Key Takeaways:

- Earnings week kicks off with JP Morgan Chase, Wells Fargo, and Citigroup reporting

- Concerns about an increase in coronavirus cases keep investors on shaky ground

- Market uncertainty still looms but broader markets above key support levels

(Tuesday Market Open) After weeks of anticipation, we finally have a full set of major earnings reports to sink our teeth into.

Tuesday began with a better than expected outcome from JP Morgan Chase JPM, helping set a positive tone early in the day. While all the big banks can help drive the market with their results, JPM is the one whose business arguably touches every base. And its CEO, Jamie Dimon, is widely looked to as a key voice on the economy.

JPM beat Wall Street analysts’ estimates on the top- and bottom lines despite overall earnings falling sharply from a year ago. Heavy trading volume in Q2 made a big difference for JPM and could also set the tone for earnings from trading stalwarts Goldman Sachs Group Inc GS and Morgan Stanley MS later this week.

Bank Earnings, Round 1: JPM, WFC, C

Trading surged 79% for JPM in Q2, with the bond and equities sides both looking robust and exceeding Wall Street’s expectations. Overall, JPM reported earnings of $1.38 a share vs. the average analyst estimate of $1.19 on revenue of $33 billion vs. the $30.3 billion expected. The company added more credit reserves to protect against possible loan issues, a move that hurt profits. Higher revenue, however, helped JPM protect its bottom line to some extent.

It wouldn’t be a huge surprise if this kind of outcome ends up being the theme for bank earnings in Q2. Heavy trading and investment banking activity could propel these companies even as they struggle with a tough net interest margin environment, the need to hold massive credit reserves, and slackening business from struggling consumers.

The other theme could be lower earnings. There’s no painting over the fact that JPM’s $1.38 earnings per share may have beaten expectations, but was down from $2.82 a year earlier. Still, JPM shares were up 1.6% in pre-market trading.

Dimon, quoted in JPM’s earnings release, painted about as good a picture as he could. He said despite some recent positive data and government action, there’s “much uncertainty” about the future path of the economy. He added that JPM’s record Markets revenue and a 54% rise in Investment Banking fees helped offset interest rate headwinds and reduced consumer activity. Rates are working against JPM and other banks.

Things weren’t so hot down the street at Wells Fargo & Co WFC, which reported a Q2 loss of 66 cents a share. That was worse than the 20-cent loss that analysts had forecast. Revenue of $17.8 billion was also weaker than analyst expectations. The company said it’s cutting its dividend to 10 cents a share. WFC shares fell more than 3% ahead of the opening bell. WFC continues to struggle more than the other huge banks.

It was WFC’s first quarterly loss in a decade, with a lot of bad stuff all around. They’ve had issues for a long time, but hopefully, they’re dealing with it.

Around the corner, at Citigroup Inc C the picture looked a little sunnier. C has been one of the better bank performers in the stock market lately, and the stock climbed another 1.5% in pre-market trading today but then fell 1% after strong trading results helped the company beat analysts’ estimates. However, profit fell substantially to 50 cents a share from $1.95 a year earlier. Revenue of $19.77 billion came in ahead of analysts’ expectations as trading revenue rose sharply.

C set aside money for protection against possible bad loans and saw consumer banking struggle.

If you can look past the fact that earnings per share for the big banks fell sharply year over year (something Wall Street had expected), it doesn’t look like a horrible day for the sector, but it wasn’t a great one, either.

One possibility as today’s session moves along is that the Dow Jones Industrial Average ($DJI) could get a boost from JPM and GS, both of which were up in the pre-market. The $DJI is showing some early strength, outpacing pre-market gains by the SPX.

Today’s earnings are just the start of a busy week of reporting. Stay tuned for Netflix Inc NFLX on Thursday, the first of the “FAANG” stocks to open its books. Abbott Laboratories ABT and Johnson & Johnson JNJ will be the vanguard reporters in Health Care. More big banks are on the way tomorrow and Thursday, too. Bank of America Corp BAC, MS, and GS all report this week.

Keep in mind what we said here yesterday about what to watch. Are companies providing any kind of guidance for the rest of the year, and are they finding ways to cut costs? Are more layoffs looming? These are questions analysts likely will ask across every sector.

