Zinger Key Points

- Dell considers selling SecureWorks, tapping Morgan Stanley and Piper Sandler to explore potential buyers.

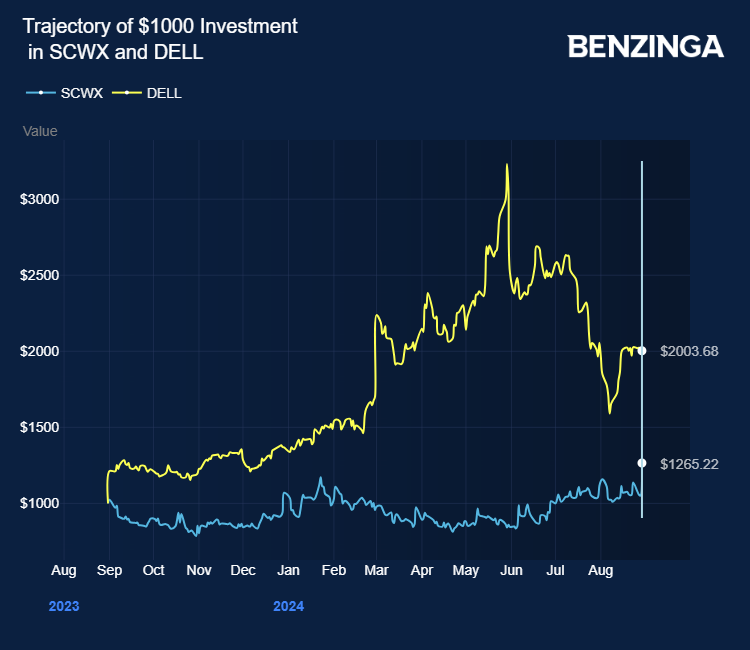

- SecureWorks stock drops nearly 4% after Dell explores sale; Dell shares rise over 6%.

- Brand New Membership Level: Benzinga Trade Alerts

Dell Technologies Inc DELL is weighing a possible sale of cybersecurity company SecureWorks Corp SCWX, Reuters cites familiar sources.

In 2019, Dell explored selling the cybersecurity company to reduce its debt. It acquired SecureWorks for $612 million in 2011.

SecureWorks stock is trading lower, close to 4%, on Friday after gains of over 20% on Thursday. Dell is up over 6% at Friday premarket trading.

On Thursday, Dell reported second-quarter revenue growth of 9% to $25.03 billion, beating the analyst consensus of $24.14 billion. As of August 2, 2024, Dell held $17.8 billion in long-term debt.

Dell has tapped investment bankers at Morgan Stanley and Piper Sandler to gauge takeover interest from potential acquirers, which include private equity firms.

SecureWorks is currently valued at $772 million. Dell owns 79.2% of SecureWorks and controls 97.4% of the company’s voting stock.

In June, SecureWorks beat first-quarter topline consensus by posting a revenue of $85.7 million. Taegis’ revenue grew 10% to $69.1 million. It expects second-quarter revenue of $80 million-$82 million versus analyst consensus of $81.2 million. Secureworks stock is up over 31% in the last 12 months.

Price Actions: SCWX stock is down 3.67% at $8.41 premarket at the last check Friday. Dell is up 6.40% at $117.83.

Photo via Shutterstock

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.