Whales with a lot of money to spend have taken a noticeably bearish stance on Home Depot.

Looking at options history for Home Depot HD we detected 24 trades.

If we consider the specifics of each trade, it is accurate to state that 33% of the investors opened trades with bullish expectations and 50% with bearish.

From the overall spotted trades, 12 are puts, for a total amount of $608,317 and 12, calls, for a total amount of $480,063.

Projected Price Targets

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $300.0 and $400.0 for Home Depot, spanning the last three months.

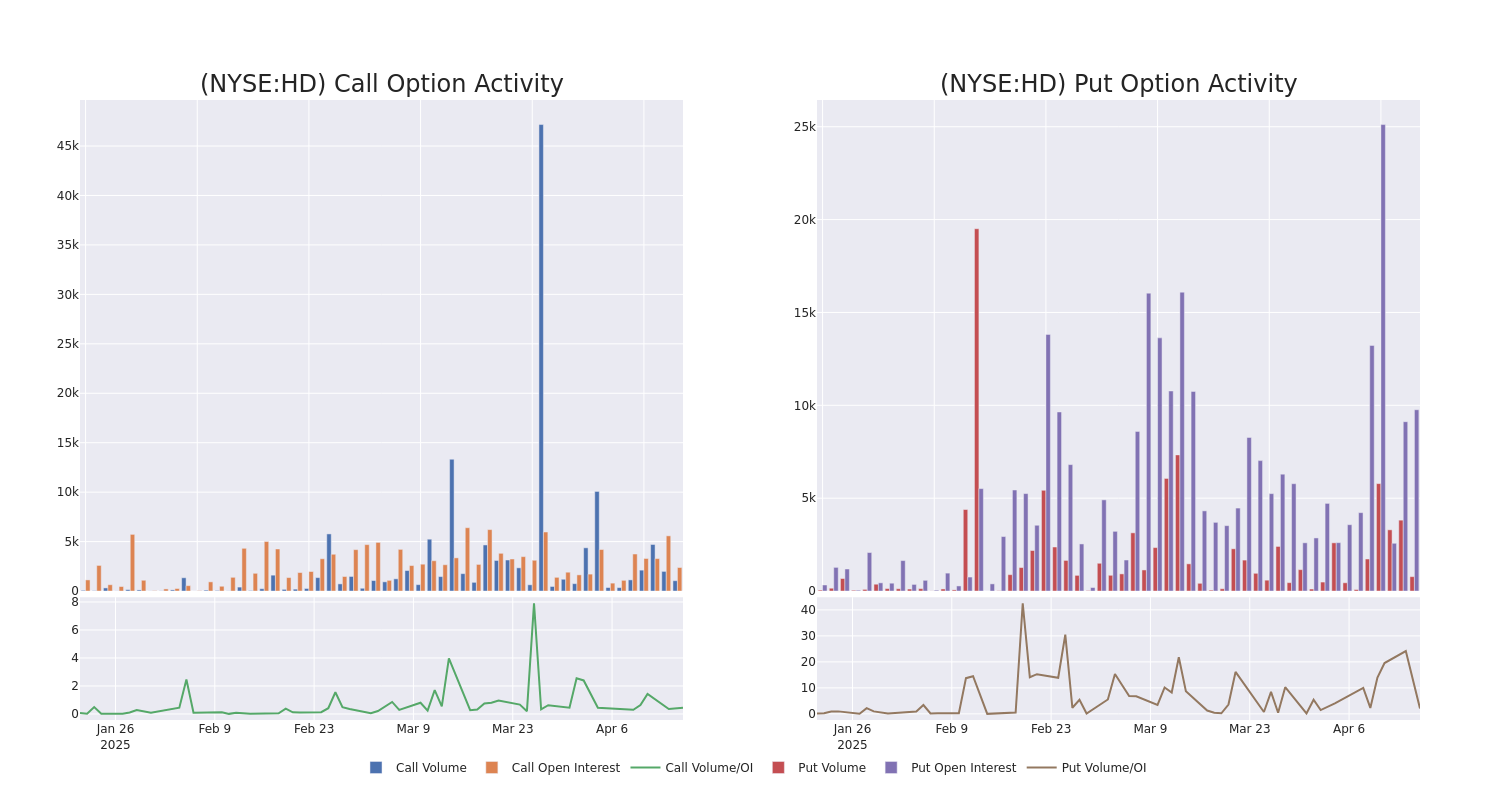

Volume & Open Interest Development

In terms of liquidity and interest, the mean open interest for Home Depot options trades today is 578.19 with a total volume of 1,790.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for Home Depot's big money trades within a strike price range of $300.0 to $400.0 over the last 30 days.

Home Depot 30-Day Option Volume & Interest Snapshot

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| HD | PUT | TRADE | BULLISH | 05/09/25 | $38.5 | $35.5 | $36.59 | $390.00 | $171.9K | 48 | 0 |

| HD | PUT | SWEEP | NEUTRAL | 05/16/25 | $7.55 | $6.9 | $7.25 | $340.00 | $84.1K | 1.6K | 117 |

| HD | PUT | TRADE | BEARISH | 03/20/26 | $60.0 | $59.05 | $60.0 | $400.00 | $60.0K | 35 | 11 |

| HD | CALL | SWEEP | BULLISH | 04/25/25 | $3.25 | $3.0 | $3.16 | $360.00 | $58.4K | 477 | 202 |

| HD | CALL | SWEEP | BULLISH | 05/16/25 | $14.85 | $13.65 | $14.55 | $345.00 | $58.2K | 237 | 49 |

About Home Depot

Home Depot is the world's largest home improvement specialty retailer, operating more than 2,300 warehouse-format stores offering more than 30,000 products in store and 1 million products online in the US, Canada, and Mexico. Its stores offer building materials, home improvement products, lawn and garden products, and decor products and provide various services, including home improvement installation services and tool and equipment rentals. The acquisition of Interline Brands in 2015 allowed Home Depot to enter the MRO business, which has been expanded through the tie-up with HD Supply (2020). The additions of the Company Store brought textiles to the lineup, and the 2024 tie-up with SRS will help grow professional demand in roofing, pool and landscaping projects.

Following our analysis of the options activities associated with Home Depot, we pivot to a closer look at the company's own performance.

Home Depot's Current Market Status

- With a trading volume of 1,674,610, the price of HD is down by -2.51%, reaching $345.23.

- Current RSI values indicate that the stock is is currently neutral between overbought and oversold.

- Next earnings report is scheduled for 27 days from now.

Professional Analyst Ratings for Home Depot

Over the past month, 2 industry analysts have shared their insights on this stock, proposing an average target price of $404.5.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access. * An analyst from Truist Securities persists with their Buy rating on Home Depot, maintaining a target price of $391. * An analyst from Piper Sandler has decided to maintain their Overweight rating on Home Depot, which currently sits at a price target of $418.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Home Depot options trades with real-time alerts from Benzinga Pro.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.