearish tendencies. Out of all the trades we spotted, 12 were puts, with a value of $687,393, and 6 were calls, valued at $343,488.

Projected Price Targets

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $7.67 and $13.0 for Ford Motor, spanning the last three months.

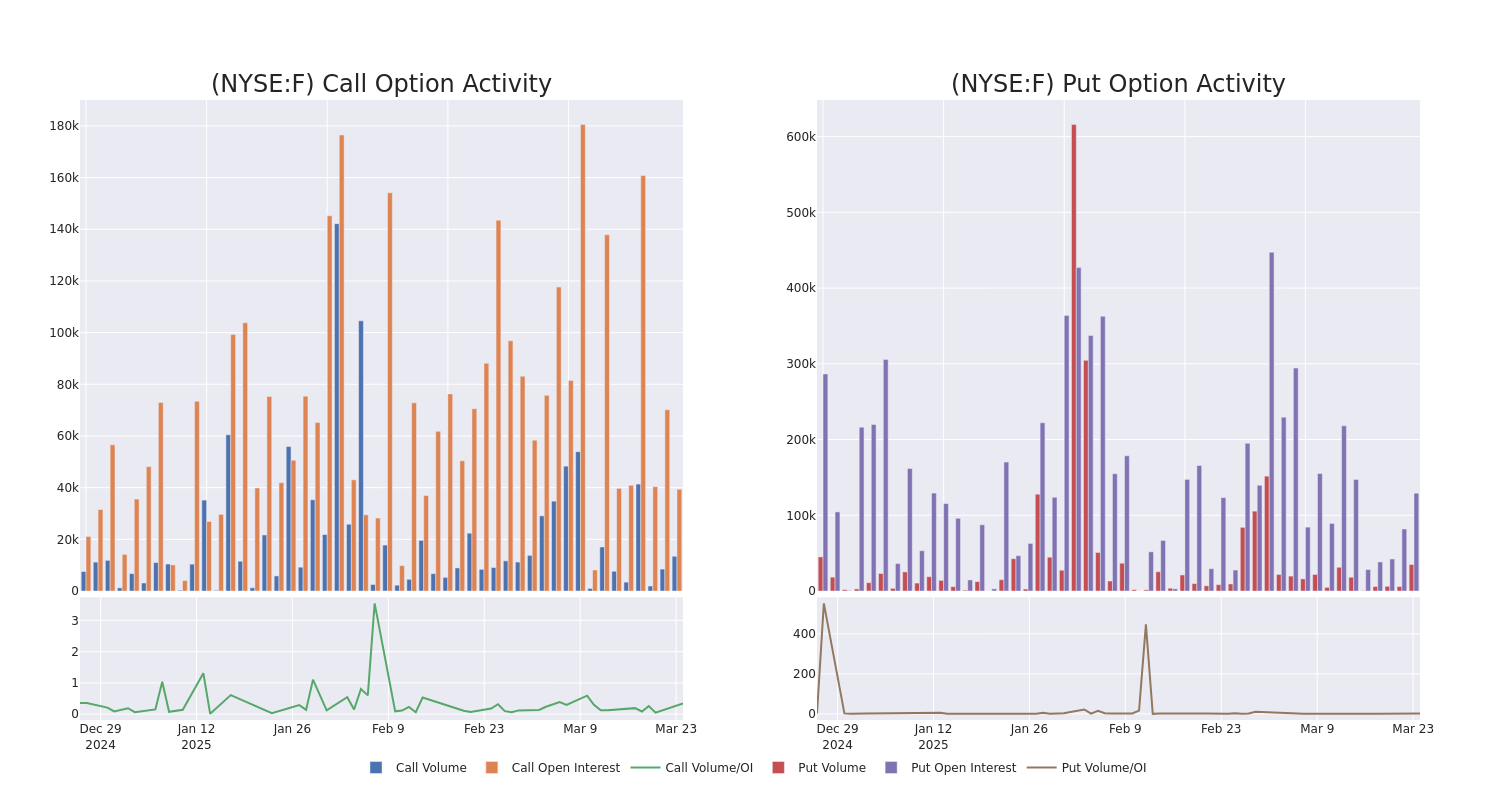

Volume & Open Interest Development

In today's trading context, the average open interest for options of Ford Motor stands at 18726.67, with a total volume reaching 48,504.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Ford Motor, situated within the strike price corridor from $7.67 to $13.0, throughout the last 30 days.

Ford Motor Option Activity Analysis: Last 30 Days

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| F | PUT | TRADE | BULLISH | 01/16/26 | $1.05 | $1.04 | $1.04 | $9.85 | $295.6K | 44.8K | 2.8K |

| F | CALL | SWEEP | BULLISH | 09/19/25 | $0.6 | $0.59 | $0.6 | $10.85 | $105.0K | 9.1K | 1.6K |

| F | CALL | SWEEP | BULLISH | 09/19/25 | $0.61 | $0.59 | $0.6 | $10.85 | $77.0K | 9.1K | 6.0K |

| F | CALL | SWEEP | BULLISH | 09/19/25 | $0.6 | $0.59 | $0.6 | $10.85 | $64.6K | 9.1K | 3.1K |

| F | PUT | SWEEP | BULLISH | 12/18/26 | $1.63 | $1.61 | $1.62 | $9.85 | $51.7K | 8.2K | 320 |

About Ford Motor

Ford Motor Co. manufactures automobiles under its Ford and Lincoln brands. In March 2022, the company announced that it will run its combustion engine business, Ford Blue, and its BEV business, Ford Model e, as separate businesses but still all under Ford Motor. The company has nearly 13% market share in the United States, about 10% share in the UK, and under 2% share in China including unconsolidated affiliates. Sales in the US made up about 68% of 2024 total company revenue. Ford has about 171,000 employees, including about 56,500 UAW employees, and is based in Dearborn, Michigan.

In light of the recent options history for Ford Motor, it's now appropriate to focus on the company itself. We aim to explore its current performance.

Where Is Ford Motor Standing Right Now?

- With a volume of 55,107,182, the price of F is up 1.95% at $10.2.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 30 days.

Expert Opinions on Ford Motor

1 market experts have recently issued ratings for this stock, with a consensus target price of $9.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access. * Consistent in their evaluation, an analyst from Piper Sandler keeps a Neutral rating on Ford Motor with a target price of $9.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Ford Motor with Benzinga Pro for real-time alerts.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.