The Q3 2022 Global X International Report can be viewed here. The report summarizes market and macroeconomic developments across our International Access suite of ETFs. For a closer look at China Sectors, please see the latest China Sector Outlook: Q4 2022.

Q3 Summary

Markets around the world continued to be disappointing in Q3, with “risk-off” sentiment dampening desire to invest in global equities. In America, the Federal Reserve (Fed) struggled with inflation advancing at a faster pace than anticipated, prompting even faster rate hikes. Geopolitical risks remained at top of mind as Ukraine launched a successful counteroffensive against Russia and US Speaker of House Nancy Pelosi’s visit to Taiwan soured US-China relations. In Europe, the ongoing energy crisis was compounded by decreased gas flows from the Nord Stream 1 pipeline, however, there are reasons to believe the worst of the European energy crisis may be behind us.

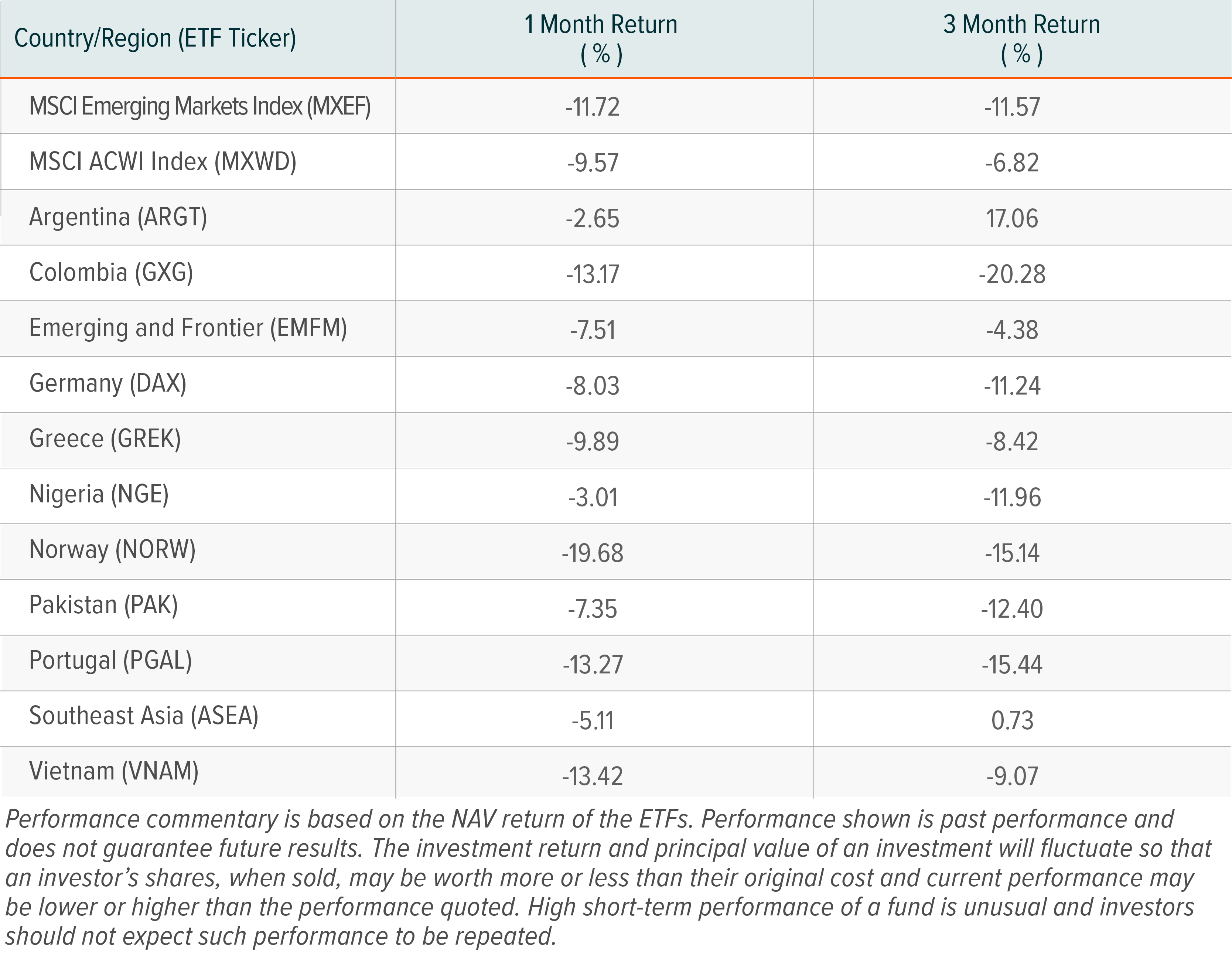

Returns for periods greater than one year are annualized. For performance current to the most recent month- and quarter-end, please click the fund name below. Performance for NORW prior to 11/1/21 reflects the historical performance of the predecessor fund.

