Zinger Key Points

- Southwest Airlines stock surges as Elliott Investment Management acquires $2 billion stake, boosting investor confidence.

- Despite a 50% decline in share price over three years, recent reports of Elliott's investment ignite optimism for Southwest.

- Get two weeks of free access to pro-level trading tools, including news alerts, scanners, and real-time market insights.

Southwest Airlines Co LUV stock is trading higher Monday amid reports that Elliott Investment Management is taking a $2 billion stake in the airline.

Initially known for revolutionizing air travel with low fares and focusing on customer service, Southwest Airlines became the top domestic carrier.

However, recent challenges have strained its long-standing success, including technology failures and a tarnished reputation.

Southwest Airlines and the broader airline industry challenges included the disruptive impact of the COVID-19 pandemic, prolonged refund processes, heightened competition, Boeing’s delivery delays affecting fleet expansion, and critical technology system failures, such as the 2022 holiday meltdown.

In April, Southwest Airlines reported first-quarter fiscal 2024 operating revenue growth of 10.9% year over year to $6.33 billion, missing the analyst consensus estimate of $6.42 billion.

Adjusted EPS was $(0.36), down from $ (0.27) last year. It missed the analyst consensus loss estimate of $(0.34). The adjusted operating loss was $(377) million, compared to $(284) million a year ago.

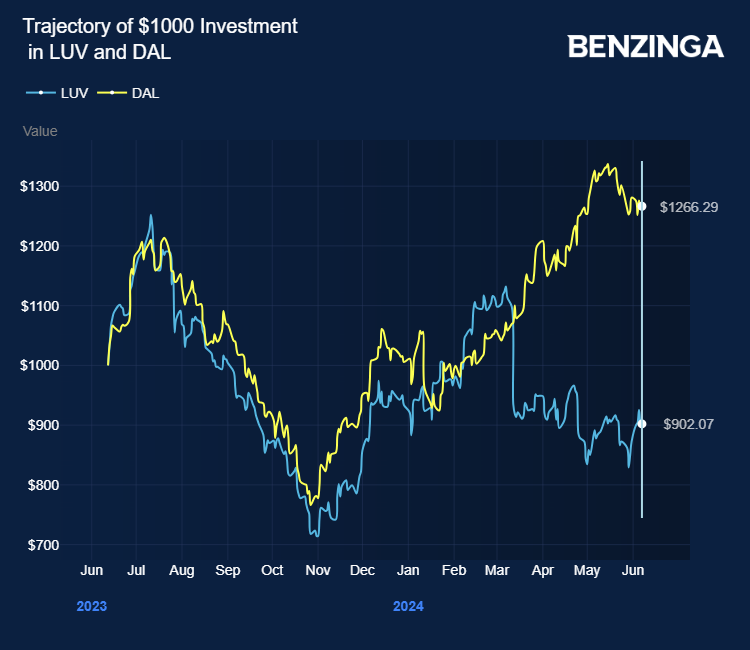

Southwest’s stock price has plunged by over 50% in the last three years, versus Delta Air Lines, Inc’s DAL 8% increase, and United Airlines Holdings Inc’s UAL 8% decline.

Meanwhile, analysts flagged industry tailwinds, including recovery in corporate travel, international demand, tighter capacity, and pandemic-driven behavioral changes.

However, they also highlighted Southwest Airlines’ cost pressure and dependency on Max aircraft.

Price Action: LUV shares are trading higher by 8.11% at $30.00 premarket at the last check Monday.

Image by Around the World Photos via Shutterstock

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.