- Broad market leadership, industry-leading R&D, and healthy margins have Applied Materials favorably positioned.

- Entrenched customer relationships provide a significant competitive advantage and bolster growth prospects.

- Current trading levels suggest over 25 percent upside and provide the necessary margin of safety for value investors.

Buffett's Blend

Value investor Warren Buffett once described his investing style as 85 percent Benjamin Graham and 15 percent Philip Fisher. While most investors know Benjamin Graham as the father of security analysis, Fisher may not be quite as well known.

Fisher made his mark on the investment industry in his own right when he coined the term "scuttlebutt" research to describe interview-intensive research with industry players. He also authored the popular book "Common Stocks and Uncommon Profits." In the book, Fisher outlined fifteen points for what to look for in a stock.

Among Fisher's due diligence points were market leadership, healthy margins, and a commitment towards research and development. This led Fisher to concentrate on innovative and growing technology companies. A technology company with a combination of Fisher's criteria at a value price would be an attractive blend of Graham's and Fisher's approaches.

Currently, semiconductor manufacturing equipment leader Applied Materials, Inc. AMAT appears to be trading at a value price (more on that below) and scores well on Fisher's criteria. As such, let's take a closer look at AMAT's business model, recent results, and competitive position ahead of the company's earnings announcement on Thursday.

Applied's Business Model

Applied Materials is an industry leader in supplying manufacturing equipment, services, and software to the semiconductor, display, and related industries worldwide. The company operates with three reportable segments that include Semiconductor Systems, Applied Global Services, and Display and Adjacent Markets.

The Semiconductor segment (65 percent of 2017 net sales) develops and sells manufacturing equipment for semiconductor chip fabrication. Global Services (21 percent) offers integrated service and software solutions for its semiconductor and display products. The Display and Adjacent Markets segment (13 percent) consists of products for manufacturing liquid crystal displays, OLEDs, and displays for other consumer-oriented technologies:

Source: Applied Materials 10-K

Source: Applied Materials 10-K

Korea (28 percent of net sales), Taiwan (23 percent), and China (19 percent) represent AMAT's top three geographic regions:

Source: Applied Materials 10-K

Source: Applied Materials 10-K

Applied is the leader in material deposition and etch, a leading supplier in display, and has an installed base of more than 30,000 tools. Samsung Electronics Co. Ltd. SSNLF, Taiwan Semiconductor TSM, Intel Corporation INTC, and Micron Technology, Inc. MU have historically represented AMAT's largest customers:

Source: Applied Materials 10-K

Latest Results, Moat Analysis, and Growth Prospects

Second Quarter 2018 Results

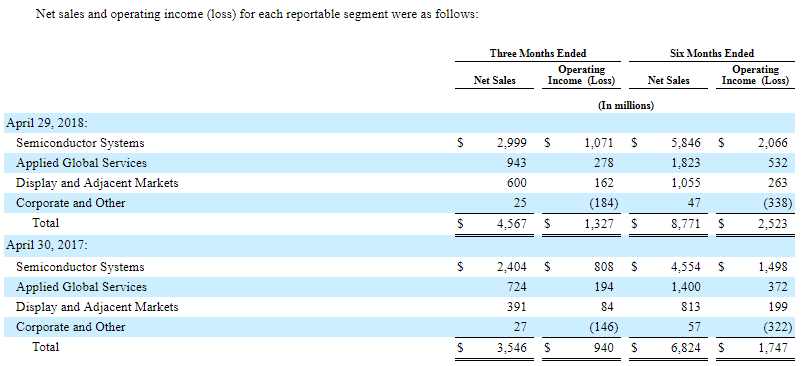

In Applied's second quarter, net sales improved 29 percent year-over-year to a record $4.57 billion. The semiconductor segment grew 25 percent to a record $2.99B while global services increased 30 percent. Global services was driven by strong demand for spare parts and new long-term service agreements and renewals:

Source: Applied Materials 10-Q

Non-GAAP operating profit increased 40 percent to $1.38B and earnings were up 54 percent to $1.22 per share. AMAT generated $611M in cash from operations, repurchased $2.5B of stock, and distributed $105M in dividends.

