Zinger Key Points

- Tiger Global buys into Broadcom, boosting its semiconductor stakes alongside major increases in TSM and LRCX.

- Amid an AI frenzy, Broadcom, seen as a key player with significant revenue forecasts, sees Tiger Global's strategic shift in tech investment

- Pelosi’s latest AI pick skyrocketed 169% in just one month. Click here to discover the next stock our government trade tracker is spotlighting—before it takes off.

Tiger Global expanded its investment portfolio by acquiring its first stake in the California-based semiconductor manufacturer Broadcom Inc AVGO in the final quarter of 2023.

Simultaneously, Tiger Global aggressively expanded its involvement in the semiconductor industry. Notably, it amplified its holdings in Taiwan Semiconductor Manufacturing Co TSM and Lam Research Corp LRCX by 47.69% and 8.9%, respectively, MarketWatch cites regulatory filings.

The prominent New York hedge fund initiated by American billionaire Chase Coleman III in 2001 strategically adjusted its investment portfolio, significantly impacting its positions in significant technology and semiconductor firms.

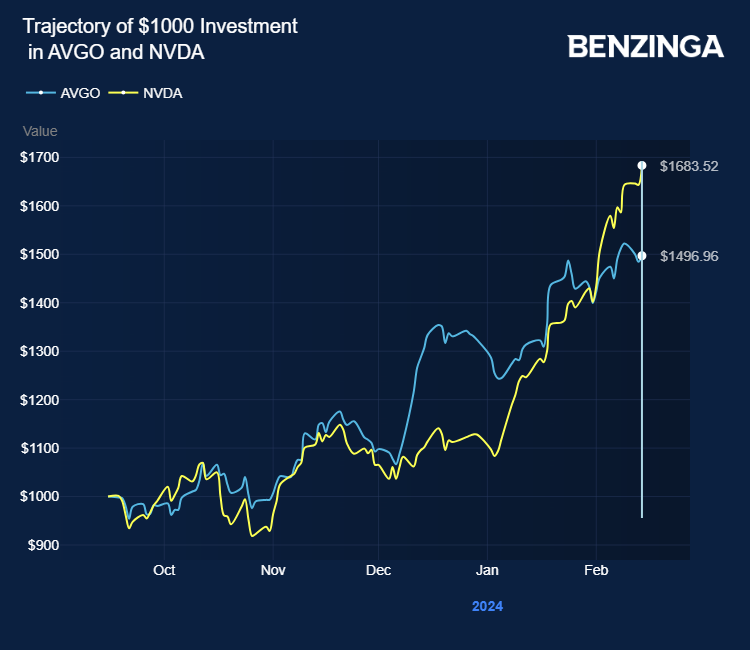

Analysts hailed Broadcom as among the biggest beneficiaries of the artificial intelligence frenzy, apart from Nvidia Corp NVDA. The stock gained 50% in the last six months. The analysts noted Broadcom as a critical global AI semiconductor supplier with $8 billion+ in the calendar year 2024 estimated revenues and a custom chip ASIC supplier with $12 billion annually.

JP Morgan projects fiscal 2024 revenue and EPS of $50 billion (versus $50.02 billion consensus) and $44.46 (versus $46.49 consensus).

The fund decreased its investments in four of the “Magnificent Seven” tech giants—Alphabet Inc GOOG GOOGL, Meta Platforms Inc META, Microsoft Corp MSFT, and Nvidia—which previously comprised nearly half of its portfolio.

In contrast, Tiger Global increased its stake in Amazon.com Inc AMZN, signaling a selective confidence in the tech sector’s leading companies.

AVGO Stock Prediction For 2024

When buying a stock for a longer time horizon, it is important for investors to assess where they think the stock is headed in the future.

When mapping a stock's future trajectory, investors should consider factors including the future earnings expectations and expected performance against a benchmark.

Broadcom's revenue has grown at an average rate of 12.38% annually over the past 5 years. The average 1-year price target from analysts is $1180.77, representing an expected -5.87% downside in 2025.

While past performance is not a guarantee of future results, investors should also look at a stock's historical performance when compared to both a benchmark index and the company's peers. Shares of Broadcom have seen an annualized return of 41.03%, outperforming the S&P500 index by 32.69%. This compares to 17.54% growth in the overall Information Technology sector. Broadcom has a beta of 0.9.

Price Action: AVGO shares traded lower by 0.36% at $1,257.65 on the last check Thursday.

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo via Shutterstock

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.