JPM remains in focus as the session begins. Many investors probably want to hear what Dimon has to say in the company’s earnings call. His comments about the economy weren’t too detailed in the press release, so it’s possible he’ll have more to say in front of analysts. Keep in mind that sometimes the market can move based on his words.

The other story today is Tesla Inc TSLA shares powering back in pre-market trading after getting slammed late yesterday.

Rally Flames Out To Start Week

This week, turnaround Tuesday couldn’t wait.

Monday’s massive pullback that turned early gains into steep losses got the first week of earnings season off to a less than a lovely start. At one point on Monday, the S&P 500 Index (SPX) had moved into positive territory for 2020. That didn’t last long, as a wave of sellers showed up in the afternoon to usher most of the major indices into the red. The Nasdaq (COMP) suffered the worst losses, down more than 2%.

Some of the most closely-followed stocks like TSLA and the FAANGs—some of the stocks that had paced the long rally—all lost ground Monday after moving sharply higher earlier. Information Technology ended up the worst performer on Monday’s sector popularity chart. That raised concerns about overall sentiment because when Tech sneezes, the rest of the market sometimes catches a cold. Tech is the largest sector as far as the SPX market cap (see more below).

Monday’s late slide—which puts the market into some shaky territory on the charts this morning—might have reflected worries about the reopening getting slowed down in parts of the country as virus cases continued to soar. News that Los Angeles and San Diego won’t open schools on time this fall really helped put a dagger in the market. If schools don’t open, businesses could continue to struggle as parents find themselves double-tasking.

Restaurants and bars in the biggest U.S. state were also ordered to close indoor access—not good for business or for anyone hoping to go out and spend a little money. This is the kind of backward path many people worried about when caseloads started rising last month. If it spreads to more states, the pressure on stocks might continue.

Concerns about potential worsening relations between the U.S. and China possibly added some extra steam to Monday’s late hammering. However, some analysts pointed out that despite COMP’s steep turn lower, the overall upward trend remains in place on the charts (see chart below).

Could Monday’s Tech Reversal Hint At Sector Rotation?

Investors might need a new catalyst to get interested in SPX sectors beyond Tech, which already makes up a growing percentage of the index. As of late last week, Tech stocks were 28% of the SPX, up from 21% in late 2016, Barron’s reported. The Communication Services sector, which includes some major “tech” names like Amazon Inc AMZN, Netflix Inc NFLX, and Alphabet Inc GOOGL, now forms 11% of the SPX, up from 2.5% back then. So nearly 40% of the SPX is two sectors out of the 11 total.

The interesting thing is that while COMP, the mega-techs, and chip stocks kept up a blistering pace since the June swoon, the rest of the market has basically walked in place.

This huge divergence between COMP and the other indices isn’t likely to last forever. One argument is that COMP could pause as other indices catch up, while another suggests COMP could roll back to be more in line with the others.

We still haven’t seen the cyclical and defensive sectors like Financials, Utilities, and Staples get much of a bid since a small initial rally back in late May that fizzled. In a truly healthy market, VIX would be a lot lower than it is now and there’d be more of a well-rounded upward move across sectors.

With all that in mind, some analysts saw the late wilt in COMP yesterday accompanied by strength in Financials and Industrials as a possible sign of some sector rotation. However, it’s just one day, and it’s not the first time that’s happened recently. Other “value” rallies haven’t received much follow-up.

Treasury Market Still Paints Grim Picture

It also wasn’t so great to see 10-year Treasury yields unable to hold the 0.66% level they were at earlier Monday. By late Monday, the yield was losing ground back toward 0.62%.

Last week’s low of just below 0.57% could remain a level to watch because the yield did rebound nicely from there. Still, it would likely be a genuine signal of economic confidence if the yield headed back toward the high of around 0.9% seen in early June. Confidence in the economy might also get a boost if June retail sales on Thursday come in ahead of expectations. They rose more than 17% in May, which could be tough to beat.

One positive takeaway from yesterday’s late reverse move is that the SPX maintained its grip on 3150, a psychological support level. The index remains pretty range-bound, and judging from its inability to hold yesterday’s highs, it seems like that 3000-3200 range has a pretty firm hold for now.

