Financial giants have made a conspicuous bearish move on MercadoLibre. Our analysis of options history for MercadoLibre MELI revealed 30 unusual trades.

Delving into the details, we found 33% of traders were bullish, while 56% showed bearish tendencies. Out of all the trades we spotted, 15 were puts, with a value of $952,123, and 15 were calls, valued at $2,148,949.

Expected Price Movements

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $1320.0 and $2500.0 for MercadoLibre, spanning the last three months.

Insights into Volume & Open Interest

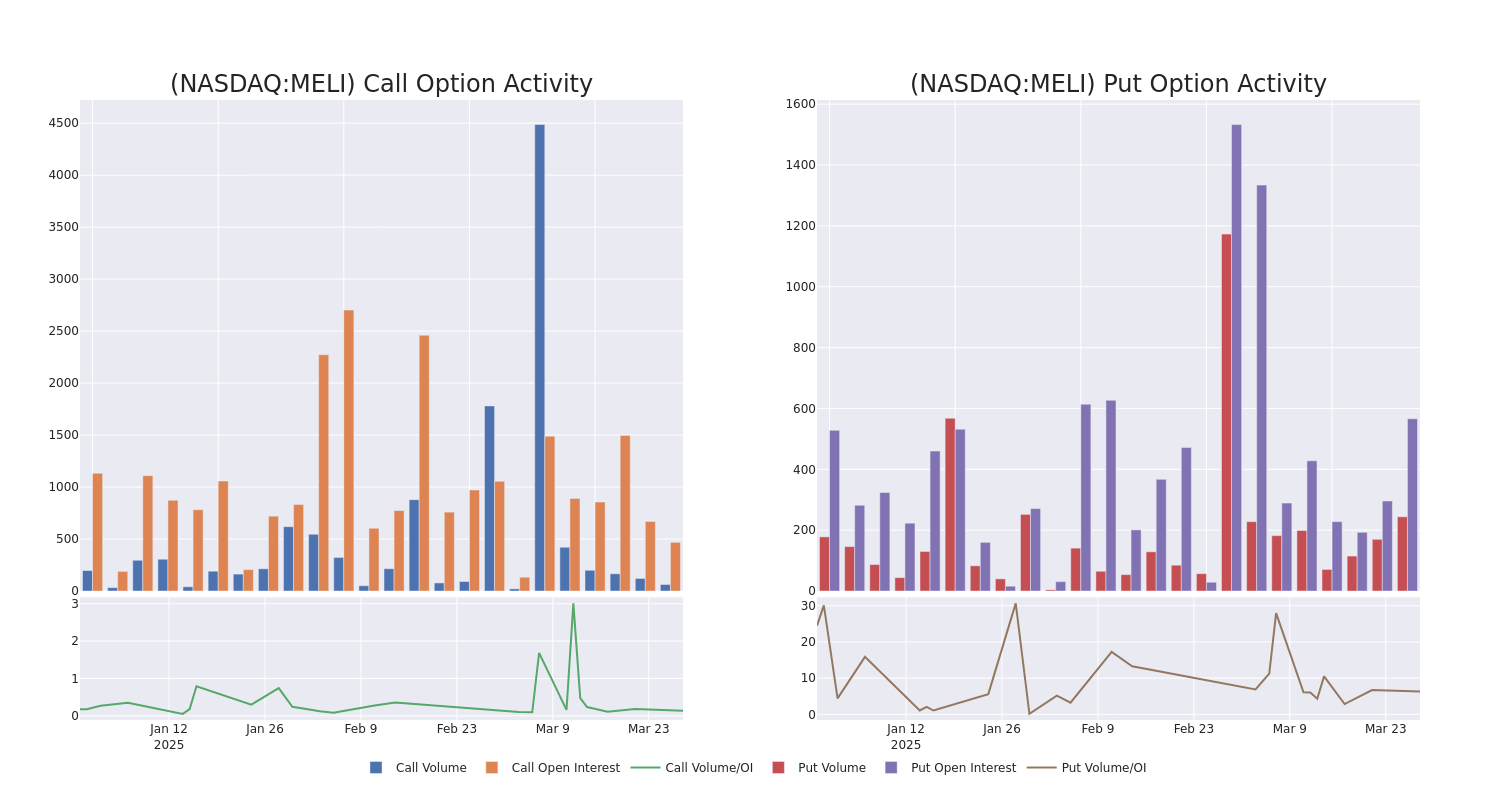

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for MercadoLibre's options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of MercadoLibre's whale activity within a strike price range from $1320.0 to $2500.0 in the last 30 days.

MercadoLibre Call and Put Volume: 30-Day Overview

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| MELI | CALL | TRADE | BEARISH | 01/15/27 | $528.0 | $510.0 | $516.0 | $2000.00 | $1.5M | 92 | 30 |

| MELI | PUT | SWEEP | BEARISH | 04/17/25 | $93.8 | $84.4 | $90.0 | $2100.00 | $243.0K | 91 | 29 |

| MELI | PUT | TRADE | BULLISH | 06/20/25 | $126.8 | $117.5 | $120.2 | $2000.00 | $192.3K | 117 | 16 |

| MELI | PUT | TRADE | BULLISH | 03/28/25 | $18.4 | $9.6 | $9.6 | $2050.00 | $134.4K | 212 | 170 |

| MELI | CALL | TRADE | BULLISH | 03/28/25 | $772.8 | $758.6 | $772.8 | $1320.00 | $77.2K | 0 | 0 |

About MercadoLibre

MercadoLibre runs the largest e-commerce marketplace in Latin America, with more than 218 million active users and 1 million active sellers across 18 countries stitching into its commerce network or fintech solutions when last reported. The company operates a host of complementary businesses to its core online shop, with shipping solutions (Mercado Envios), a payment and financing operation (Mercado Pago and Mercado Credito), advertisements (Mercado Clics), classifieds, and a turnkey e-commerce solution (Mercado Shops) rounding out its arsenal. MercadoLibre generates revenue from final value fees, advertising royalties, payment processing, insertion fees, subscription fees, and interest income from consumer and small-business lending.

Following our analysis of the options activities associated with MercadoLibre, we pivot to a closer look at the company's own performance.

Where Is MercadoLibre Standing Right Now?

- With a volume of 170,672, the price of MELI is down -2.16% at $2050.6.

- RSI indicators hint that the underlying stock is currently neutral between overbought and oversold.

- Next earnings are expected to be released in 34 days.

What Analysts Are Saying About MercadoLibre

In the last month, 1 experts released ratings on this stock with an average target price of $2750.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access. * An analyst from Goldman Sachs persists with their Buy rating on MercadoLibre, maintaining a target price of $2750.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for MercadoLibre with Benzinga Pro for real-time alerts.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.