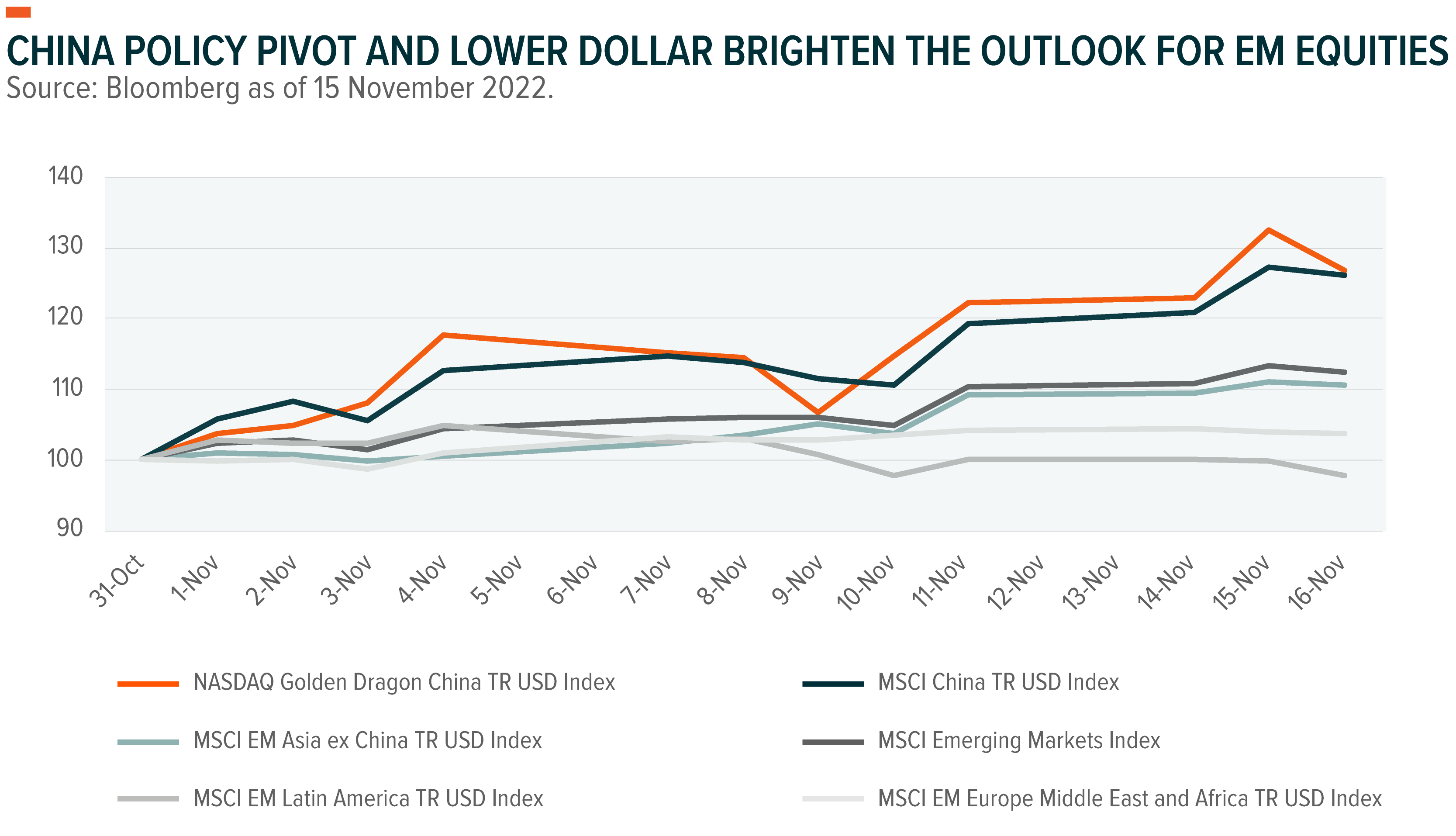

Geopolitical risks declined somewhat as the U.S. and China resumed dialogue at the G20 summit in Bali. Presidents Biden and Xi Jinping seem to be working on finding common ground, which could lead to healthier competition on technology. The drop in the U.S. dollar coupled with a declining risk-off environment bode well for the Tech sector’s investment backdrop. The Nasdaq Golden Dragon China Index, which tracks dozens of Chinese stocks listed on American exchanges, rose more than 8% the day after the Biden-Xi meeting.1 China’s latest initiatives to rescue its real estate market and ease COVID-19 restrictions could further boost growth prospects and earnings expectations, potentially triggering a sustained rebound in Chinese equities.

