The Motherland monument in Kiev. Zeynep Elif Özdemir/Pexels

A Missing Piece Falls Into Place

One of the objections to claims that Russia would invade Ukraine earlier this week was the lack of a casus belli for the Russian people. Clint Ehrlich made this point on Twitter,

And Russian journalist Anatoly Karlin made a similar point in his piece we presented yesterday ("Why Russia May Invade Ukraine After All"):

One of the main counter-arguments is that Russia has invested scant resources into war propaganda. The obvious rejoinder is that any casus belli - be it a false flag, or kindly provisioned by the Ukrainians themselves - will only appear towards the tail end of prewar preparations, and that a propaganda campaign preceding it would only serve to discredit it.

Now we appear to have that casus belli, as Karlin noted on Twitter early Thursday:

Bear in mind that whether this report by Russian state media is accurate or not is beside the point; the point is that the Russian people would need to hear a reason why their armed forces are invading Ukraine, and this could serve as such a reason.

Investment Considerations

The likely market reaction to an all-out invasion of Ukraine by Russia would be probably be to the downside. For that reason, as we suggested yesterday, you might want to consider hedging by purchasing optimal put options on a broad based index ETF such as the SPDR S&P 500 Trust SPY or the Invesco QQQ ETF QQQ.

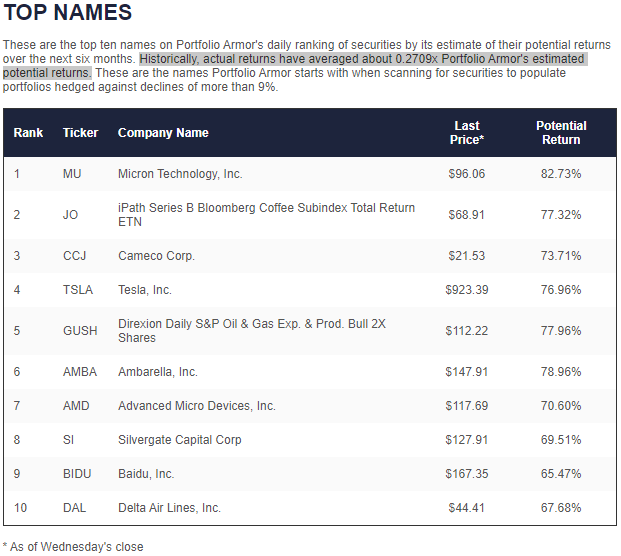

One sector that may rally in the event of an invasion is oil. Our current top oil name is the Direxion Daily S&P Oil & Gas Exp. & Prod. Bull 2X Shares ETF GUSH. You can see the current full list of our top ten names as of Wednesday's close below.

Screen capture via Portfolio Armor on 2/17/2022.

Another top name to note there is the iPath Series B Bloomberg Coffee Subindex Total Return ETN JO. As ZeroHedge reported yesterday, Rabobank warned that coffee prices may "soar out of control". ZeroHedge also quoted Goldman Sachs's head commodities strategies, Jeff Currie there:

I've been doing this 30 years and I've never seen markets like this," Currie told Bloomberg in an interview. "This is a molecule crisis. We're out of everything, I don't care if it's oil, gas, coal, copper, aluminum, you name it we're out of it.

Presumably, a major war in Europe wouldn't help the situation.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.