High-rolling investors have positioned themselves bullish on Agnico Eagle Mines AEM, and it's important for retail traders to take note. \This activity came to our attention today through Benzinga's tracking of publicly available options data. The identities of these investors are uncertain, but such a significant move in AEM often signals that someone has privileged information.

Today, Benzinga's options scanner spotted 16 options trades for Agnico Eagle Mines. This is not a typical pattern.

The sentiment among these major traders is split, with 37% bullish and 31% bearish. Among all the options we identified, there was one put, amounting to $29,580, and 15 calls, totaling $1,462,708.

What's The Price Target?

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $30.0 to $130.0 for Agnico Eagle Mines during the past quarter.

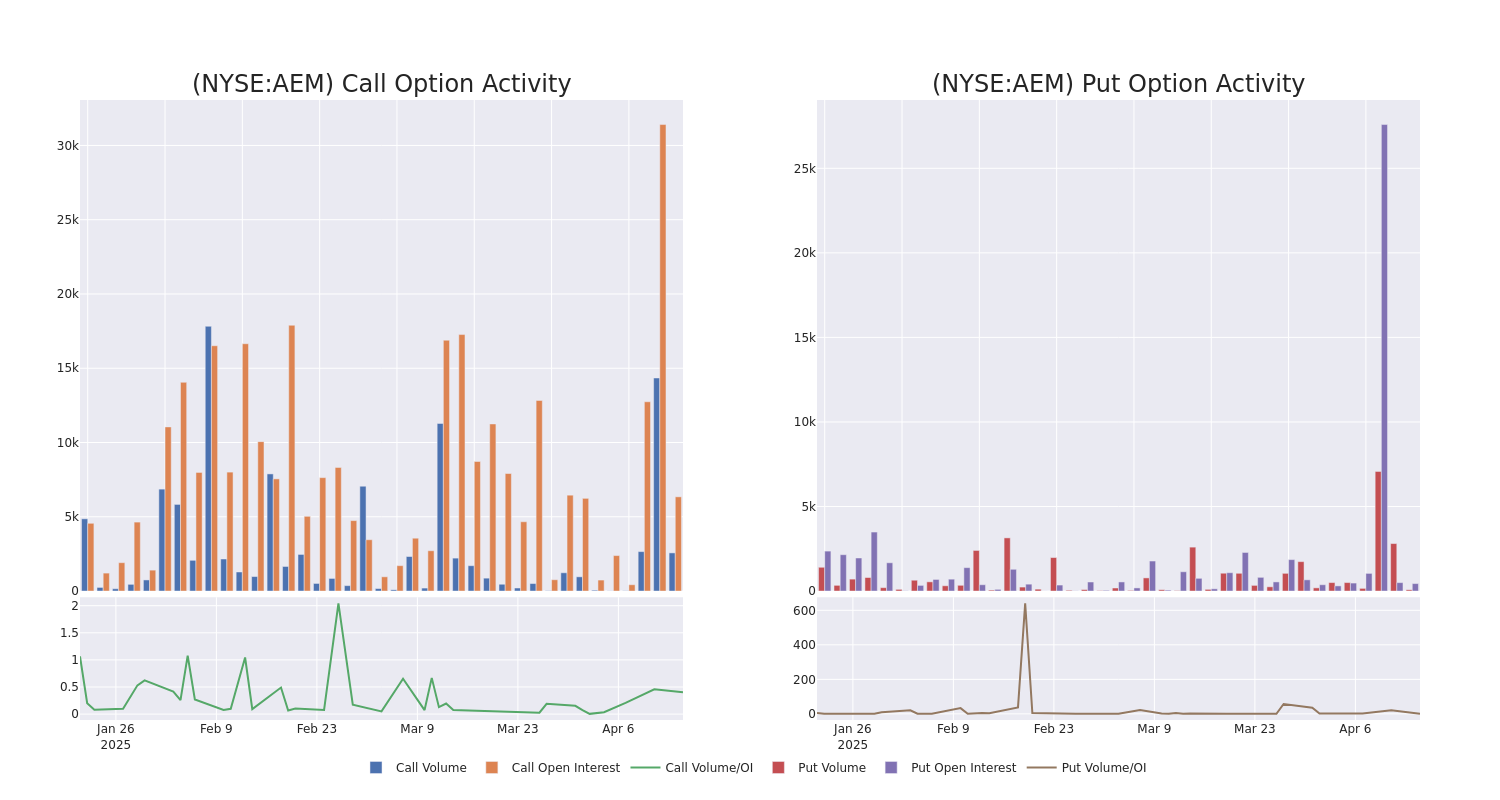

Volume & Open Interest Development

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Agnico Eagle Mines's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Agnico Eagle Mines's substantial trades, within a strike price spectrum from $30.0 to $130.0 over the preceding 30 days.

Agnico Eagle Mines Option Activity Analysis: Last 30 Days

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| AEM | CALL | TRADE | BULLISH | 01/15/27 | $38.0 | $37.2 | $37.7 | $95.00 | $282.7K | 151 | 75 |

| AEM | CALL | SWEEP | BULLISH | 10/17/25 | $21.7 | $21.3 | $21.7 | $105.00 | $266.9K | 158 | 123 |

| AEM | CALL | SWEEP | NEUTRAL | 06/18/26 | $59.3 | $55.5 | $57.4 | $65.00 | $229.5K | 41 | 20 |

| AEM | CALL | TRADE | BEARISH | 01/16/26 | $12.2 | $11.7 | $11.9 | $130.00 | $146.3K | 934 | 133 |

| AEM | CALL | SWEEP | BULLISH | 10/17/25 | $28.9 | $27.3 | $28.89 | $95.00 | $118.4K | 43 | 248 |

About Agnico Eagle Mines

Agnico Eagle is a gold miner with mines in Canada, Mexico, Finland, and Australia. Agnico operated just one mine, LaRonde, as recently as 2008 before bringing its other mines online in rapid succession in the following years. It merged with Kirkland Lake Gold in 2022, acquiring the Detour Lake and Macassa mines in Canada along with the high-grade, low-cost Fosterville mine in Australia. It sold around 3.4 million gold ounces in 2024 and had about 15 years of gold reserves at end 2024. Agnico Eagle is focused on increasing gold production in lower-risk jurisdictions and bought the remaining 50% of its Canadian Malartic mine along with the Wasamac project and other assets from Yamana Gold in 2023.

After a thorough review of the options trading surrounding Agnico Eagle Mines, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Current Position of Agnico Eagle Mines

- With a trading volume of 803,690, the price of AEM is up by 1.22%, reaching $119.84.

- Current RSI values indicate that the stock is may be overbought.

- Next earnings report is scheduled for 9 days from now.

What The Experts Say On Agnico Eagle Mines

A total of 5 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $122.4.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access. * An analyst from B of A Securities has decided to maintain their Buy rating on Agnico Eagle Mines, which currently sits at a price target of $142. * An analyst from Raymond James has decided to maintain their Outperform rating on Agnico Eagle Mines, which currently sits at a price target of $130. * In a cautious move, an analyst from UBS downgraded its rating to Neutral, setting a price target of $110. * An analyst from RBC Capital has decided to maintain their Outperform rating on Agnico Eagle Mines, which currently sits at a price target of $115. * An analyst from UBS persists with their Neutral rating on Agnico Eagle Mines, maintaining a target price of $115.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Agnico Eagle Mines, Benzinga Pro gives you real-time options trades alerts.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.