European equities rebounded to a three-month high, rising 15.3% on the month to November 14th amid optimism about China’s reopening, better-than-expected third-quarter earnings, and lower-than-expected U.S. inflation in October drove the performance.2 Equities are recovering from this year’s plunge caused by concerns over hawkish central banks and the energy crisis. The UK’s outlook seems more clouded given the ongoing austerity measures and higher interest rates coupled with UK unemployment rising slightly more than expected.

Relative to the U.S., where inflation numbers came in lower than expected in October, inflation continued to rise across Europe and the UK. Inflation in Europe hit 10.7% year-over-year (yoy) and 11.1% yoy in the UK.3 However, inflation could be “almost within reach,” according to European Central Bank (ECB) member Edward Scicluna. The ECB will publish its updated economic forecasts in mid-December when it gathers for another rate decision. In September, the central bank forecasted an annual inflation rate of 8.1% yoy this year and 5.5% yoy for 2023.4 In the UK, the Bank of England (BoE) forecasts 10.9% yoy inflation for 2022, followed by a rapid fall to 5.2% yoy in 2023.5

Investment strategies highlighted this month:

- U.S. Equities Rebound on Lower Inflation – Markets welcomed October’s lower inflation and the possibility that the Federal Reserve (Fed) shifts to a more gradual stance. Still, the terminal fed funds rate is likely to remain around 5% despite the sharp repricing in fed funds futures.

- Chinese Equities Rebound on Policy Shifts – Growth-supportive measures, including eased COVID restrictions and a real estate rescue plan, helped Chinese equities rebound. More broadly, the rebound helped investor sentiment turn positive on emerging markets (EM).

- COP27 Pledges Can Help Restore Appetite for Growth – More initiatives to tackle climate change, alongside declining geopolitical risks, may drive a shift back to growth stocks.

