Whales with a lot of money to spend have taken a noticeably bearish stance on Danaher.

Looking at options history for Danaher DHR we detected 16 trades.

If we consider the specifics of each trade, it is accurate to state that 37% of the investors opened trades with bullish expectations and 56% with bearish.

From the overall spotted trades, 14 are puts, for a total amount of $1,099,493 and 2, calls, for a total amount of $324,480.

Predicted Price Range

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $170.0 to $210.0 for Danaher over the recent three months.

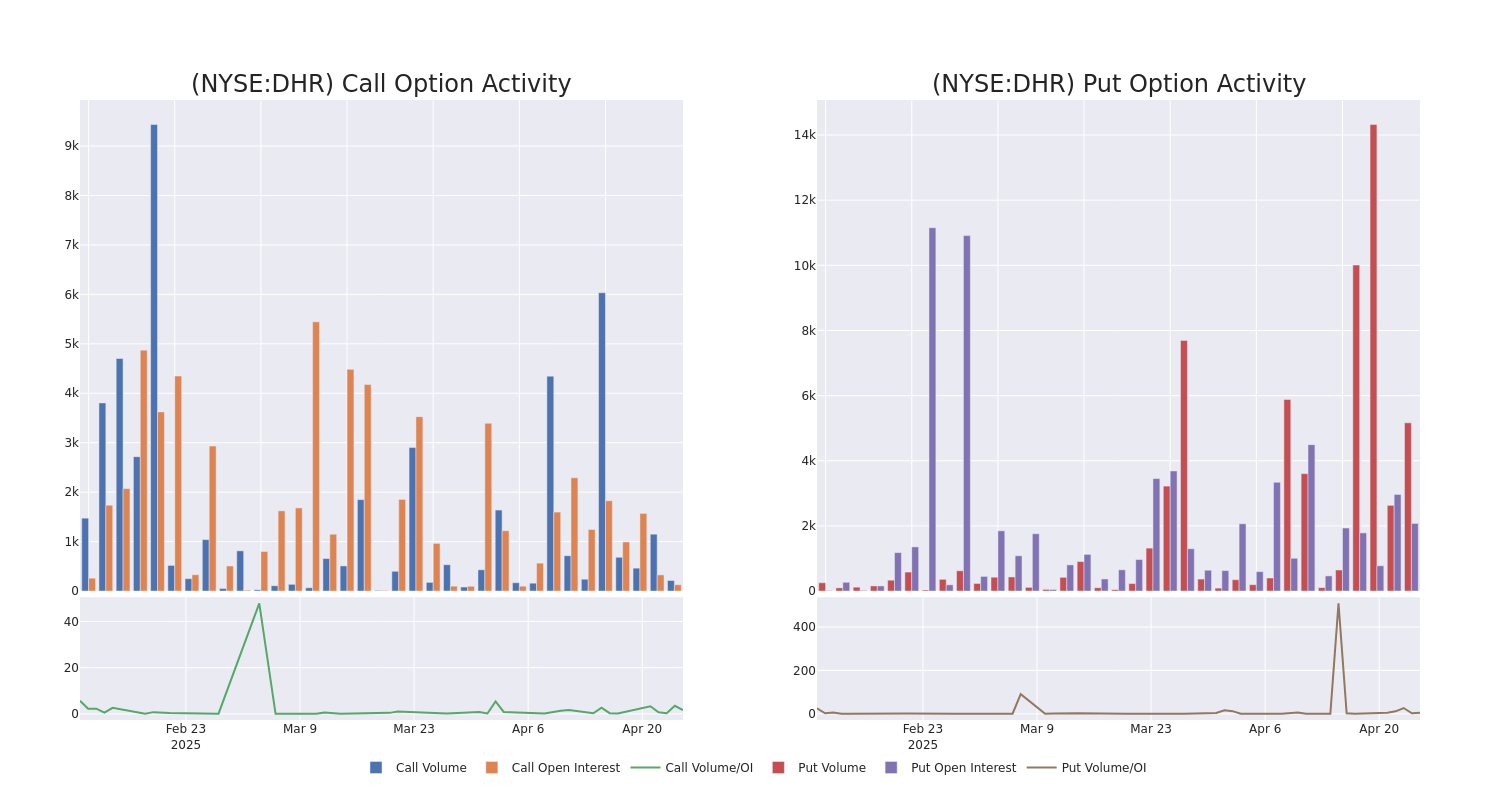

Volume & Open Interest Trends

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for Danaher's options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Danaher's whale activity within a strike price range from $170.0 to $210.0 in the last 30 days.

Danaher Call and Put Volume: 30-Day Overview

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| DHR | CALL | SWEEP | BULLISH | 04/25/25 | $27.2 | $26.3 | $27.04 | $170.00 | $246.0K | 127 | 92 |

| DHR | PUT | SWEEP | BEARISH | 06/20/25 | $16.2 | $16.2 | $16.2 | $210.00 | $105.5K | 866 | 418 |

| DHR | PUT | SWEEP | BEARISH | 06/20/25 | $17.7 | $16.7 | $17.23 | $210.00 | $103.2K | 866 | 118 |

| DHR | PUT | TRADE | BEARISH | 06/20/25 | $17.5 | $15.8 | $16.94 | $210.00 | $101.6K | 866 | 241 |

| DHR | PUT | SWEEP | BULLISH | 06/20/25 | $16.5 | $15.8 | $15.7 | $210.00 | $97.3K | 866 | 539 |

About Danaher

In 1984, Danaher's founders transformed a real estate organization into an industrial-focused manufacturing company. Then, through a series of mergers, acquisitions, and divestitures, Danaher now focuses primarily on manufacturing scientific instruments and consumables in the life science and diagnostic industries after the late 2023 divestiture of its environmental and applied solutions group, Veralto.

After a thorough review of the options trading surrounding Danaher, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Danaher's Current Market Status

- Trading volume stands at 1,116,247, with DHR's price up by 0.15%, positioned at $196.79.

- RSI indicators show the stock to be is currently neutral between overbought and oversold.

- Earnings announcement expected in 88 days.

What Analysts Are Saying About Danaher

Over the past month, 5 industry analysts have shared their insights on this stock, proposing an average target price of $239.0.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access. * An analyst from UBS persists with their Buy rating on Danaher, maintaining a target price of $240. * In a cautious move, an analyst from RBC Capital downgraded its rating to Outperform, setting a price target of $250. * An analyst from Baird has decided to maintain their Outperform rating on Danaher, which currently sits at a price target of $225. * An analyst from Jefferies persists with their Buy rating on Danaher, maintaining a target price of $230. * In a cautious move, an analyst from Guggenheim downgraded its rating to Buy, setting a price target of $250.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Danaher, Benzinga Pro gives you real-time options trades alerts.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.