What is ERC-1404?

ERC-1404 is a simple restricted token standard on Ethereum. The recent development of the ERC-1404 standard has a couple key features differentiating it from other standards; most notably, it holds similar properties to regulated securities. This feature gives the ERC-1404 token the properties to become a publicly traded, tokenized asset.

ERC-1404 Overview

The new standard was proposed by TokenSoft, a leading blockchain-solutions company. The ERC-1404 consensus gives token issuers more control over circulation as well as visibility of holders. The ability to freeze supply and identify holders of the token differentiates it from the typical ERC-20 standard often used for altcoins. The ERC-1404 token was the only standard to be filed in multiple U.S. Securities and Exchange Commission (SEC) hearings, which could eventually result in the ability to transfer equities, debt and derivatives with it.

Why Do People Use ERC-1404?

The utility of ERC-1404 is still largely speculative as it works its way through SEC filings. However, its potential use case could be ground-breaking for financial services that are looking to get involved with tokenization of assets while complying with the law.

ERC-1404 vs. Other Smart Contracts

The ERC-1404 standard is not nearly as popular as the ERC-20 or ERC-721 standards.

The level of use is unlikely to change as ERC-1404 is designed for corporate use.

The ICO boom was largely credited to the ERC-20 standard, as it made the creation of altcoins simpler than ever. Likewise, the ERC-721 standard played a key role in the recent non-fungible token (NFT) craze, as it is the primary contract used for NFTs.

While the user appeal of ERC-1404 varies greatly from the other popularized standards, the impact of a regulated token standard could prove impactful.

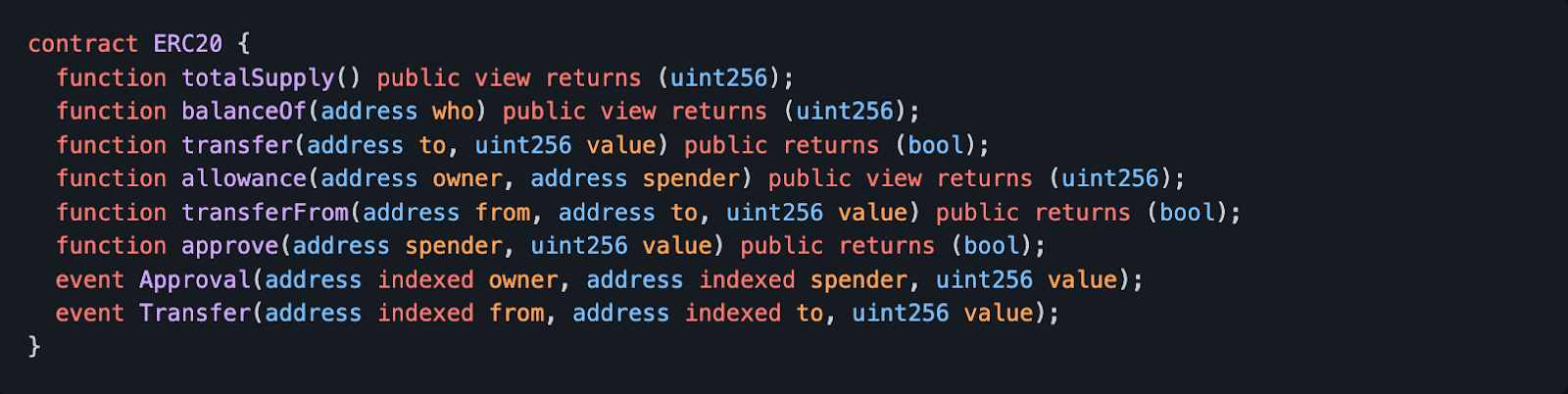

The ERC-1404 standard is a mirror image of ERC-20 with two additional lines of code. The code behind these protocols can be seen below.

ERC-20:

Source: GitHub

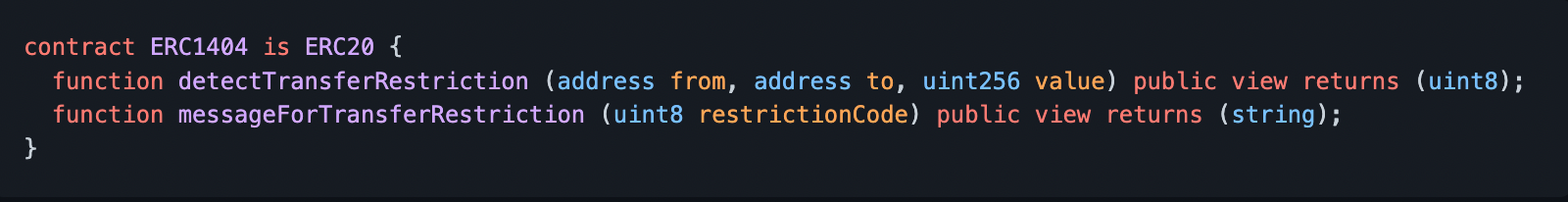

ERC-1404:

Source: GitHub

The importance of the first additional function, detectTransferRestriction, is that the issuer of the token is granted the ability to restrict transfers. This can be important when:

- token is in a lock-up period

- token recipient is not white-listed

The second line of code, messageForTransferRestriction, provides a human-readable explanation as to why a transaction is prohibited.

The Potential for ERC-1404

While the ERC-1404 standard is new and rarely practiced, the potential of linking tokens to securities in a safe and legal way is ground-breaking. The first SEC-registered security token for the general public was released in 2021 by INX, a regulated trading platform. The token uses a standard similar to that of ERC-1404 – another variation of ERC-20.

With digital assets becoming more regulated, the rules of the road become more clear for corporations and innovators. These changes should help speed up adoption of cryptocurrencies and blockchain-based solutions. The future of ERC-1404 lies largely in the hands of the SEC and its future rulings regarding the new standard.

This post contains sponsored advertising content. This content is for informational purposes only and is not intended to be investing advice

Photo by Shubham Dhage on Unsplash

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.