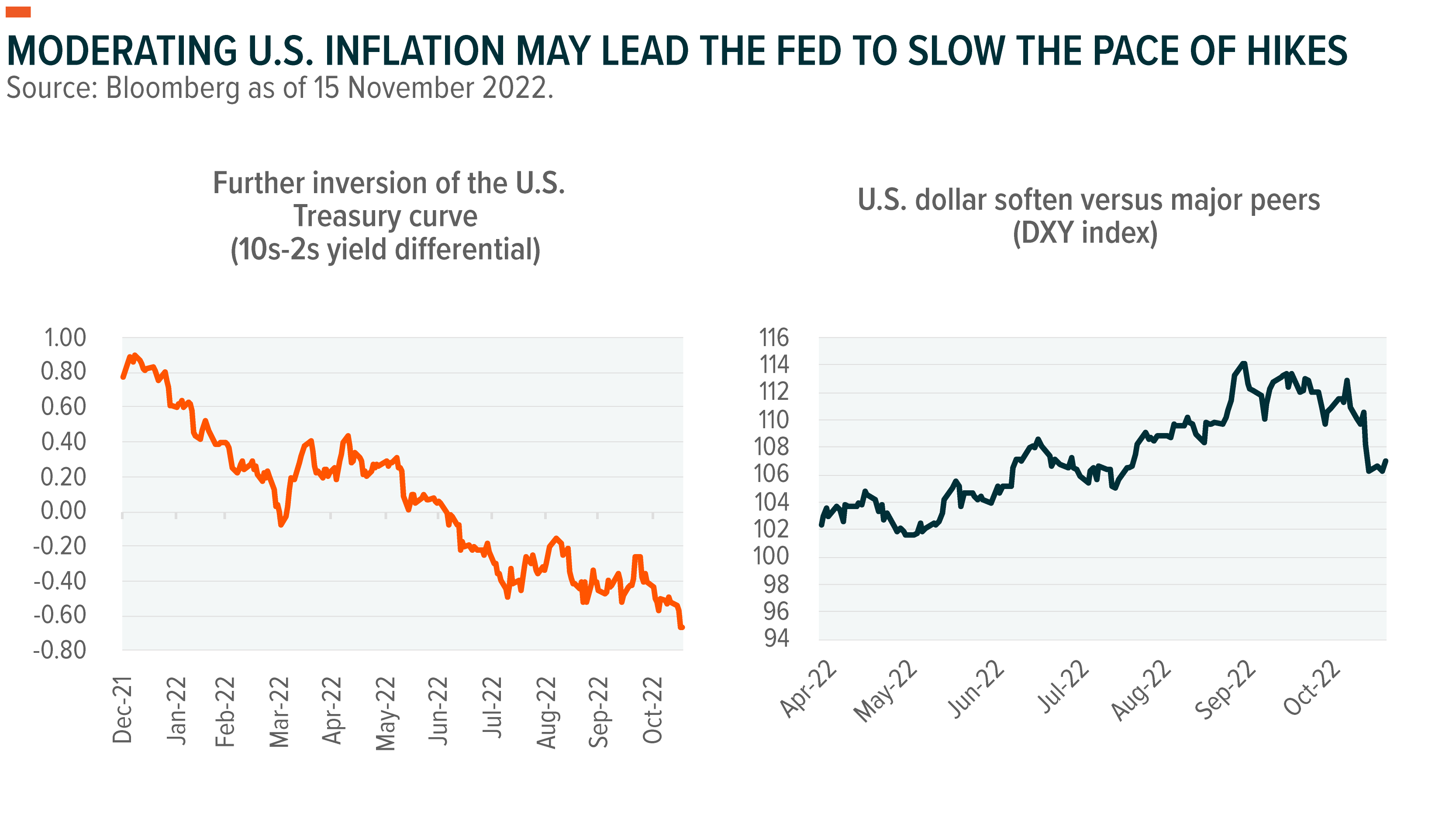

U.S. Inflation: Moderation May Lead the Fed to Slow the Pace of Hikes

October inflation data suggest a potential peak in annual price gains. The report may lead the Fed to slow the pace of rate hikes to 50 basis points (bps) in December from 75bps. Following the report, the S&P 500 rose 6.5% and Nasdaq 9.4%, short-term Treasury yields dropped 20bps while the U.S.6 Treasury curve inversion intensified, and the U.S. dollar weakened by 3.4% versus major peers.7

Headline CPI fell from 8.2% yoy to 7.7% yoy, the smallest print since the beginning of the year.8 Core CPI inflation declined from 6.6% yoy to 6.3% yoy, led by a larger-than-expected decline in core good prices, including used cars, clothing, and household furnishings. Medical care services prices also declined.9 Conversely, housing inflation remains stickier, although rent is moderating slightly.

While services inflation remains robust amid the strong job market, rising evidence of core goods deflation is a major driver behind the sharp repricing of the terminal fed funds rate to about 4.9% from around 5.1%. The repricing led to a market rally.10 However, the labor market is likely to be a superior determinant of the terminal rate, which we believe remains close to 5%. Should jobs market data deteriorate, we believe the Fed could step down its rate hikes to 25bps at the beginning of 2023.

Following the October inflation report, Fed Vice Chair Lael Brainard said the central bank should soon moderate the size of its interest rate increases, signaling that she favors slowing to a half-point hike as early as December. Since then, other Fed officials, including Governor Waller, backed expectations that they will moderate interest rate increases to 50bps next month while stressing the need to keep hiking into 2023.

Meanwhile, political risks declined following the midterm elections. The Democrats secured the Senate, while the Republicans won a narrow House majority. Markets generally welcomed this outcome because it points to a continuation of current policies and reduces the risk of political discords about the upcoming vote on budget. From an international perspective, the Democrats retaining control of the Senate is a positive signal that the Biden Administration can continue to work towards its climate change pledges. It also signals that the administration can advance its dialogue with China on key issues including climate change, technology, and national security.