Over the course of Q3, MSCI ACWI returned -6.82% against -11.57% for the MSCI Emerging Markets Index, meaning that emerging markets performed worse than the world as a whole. In comparison, the US-based S&P 500 returned -4.89%, implying stronger performance for the US than international equities. Among Global X’s single-country and regional ETFs, 3 outperformed the ACWI while 8 underperformed it.

The challenging global environment leaves investors looking for the light at the end of the tunnel.

Notable Performers

Argentina broke away from the rest of the pack with the Global X MSCI Argentina ETF (ARGT) delivering strongly positive returns of 17.06%, though this was in part a recovery from weak performance in Q2 2022. Volatility in Q2 arose from deteriorating confidence in Argentina’s ability to get a handle on its economic crisis. Q3 began with uncertainty, as the resignation of Economy Minister Martin Guzman in July was followed only three weeks later by the resignation of his successor, Silvina Batakis. This changed to some extent in August when the current Minister of Economy Sergio Massa took office with the blessing of Vice President Kirchner and won early victories in the form of a $700mn loan from the Inter-American Development Bank and $2bn debt deal with the Paris Club. This short-term stability allowed Argentine equities to breathe a sigh of relief in Q3, even as inflation is expected to approach 100% by the end of the year despite abnormally high interest rates.

Meanwhile, the Global X FTSE Southeast Asia ETF (ASEA) managed to eke out positive returns despite a very adverse global environment, returning 0.73% over the period. Like other markets, ASEAN (The Association of Southeast Asian Nations) is coping with the impacts of inflation and reverberations from Russia’s war in Ukraine. However, some markets in ASEAN stood out for stability amidst the troubles of Q3. Furthermore, ASEA has heavy exposure to major Southeast Asian banks, with a 57% allocation to Financials. As central banks around the world tighten interest rates, Financials possibly stand to benefit. In Q3, the Financials holdings in ASEA returned 4.61%.1

Laggards

The Global X MSCI Colombia ETF (GXG) continued its downward trend after June’s contentious Presidential election, posting losses of -20.28% in Q3. Since the election in June, investors are still trying to assess the implications of Gustavo Petro’s historic presidency. As political uncertainty continued to have an adverse impact on investor appetite towards Colombian equities, a slump in commodity prices acted as a headwind to Colombia’s economy. On the bright side, Ecopetrol saw its net profit double Year-over-Year from 990.7mn USD in Q3 2021 to 2.18bn USD in Q3 2022 on the back of rising oil prices and production.2 However, shares of Ecopetrol remain historically low as investors seem to wait for signals from Gustavo Petro on how far he will reform the country’s dependence on oil revenues.

Over in Europe, the energy crisis and a slowdown in economic growth contributed to negative returns of -15.44% for the Global X MSCI Portugal ETF (PGAL). Portugal dodged a recession in Q3 with 0.4% GDP growth, which was higher than expectations, but markets are preparing for a likely contraction in Q4.3 PGAL’s high allocation to Utilities (53.22% average weight in Q3) means the fund had a defensive tilt.4 Both of the two largest holdings, Energias De Portugal (EDP SA) and EDP Renovaveis, beat expectations with their Q3 earnings. However, a strong dollar and weak Euro worked against PGAL, contributing -6% to total returns for the fund in Q3.5

