Financial giants have made a conspicuous bullish move on Salesforce. Our analysis of options history for Salesforce CRM revealed 53 unusual trades.

Delving into the details, we found 50% of traders were bullish, while 30% showed bearish tendencies. Out of all the trades we spotted, 18 were puts, with a value of $1,259,452, and 35 were calls, valued at $1,746,099.

Predicted Price Range

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $100.0 to $430.0 for Salesforce over the last 3 months.

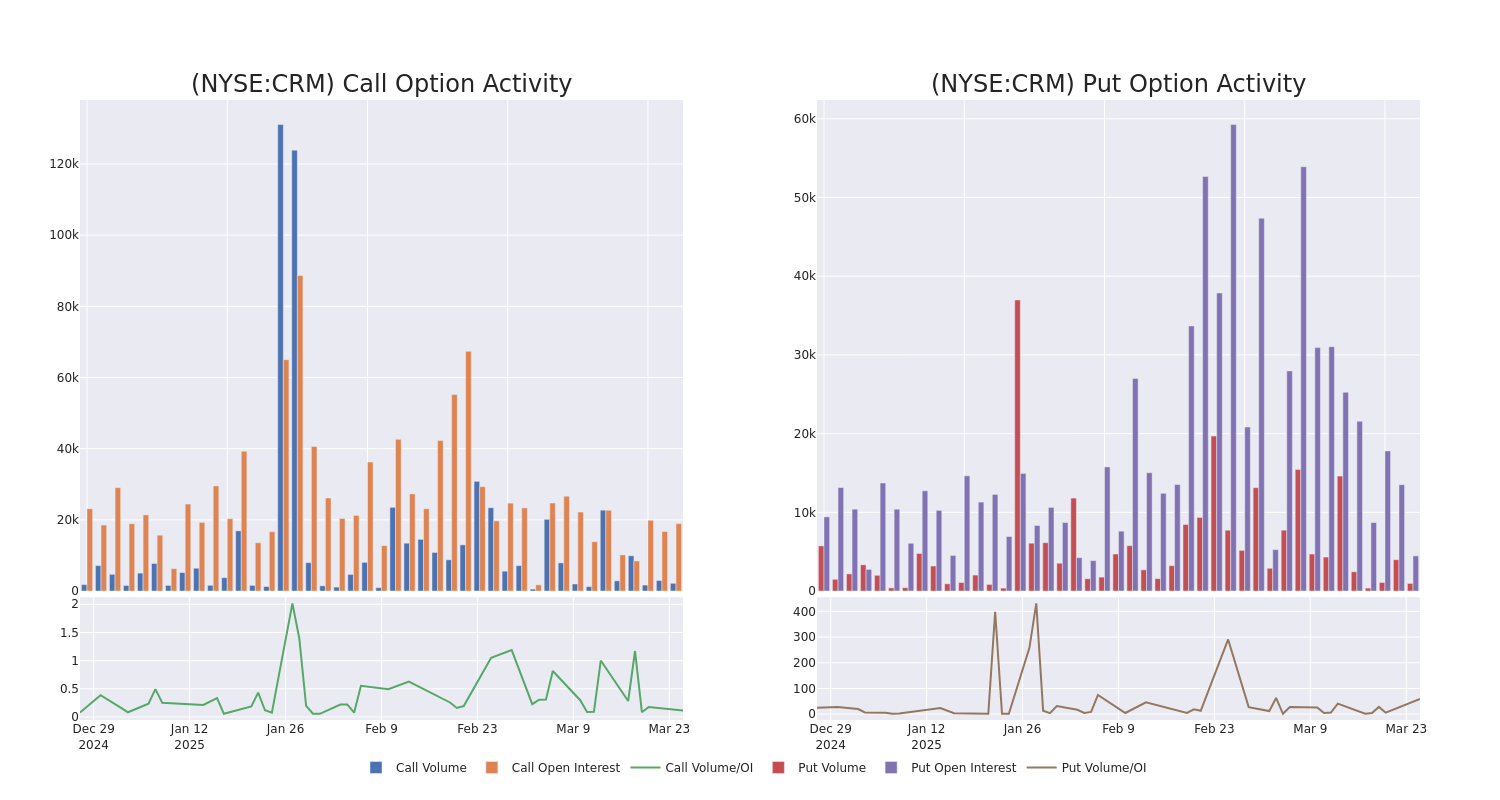

Volume & Open Interest Trends

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Salesforce's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Salesforce's substantial trades, within a strike price spectrum from $100.0 to $430.0 over the preceding 30 days.

Salesforce Option Activity Analysis: Last 30 Days

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CRM | PUT | TRADE | BULLISH | 10/17/25 | $14.85 | $14.6 | $14.7 | $260.00 | $441.0K | 7 | 300 |

| CRM | CALL | TRADE | BEARISH | 05/16/25 | $12.95 | $12.75 | $12.75 | $290.00 | $118.5K | 1.4K | 9 |

| CRM | PUT | SWEEP | BULLISH | 08/15/25 | $13.2 | $12.85 | $12.8 | $270.00 | $111.4K | 1.1K | 108 |

| CRM | CALL | SWEEP | BEARISH | 06/18/26 | $26.5 | $26.2 | $26.2 | $350.00 | $94.3K | 700 | 36 |

| CRM | CALL | TRADE | NEUTRAL | 01/15/27 | $147.2 | $145.05 | $145.95 | $160.00 | $72.9K | 81 | 72 |

About Salesforce

Salesforce provides enterprise cloud computing solutions. The company offers customer relationship management technology that brings companies and customers together. Its Customer 360 platform helps the group to deliver a single source of truth, connecting customer data across systems, apps, and devices to help companies sell, service, market, and conduct commerce. It also offers Service Cloud for customer support, Marketing Cloud for digital marketing campaigns, Commerce Cloud as an e-commerce engine, the Salesforce Platform, which allows enterprises to build applications, and other solutions, such as MuleSoft for data integration.

In light of the recent options history for Salesforce, it's now appropriate to focus on the company itself. We aim to explore its current performance.

Present Market Standing of Salesforce

- Currently trading with a volume of 1,633,796, the CRM's price is up by 0.66%, now at $287.84.

- RSI readings suggest the stock is currently is currently neutral between overbought and oversold.

- Anticipated earnings release is in 64 days.

Expert Opinions on Salesforce

A total of 5 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $322.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access. * An analyst from Macquarie persists with their Neutral rating on Salesforce, maintaining a target price of $320. * Consistent in their evaluation, an analyst from Citigroup keeps a Neutral rating on Salesforce with a target price of $350. * Maintaining their stance, an analyst from Scotiabank continues to hold a Sector Outperform rating for Salesforce, targeting a price of $345. * Consistent in their evaluation, an analyst from Macquarie keeps a Neutral rating on Salesforce with a target price of $320. * Maintaining their stance, an analyst from DA Davidson continues to hold a Neutral rating for Salesforce, targeting a price of $275.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Salesforce, Benzinga Pro gives you real-time options trades alerts.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.