Deep-pocketed investors have adopted a bearish approach towards Apple AAPL, and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in AAPL usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga's options scanner highlighted 281 extraordinary options activities for Apple. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 41% leaning bullish and 43% bearish. Among these notable options, 128 are puts, totaling $11,204,066, and 153 are calls, amounting to $18,401,060.

What's The Price Target?

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $110.0 to $250.0 for Apple over the recent three months.

Analyzing Volume & Open Interest

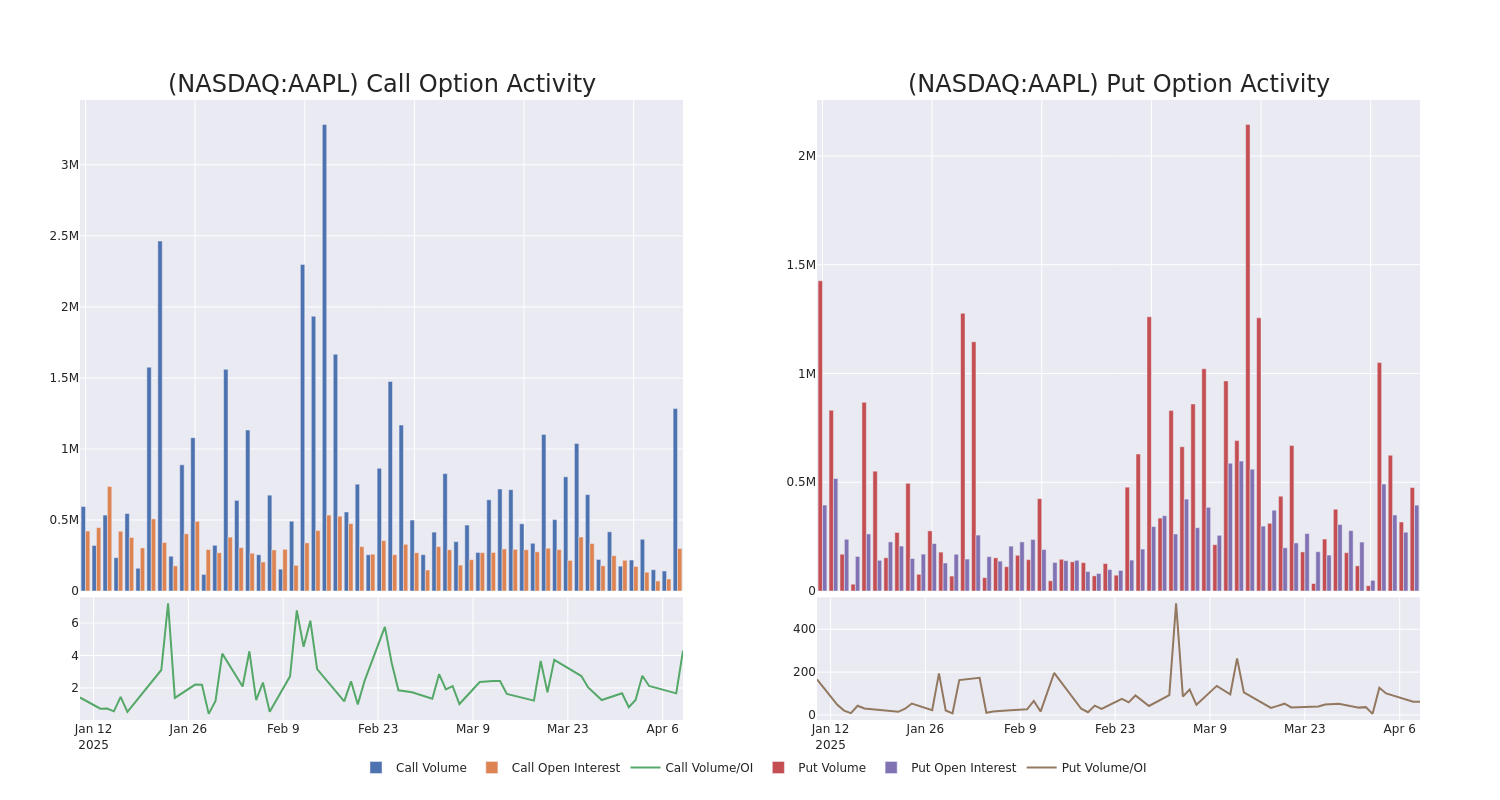

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Apple's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Apple's significant trades, within a strike price range of $110.0 to $250.0, over the past month.

Apple Call and Put Volume: 30-Day Overview

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| AAPL | CALL | SWEEP | BULLISH | 06/20/25 | $30.2 | $30.2 | $30.2 | $175.00 | $3.0M | 6.5K | 6.3K |

| AAPL | CALL | SWEEP | BEARISH | 12/18/26 | $31.95 | $31.6 | $31.6 | $210.00 | $2.1M | 3.8K | 3.2K |

| AAPL | CALL | SWEEP | BEARISH | 12/18/26 | $31.9 | $31.85 | $31.85 | $210.00 | $704.0K | 3.8K | 3.9K |

| AAPL | CALL | SWEEP | BULLISH | 04/11/25 | $10.55 | $10.45 | $10.45 | $190.00 | $522.5K | 15.2K | 49.5K |

| AAPL | CALL | SWEEP | BEARISH | 12/18/26 | $31.65 | $31.6 | $31.6 | $210.00 | $470.8K | 3.8K | 293 |

About Apple

Apple is among the largest companies in the world, with a broad portfolio of hardware and software products targeted at consumers and businesses. Apple's iPhone makes up a majority of the firm sales, and Apple's other products like Mac, iPad, and Watch are designed around the iPhone as the focal point of an expansive software ecosystem. Apple has progressively worked to add new applications, like streaming video, subscription bundles, and augmented reality. The firm designs its own software and semiconductors while working with subcontractors like Foxconn and TSMC to build its products and chips. Slightly less than half of Apple's sales come directly through its flagship stores, with a majority of sales coming indirectly through partnerships and distribution.

Having examined the options trading patterns of Apple, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Apple's Current Market Status

- With a volume of 144,108,596, the price of AAPL is down -0.22% at $172.04.

- RSI indicators hint that the underlying stock is currently neutral between overbought and oversold.

- Next earnings are expected to be released in 22 days.

Expert Opinions on Apple

In the last month, 5 experts released ratings on this stock with an average target price of $235.18.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access. * An analyst from Wedbush has revised its rating downward to Outperform, adjusting the price target to $325. * An analyst from Keybanc persists with their Underweight rating on Apple, maintaining a target price of $170. * An analyst from Jefferies has elevated its stance to Hold, setting a new price target at $167. * Maintaining their stance, an analyst from Wedbush continues to hold a Outperform rating for Apple, targeting a price of $250. * An analyst from Rosenblatt has decided to maintain their Buy rating on Apple, which currently sits at a price target of $263.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Apple options trades with real-time alerts from Benzinga Pro.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.