Applied's Competitive Advantages

The third point of Philip Fisher's fifteen-point investment checklist emphasized the importance of a company's research and development:

"[R&D investment and related ratios] can prove a crude yardstick that may give a worthwhile hint that one company is doing an abnormal amount of research or another not nearly enough."

In the rapidly-changing technology industry, research and development is vital. It also appears to be one of AMAT's biggest strengths:

Source: Applied Materials, Research and Development, Finbox.io

Applied's $1.8B in R&D leads its peers and allows the company to take advantage of technology shifts. Its entrenched relationships and collaboration with customers also appear to give AMAT an enduring advantage over upstarts. Overall, Applied looks to have a significant competitive advantage in relation to its peers.

AMAT's return on invested capital (26.6 percent) in comparison to peers and its own weighted average cost of capital (10 percent) also provides validation of its strong competitive position:

Source: Applied Materials, Return on Invested Capital, Finbox.io

Sources of Growth

AMAT's strength in R&D and relationships with its customers should continue to make it difficult for peers while simultaneously bolstering growth. As demand for ever-evolving chips grows with the rise of industry trends (mobile, internet of things, artificial intelligence, and automation) AMAT's customer-driven R&D insights can continue to support next-generation product and growth. While Applied looks positioned for growth over the long term, semiconductor comps will be tougher and management expects weakened display growth over the short-term.

AMAT's Intrinsic Value:

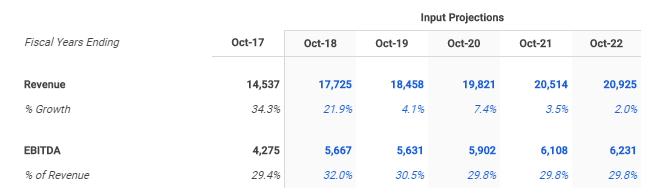

Wall Street sees double-digit revenue growth with expansion in EBITDA margin over the next year:

Source: Applied Materials 5-Year DCF Model, finbox.io

Revenue growth is expected to be in the mid-single digits over the medium-term while EBITDA margin moderates.

Source: Applied Materials, finbox.io Revenue Explorer

Incorporating these estimates into twelve finbox.io valuation models produces an average fair value estimate of $56.33 per share. This suggests 17 percent upside to recent trading levels:

Source: Applied Materials, finbox.io

Wall Street's 1-year target is even higher at $66.35 per share, which implies almost 40 percent upside. A blended valuation (50 percent finbox.io and 50 percent Wall Street) produces a $61.34 estimate of intrinsic value, or 27 percent upside.

Risks:

The cyclical nature in demand from the semiconductor industry affects all industry players. Weakness in the global economy could affect chipmaker demand and capital expenditures, which could soften demand for AMAT's products and services. Still, Applied's broad portfolio of products should help to offset. Applied needs to continue to anticipate technology transitions to maintain its competitive position as well.

Applied Materials Conclusion:

Applied Materials' commitment to research and development and entrenched relationships with customers appears to give the company a significant competitive advantage over peers. Market leadership, healthy margins, and favorable industry trends all have AMAT positioned well. Showing over 25 percent upside, Fisher and Buffett-inspired value investors should give AMAT a closer look ahead of its earnings announcement this week.

Author: Matt Hogan

Expertise: Valuation, financial statement analysis

Matt Hogan is a co-founder of finbox.io. His expertise is in investment decision making. Prior to finbox.io, Matt worked for an investment banking group providing fairness opinions in connection to stock acquisitions. He spent much of his time building valuation models to help clients determine an asset's fair value. He believes that these same valuation models should be used by all investors before buying or selling a stock.

His work is frequently published at InvestorPlace, Benzinga, ValueWalk, AAII, Barron's, Seeking Alpha and investing.com.

Matt can be reached at matt@finbox.io.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.