China Policy Pivot: Chinese Equities Rebound As Outlook Improves

The lower U.S. dollar coupled with the possibility of a declining risk-off environment could remove some of the challenges facing Chinese equities. In addition, initiatives to ease the government’s COVID restrictions and rescue China’s real estate market and could catalyze a sustained rebound in Chinese equities. The recalibration of the zero-COVID policy includes limiting mass testing and reducing the amount of time in quarantine.11 These moves aren’t the end of zero-COVID, but they are likely to improve the economic outlook by stimulating businesses activity and consumption. Lockdowns led to disappointing retail sales over the last month, but easing restrictions could lead to a rebound that benefits consumer discretionary-oriented sectors and themes like E-commerce and Electric Vehicles.

Meanwhile, financial regulators issued a plan to boost the property market, including measures that address developers’ liquidity problems and reduce down-payment requirements for homebuyers.12 Another positive is the U.S. and China working on building a relationship that is supportive of Chinese tech, including its e-commerce giants. Following the Biden-Xi meeting, Alibaba and Pinduoduo rebounded a strong 12.2% and 9.6%, respectively.13

Overall, we expect these measures to boost China’s growth outlook for this year and next. The International Monetary Fund (IMF) currently forecasts China’s economy to grow just 3.2% in 2022 before accelerating to 4.4% in 2023, compared with global GDP growth forecasts of just 2.7%.14 China’s Q3 GDP growth already surprised to the upside at 3.9% yoy while industrial production continues to recover.15

The Biden-Xi meeting resulting in resumed cooperation on climate change fuels optimism about China’s push to technological and manufacturing self-sufficiency, notably in Cleantech. Themes that look well-positioned to benefit from this upside potential in Chinese stocks include Wind and Solar, an industry where more than half of the constituents are produced by Chinese companies. The Indxx Global CleanTech v2 Index climbed 22% on the month to November 15th.16

China’s improving economic outlook could also benefit themes like Lithium & Battery Technology and Disruptive Materials, led by copper and lithium prices. The Solactive Disruptive Materials V2 Index, which tracks companies involved in the exploration and mining of rare earth materials, including zinc, palladium, nickel, manganese, lithium, copper, and cobalt, jumped by almost 20% on the month to November 15th.17

COP27 Talks: Government Pledges Can Help Sentiment for Growth Stocks

The 2022 COP27 meeting in Sharm-el-Sheik, Egypt, took place amid polemics about countries’ commitments to meet the 2015 Paris agreement to limit temperature rises to 1.5 degrees Celsius. Currently, international actions are insufficient, as outlined in an October report from the United Nations (UN). The report stated that current global efforts could limit global warming by only 2.5 degrees Celsius compared to pre-industrial levels by the end of the century.18 Meanwhile, this year included numerous ecological disasters, including climate-enhanced heatwaves leading to severe droughts in Europe, hurricanes in Florida, and floods in Pakistan, and these after just 1.2 degrees Celsius of warming.

Just 100 companies in the world are responsible for about 70% of the global greenhouse gas emissions since 1988, predominantly fossil fuel companies.19 These energy players are critical to support global decarbonization goals alongside government initiatives, and this year a notable number them participated in COP27 discussions.

The main topic of discussion was financing for developing nations to adapt to climate change. The U.S. doubled its pledge to $100 billion for the Adaptation Fund, which finances programs that help poorer countries adapt to climate change. Also, the U.S. pledged another US$150 million for efforts across Africa.20 In addition, the U.S. plans to fund emerging nations’ clean energy transitions through carbon credits sold to businesses, with the cash proceeds to be invested in closing coal plants and acquiring renewables. Developed countries are expected to provide about US$100 billion annually by 2023 to help developing nations finance their green energy transition. However, according to the UN, developing nations will require much more to adapt to climate change, as much as US$340 billion per year by 2030.21

Another big topic of discussion was the U.S.’ announcement that it would tighten its methane rules, a pledge that it made at COP26 in Glasgow. The U.S. wants to reduce emissions of the greenhouse gas methane from oil and gas companies by requiring them to detect and repair methane leaks. The UN announced the launch of a public database of global methane leaks detected by space satellites. The database intends to support the Global Methane Pledge, an international effort to reduce methane emissions by at least 30% by 2030. Led by the U.S. and EU, 111 nations signed on to support the effort at COP26.

Green transition themes, such as Cleantech, could benefit from these new waves of international pledges to decarbonization.

Image sourced from Shutterstock

This post contains sponsored advertising content. This content is for informational purposes only and not intended to be investing advice.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.