Financial giants have made a conspicuous bullish move on ConocoPhillips. Our analysis of options history for ConocoPhillips COP revealed 9 unusual trades.

Delving into the details, we found 44% of traders were bullish, while 44% showed bearish tendencies. Out of all the trades we spotted, 3 were puts, with a value of $169,297, and 6 were calls, valued at $285,959.

Predicted Price Range

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $90.0 to $115.0 for ConocoPhillips over the last 3 months.

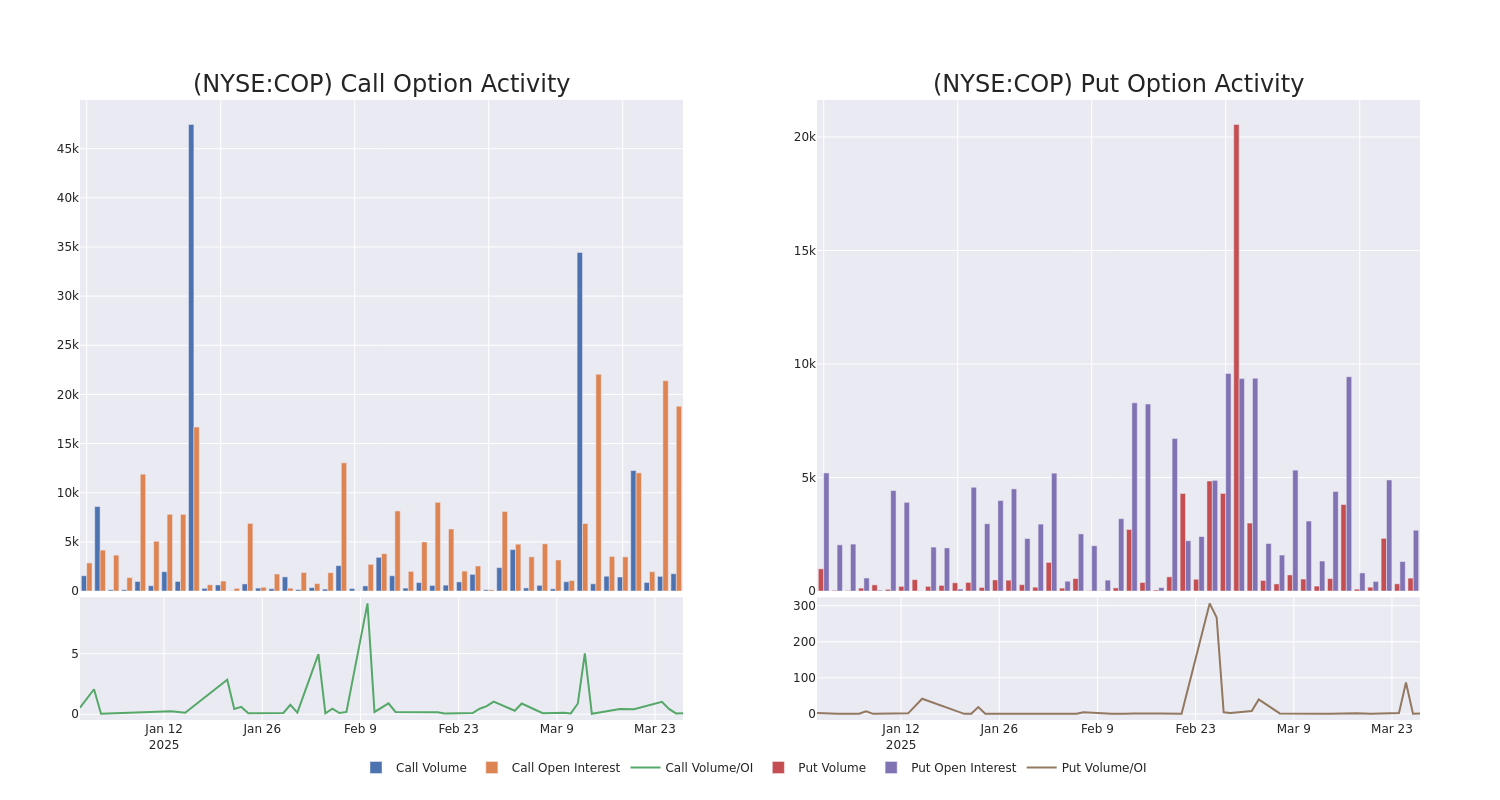

Volume & Open Interest Development

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for ConocoPhillips's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of ConocoPhillips's whale trades within a strike price range from $90.0 to $115.0 in the last 30 days.

ConocoPhillips 30-Day Option Volume & Interest Snapshot

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| COP | PUT | SWEEP | BULLISH | 05/16/25 | $4.75 | $4.7 | $4.7 | $105.00 | $99.2K | 1.1K | 212 |

| COP | CALL | SWEEP | NEUTRAL | 05/16/25 | $3.5 | $3.2 | $3.2 | $105.00 | $85.7K | 3.5K | 326 |

| COP | CALL | TRADE | BULLISH | 06/20/25 | $2.63 | $2.6 | $2.63 | $110.00 | $51.8K | 13.8K | 449 |

| COP | CALL | TRADE | BEARISH | 06/20/25 | $2.72 | $2.6 | $2.6 | $110.00 | $51.2K | 13.8K | 252 |

| COP | CALL | TRADE | BULLISH | 06/20/25 | $2.6 | $2.55 | $2.6 | $110.00 | $41.8K | 13.8K | 646 |

About ConocoPhillips

ConocoPhillips is a US-based independent exploration and production firm. In 2023, it produced 1.2 million barrels per day of oil and natural gas liquids and 3.1 billion cubic feet per day of natural gas, primarily from Alaska and the Lower 48 in the United States and Norway in Europe and several countries in Asia-Pacific and the Middle East. Proven reserves at year-end 2023 were 6.8 billion barrels of oil equivalent.

Following our analysis of the options activities associated with ConocoPhillips, we pivot to a closer look at the company's own performance.

Where Is ConocoPhillips Standing Right Now?

- With a trading volume of 1,653,126, the price of COP is down by -0.3%, reaching $102.89.

- Current RSI values indicate that the stock is may be approaching overbought.

- Next earnings report is scheduled for 35 days from now.

Expert Opinions on ConocoPhillips

In the last month, 2 experts released ratings on this stock with an average target price of $120.5.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access. * Maintaining their stance, an analyst from Morgan Stanley continues to hold a Overweight rating for ConocoPhillips, targeting a price of $126. * Consistent in their evaluation, an analyst from JP Morgan keeps a Overweight rating on ConocoPhillips with a target price of $115.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for ConocoPhillips with Benzinga Pro for real-time alerts.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.