Whales with a lot of money to spend have taken a noticeably bearish stance on Verizon Communications.

Looking at options history for Verizon Communications VZ we detected 9 trades.

If we consider the specifics of each trade, it is accurate to state that 33% of the investors opened trades with bullish expectations and 66% with bearish.

From the overall spotted trades, 4 are puts, for a total amount of $137,423 and 5, calls, for a total amount of $501,336.

Projected Price Targets

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $32.0 to $47.0 for Verizon Communications over the recent three months.

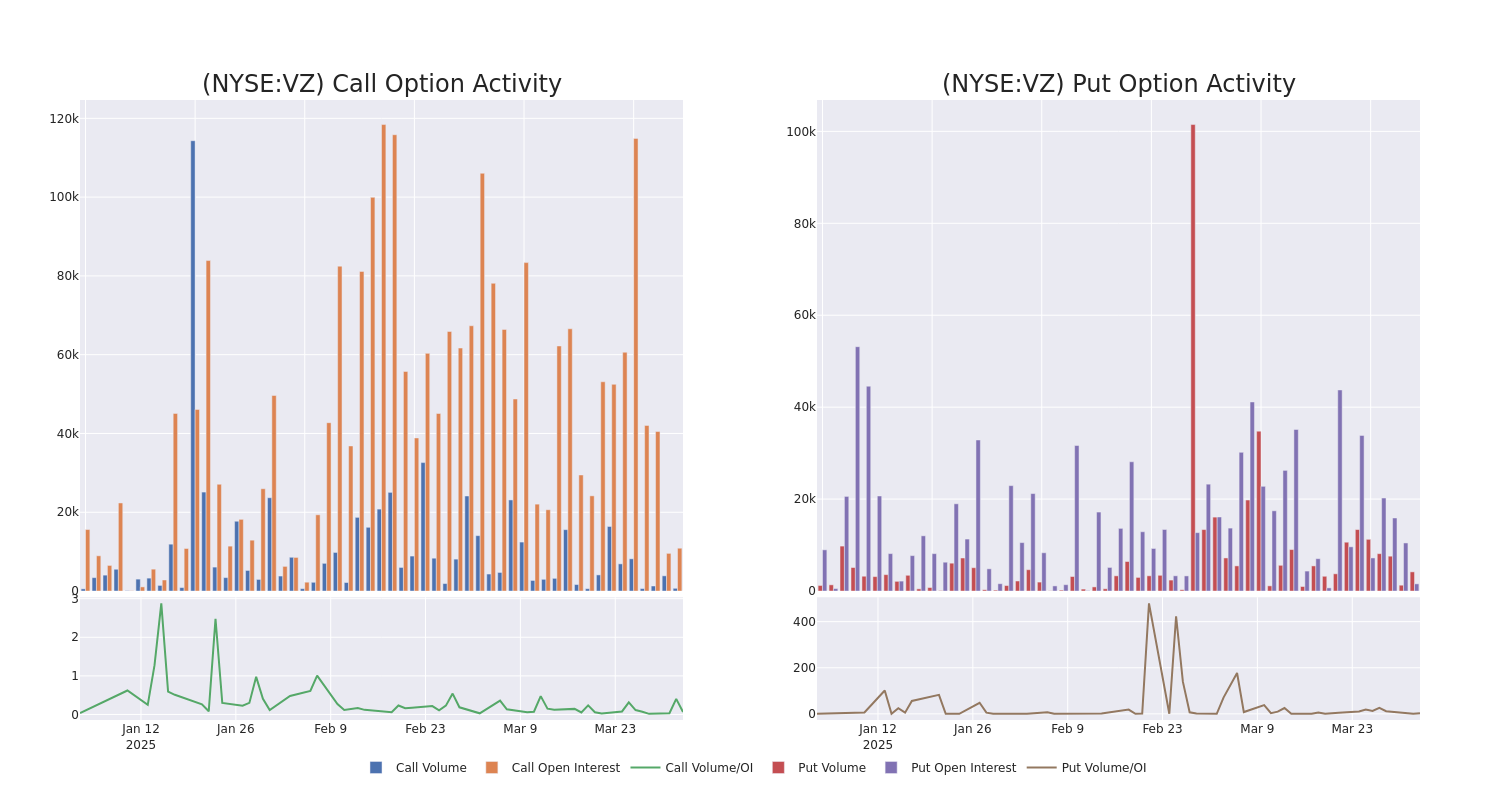

Analyzing Volume & Open Interest

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Verizon Communications's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Verizon Communications's significant trades, within a strike price range of $32.0 to $47.0, over the past month.

Verizon Communications Option Volume And Open Interest Over Last 30 Days

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| VZ | CALL | TRADE | BULLISH | 06/18/26 | $7.9 | $7.3 | $7.9 | $38.00 | $158.0K | 708 | 200 |

| VZ | CALL | SWEEP | BULLISH | 01/16/26 | $13.0 | $12.65 | $13.0 | $32.00 | $117.0K | 844 | 100 |

| VZ | CALL | TRADE | BEARISH | 01/16/26 | $10.25 | $10.05 | $10.05 | $35.00 | $100.5K | 5.7K | 0 |

| VZ | CALL | SWEEP | BEARISH | 06/18/26 | $5.4 | $5.3 | $5.3 | $42.00 | $87.9K | 1.3K | 1 |

| VZ | PUT | SWEEP | BEARISH | 07/18/25 | $1.8 | $1.77 | $1.79 | $44.00 | $50.2K | 1.5K | 1.7K |

About Verizon Communications

Wireless services account for about 70% of Verizon Communications' total service revenue and nearly all of its operating income. The firm serves about 93 million postpaid and 20 million prepaid phone customers via its nationwide network, making it the largest US wireless carrier. Fixed-line telecom operations include local networks in the Northeast, which reach about 30 million homes and businesses and serve about 8 million broadband customers. Verizon also provides telecom services nationwide to enterprise customers, often using a mixture of its own and other carriers' networks. Verizon agreed to acquire Frontier Communications in September 2024.

Following our analysis of the options activities associated with Verizon Communications, we pivot to a closer look at the company's own performance.

Where Is Verizon Communications Standing Right Now?

- Currently trading with a volume of 10,816,882, the VZ's price is down by -1.66%, now at $44.62.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 20 days.

What The Experts Say On Verizon Communications

A total of 2 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $47.5.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access. * An analyst from RBC Capital downgraded its action to Sector Perform with a price target of $45. * Consistent in their evaluation, an analyst from Oppenheimer keeps a Outperform rating on Verizon Communications with a target price of $50.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Verizon Communications, Benzinga Pro gives you real-time options trades alerts.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.