Deep-pocketed investors have adopted a bullish approach towards NIO NIO, and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in NIO usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga's options scanner highlighted 20 extraordinary options activities for NIO. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 50% leaning bullish and 40% bearish. Among these notable options, 6 are puts, totaling $1,181,924, and 14 are calls, amounting to $831,553.

Projected Price Targets

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $3.5 and $12.0 for NIO, spanning the last three months.

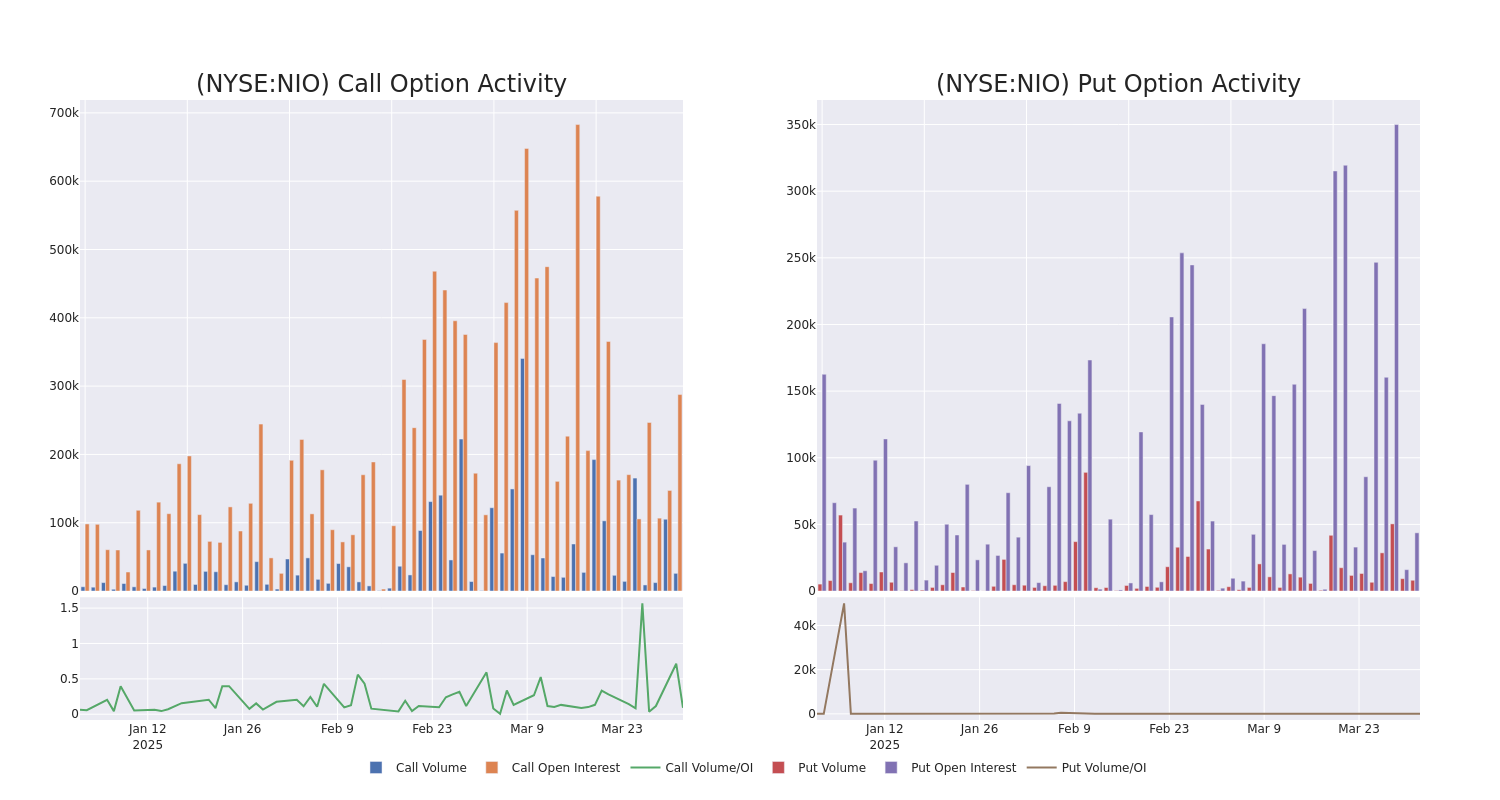

Insights into Volume & Open Interest

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for NIO's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of NIO's whale trades within a strike price range from $3.5 to $12.0 in the last 30 days.

NIO 30-Day Option Volume & Interest Snapshot

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| NIO | PUT | SWEEP | BEARISH | 01/16/26 | $8.15 | $8.05 | $8.15 | $12.00 | $668.7K | 3.7K | 821 |

| NIO | PUT | TRADE | BULLISH | 01/16/26 | $0.64 | $0.62 | $0.62 | $3.50 | $372.0K | 7.5K | 6.0K |

| NIO | CALL | TRADE | BULLISH | 06/20/25 | $0.2 | $0.19 | $0.2 | $5.00 | $96.4K | 51.3K | 4.9K |

| NIO | CALL | SWEEP | BULLISH | 11/21/25 | $0.82 | $0.8 | $0.82 | $4.00 | $73.8K | 4.6K | 1.8K |

| NIO | CALL | TRADE | BULLISH | 11/21/25 | $0.82 | $0.8 | $0.82 | $4.00 | $73.8K | 4.6K | 981 |

About NIO

Nio is a leading electric vehicle maker, targeting the premium segment. Founded in November 2014, Nio designs, develops, jointly manufactures, and sells premium smart electric vehicles. The company differentiates itself through continuous technological breakthroughs and innovations such as battery swapping and autonomous driving technologies. Nio launched its first model, its ES8 seven-seater electric SUV, in December 2017, and began deliveries in June 2018. Its current model portfolio includes midsize to large sedans and SUVs. It sold around 222,000 EVs in 2024, accounting for about 2% of the China passenger new energy vehicle market.

Having examined the options trading patterns of NIO, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Current Position of NIO

- Trading volume stands at 33,092,462, with NIO's price up by 2.28%, positioned at $3.9.

- RSI indicators show the stock to be is currently neutral between overbought and oversold.

- Earnings announcement expected in 65 days.

Expert Opinions on NIO

2 market experts have recently issued ratings for this stock, with a consensus target price of $6.15.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access. * An analyst from Citigroup persists with their Buy rating on NIO, maintaining a target price of $8. * Maintaining their stance, an analyst from Mizuho continues to hold a Neutral rating for NIO, targeting a price of $4.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest NIO options trades with real-time alerts from Benzinga Pro.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.