Whales with a lot of money to spend have taken a noticeably bullish stance on Lockheed Martin.

Looking at options history for Lockheed Martin LMT we detected 8 trades.

If we consider the specifics of each trade, it is accurate to state that 62% of the investors opened trades with bullish expectations and 25% with bearish.

From the overall spotted trades, 2 are puts, for a total amount of $174,200 and 6, calls, for a total amount of $418,405.

Predicted Price Range

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $400.0 to $480.0 for Lockheed Martin over the last 3 months.

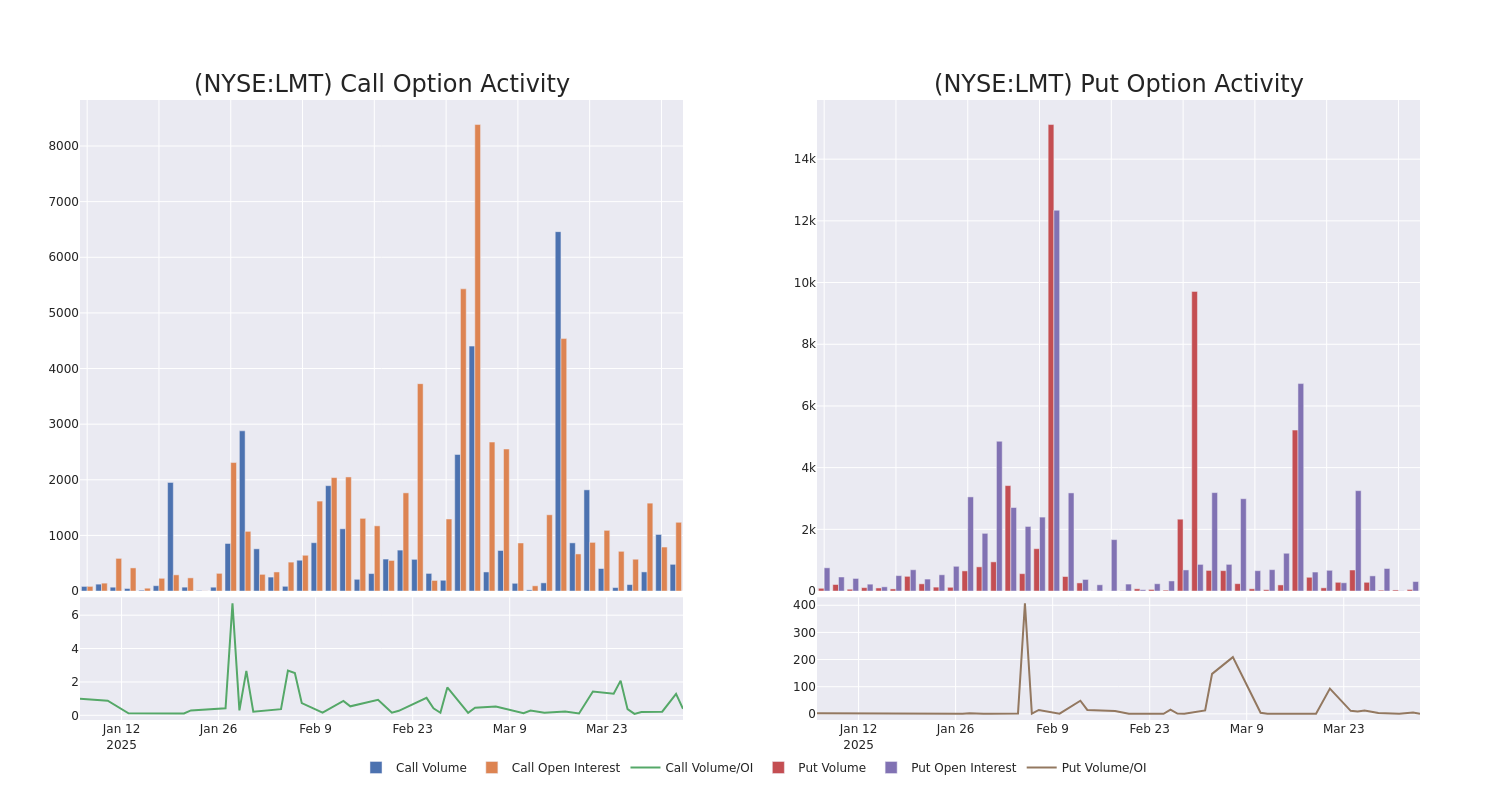

Analyzing Volume & Open Interest

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Lockheed Martin's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Lockheed Martin's significant trades, within a strike price range of $400.0 to $480.0, over the past month.

Lockheed Martin Option Activity Analysis: Last 30 Days

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| LMT | CALL | TRADE | BULLISH | 05/16/25 | $62.0 | $61.5 | $62.0 | $400.00 | $124.0K | 20 | 20 |

| LMT | CALL | SWEEP | BULLISH | 04/04/25 | $13.1 | $7.8 | $10.3 | $450.00 | $103.0K | 371 | 144 |

| LMT | PUT | TRADE | BEARISH | 01/16/26 | $29.6 | $26.7 | $29.2 | $440.00 | $87.6K | 255 | 30 |

| LMT | PUT | TRADE | BEARISH | 01/15/27 | $43.3 | $41.6 | $43.3 | $440.00 | $86.6K | 53 | 21 |

| LMT | CALL | SWEEP | BULLISH | 04/04/25 | $8.5 | $7.1 | $8.0 | $450.00 | $80.0K | 371 | 248 |

About Lockheed Martin

Lockheed Martin is the world's largest defense contractor and has dominated the Western market for high-end fighter aircraft since it won the F-35 Joint Strike Fighter program in 2001. Aeronautics is Lockheed's largest segment, which derives upward of two-thirds of its revenue from the F-35. Lockheed's remaining segments are rotary and mission systems, mainly encompassing the Sikorsky helicopter business; missiles and fire control, which creates missiles and missile defense systems; and space systems, which produces satellites and receives equity income from the United Launch Alliance joint venture.

In light of the recent options history for Lockheed Martin, it's now appropriate to focus on the company itself. We aim to explore its current performance.

Lockheed Martin's Current Market Status

- Trading volume stands at 718,606, with LMT's price down by -1.1%, positioned at $447.88.

- RSI indicators show the stock to be is currently neutral between overbought and oversold.

- Earnings announcement expected in 19 days.

Professional Analyst Ratings for Lockheed Martin

Over the past month, 3 industry analysts have shared their insights on this stock, proposing an average target price of $480.33.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access. * An analyst from B of A Securities has revised its rating downward to Neutral, adjusting the price target to $485. * Maintaining their stance, an analyst from Wells Fargo continues to hold a Equal-Weight rating for Lockheed Martin, targeting a price of $476. * An analyst from RBC Capital has revised its rating downward to Sector Perform, adjusting the price target to $480.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Lockheed Martin, Benzinga Pro gives you real-time options trades alerts.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.