Deep-pocketed investors have adopted a bearish approach towards IonQ IONQ, and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in IONQ usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga's options scanner highlighted 19 extraordinary options activities for IonQ. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 36% leaning bullish and 63% bearish. Among these notable options, 14 are puts, totaling $609,296, and 5 are calls, amounting to $244,382.

Expected Price Movements

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $20.0 and $45.0 for IonQ, spanning the last three months.

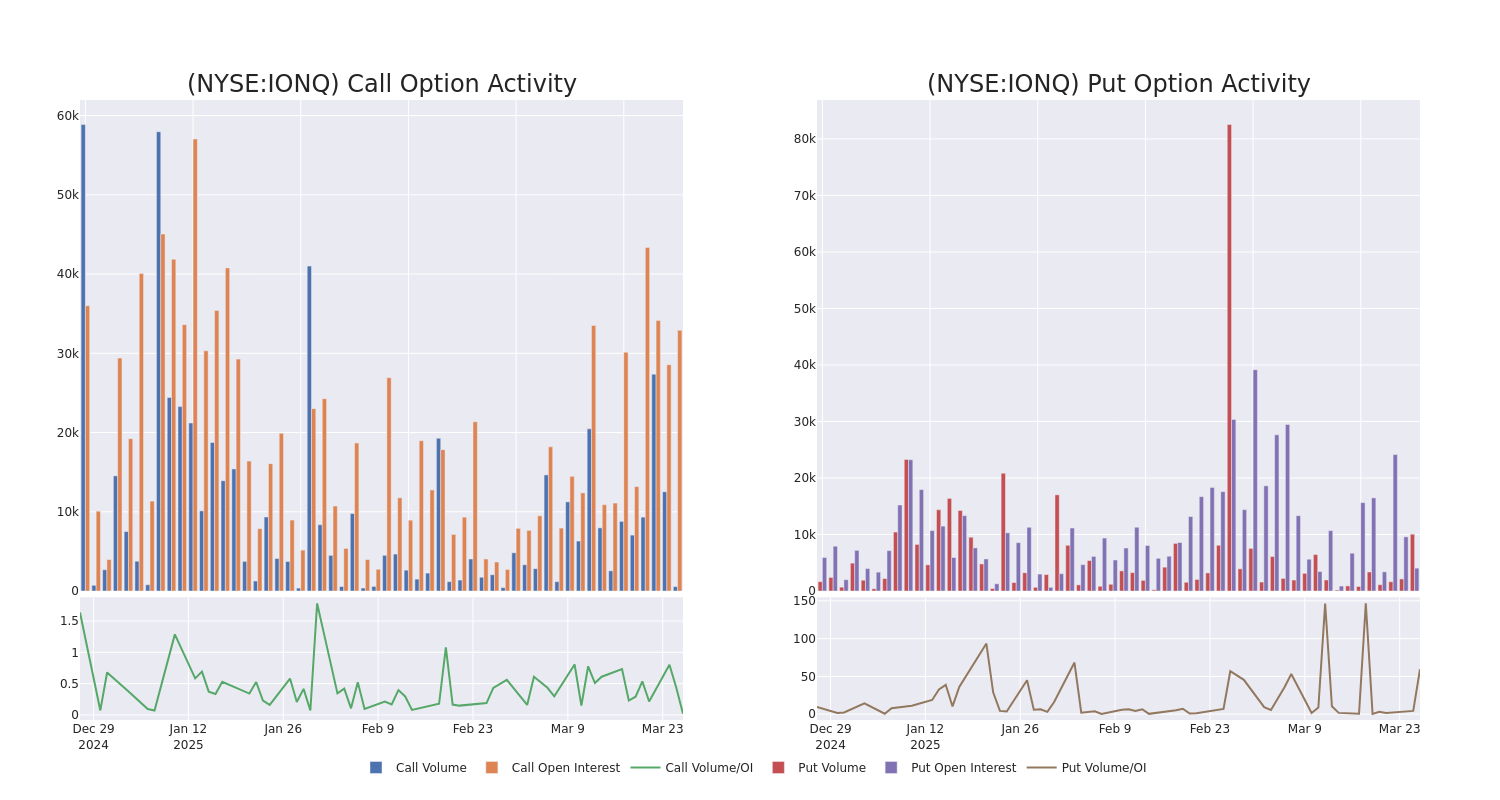

Volume & Open Interest Development

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for IonQ's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across IonQ's significant trades, within a strike price range of $20.0 to $45.0, over the past month.

IonQ Call and Put Volume: 30-Day Overview

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| IONQ | PUT | SWEEP | BEARISH | 12/19/25 | $4.9 | $4.75 | $4.9 | $20.00 | $146.5K | 578 | 300 |

| IONQ | CALL | SWEEP | BULLISH | 04/17/25 | $5.5 | $5.45 | $5.5 | $21.50 | $75.9K | 0 | 142 |

| IONQ | CALL | SWEEP | BULLISH | 04/17/25 | $5.55 | $5.45 | $5.55 | $21.50 | $68.8K | 0 | 269 |

| IONQ | PUT | SWEEP | BEARISH | 04/04/25 | $0.85 | $0.76 | $0.84 | $24.00 | $65.6K | 434 | 811 |

| IONQ | PUT | TRADE | BULLISH | 01/16/26 | $23.25 | $22.85 | $22.93 | $45.00 | $45.8K | 266 | 20 |

About IonQ

IonQ Inc sells access to several quantum computers of various qubit capacities and is in the process of researching and developing technologies for quantum computers with increasing computational capabilities. The company currently makes access to its quantum computers available via cloud platforms and also to select customers via its own cloud service. This cloud-based approach enables the broad availability of quantum-computing-as-a-service (QCaaS). The company derives its revenue from its quantum-computing-as-a-service arrangements, consulting services related to co-developing algorithms on company's quantum computing systems and contracts associated with the design, development, and construction of specialized quantum computing systems together with related services.

Having examined the options trading patterns of IonQ, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Current Position of IonQ

- Trading volume stands at 20,466,689, with IONQ's price down by -1.84%, positioned at $25.08.

- RSI indicators show the stock to be is currently neutral between overbought and oversold.

- Earnings announcement expected in 42 days.

Expert Opinions on IonQ

In the last month, 2 experts released ratings on this stock with an average target price of $49.5.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access. * Maintaining their stance, an analyst from Benchmark continues to hold a Buy rating for IonQ, targeting a price of $45. * Reflecting concerns, an analyst from Needham lowers its rating to Buy with a new price target of $54.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for IonQ with Benzinga Pro for real-time alerts.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.