CHART OF THE DAY: COULD IT BE A KEY REVERSAL DAY? When the bear engulfs the bull, it’s time to pay attention. What looked like another record high turned into a more than 400-point drop in the Nasdaq Composite (COMP—candlestick) yesterday. When the high is greater than the last trading day’s high and the close is less than the last trading day’s close and trading range, it’s referred to as a bearish engulfing pattern. The second bar literally engulfs the smaller one and suggests a potential reversal. It could be a short-term one since the uptrend in COMP is still intact. Data source: Nasdaq. Chart source: The thinkorswim® platform from TD Ameritrade. For illustrative purposes only. Past performance does not guarantee future results.

Fact-Finding Mission: If you’ve been watching the $DJI lately instead of the broader SPX, you might be getting a disjoined picture of the markets. Remember, the $DJI is just 30 stocks, and it’s been getting pushed and pulled by a few of them going up or down sharply over the last week or two. For instance, on two separate days last week, Boeing (BA) and Walgreens Boots Alliance (WBA) really pushed down the $DJI to losses far worse than the ones suffered by the SPX, where those companies were one out of 500 instead of one out of 50.

Then on Friday, big 3% rallies in a couple of the $DJI’s bank stocks helped the $DJI post gains by midday that doubled gains in the SPX. Industrials and Financials helped the $DJI to slight gains Monday even while the rest of the market sagged. The point remains that the $DJI draws headlines mostly from its veteran status going back to the 1800’s. It’s not the best picture of the market on any given day. So watch what you watch.

Silver Lining? Industrials got off to a good start for the week. Stocks like 3M (MMM), Honeywell International Inc HON, Caterpillar Inc CAT, and Deere & Company DE had strong sessions, as it looked like China could be getting some infrastructure spending underway. Bank shares also looked strong going into their earnings reports. Resort and casino firms also got a boost from China, with Wynn Resorts Limited WYNN, MGM Resorts International MGM and Las Vegas Sands Corp LVS also rising. This could be a function of their businesses in Macau possibly improving as quarantine-related restrictions have eased.

Another possibly related trend lately is a decent rise in many commodities. This includes copper, often seen as a global barometer for industrial demand. Copper prices are up 88% from their mid-March low, and on Monday reached their highest levels since early 2019. This could reflect hopes for U.S. infrastructure spending initiatives, or ideas that Chinese demand for raw materials might be improving.

Why Watch Volatility? Here’s a Reason: Even before things turned lower yesterday, the Cboe Volatility Index (VIX) looked like it was trying to tell investors something. It was up 9% Monday right before stocks really did their about-face, another reminder how it can be important to keep your eyes on the VIX if you’re trading stocks. Sometimes a VIX rally can mean tough times ahead for the market, as we saw a month ago when VIX rose for a few days during a stock market rally. Stocks then plunged nearly 6% on June 11.

No one’s forecasting a repeat of that, necessarily. However, a rising VIX could reflect more investors getting cautious about the path ahead, which isn’t too surprising seeing how far major indices—especially COMP—have come over the last few months.

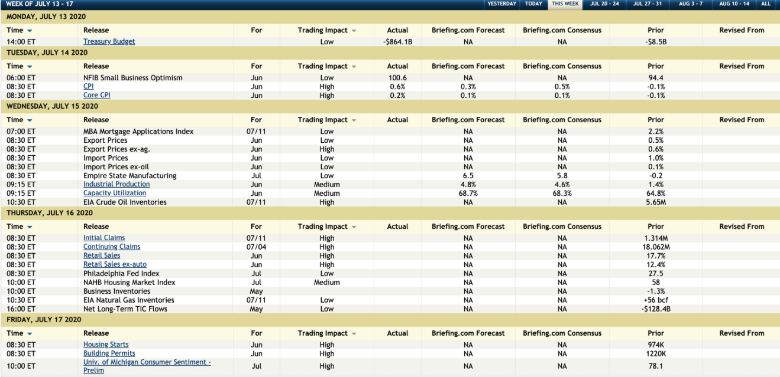

This week’s economic calendar. Source: Briefing.com

TD Ameritrade® commentary for educational purposes only. Member SIPC.

Photo by Getty Images.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.