Outlook for Q4 and Beyond

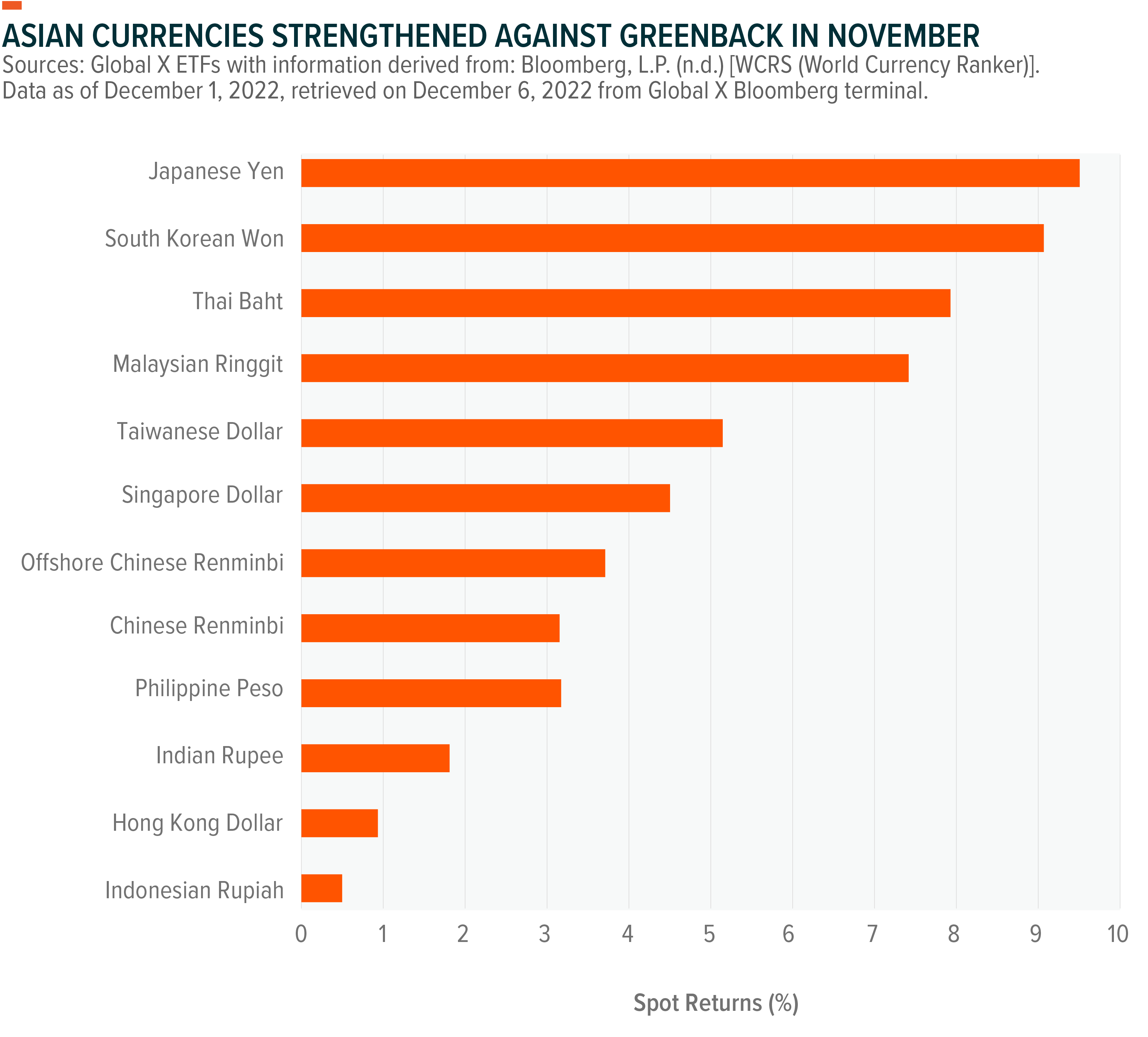

October’s reading for inflation in the US came in cooler than expected at 7.7% and sparked a rush of optimism. This was the case for US equities with the NASDAQ Composite up 6.02% and the S&P 500 up 4.80%, and international equities as well with the MSCI ACWI up 5.61% in the two-week period between Nov 4 and Nov 18. October’s inflation data was released on Nov 10. Some currencies that weakened because of hawkish Fed policy gained ground against the dollar. The Japanese Yen (JPY) notably climbed up to 138 JPY after previously breaking 150 JPY.

Despite the positive market reaction, we expect a gradual recession in the US and Europe in the first half of 2023. Asian markets will likely generally see growth in 2023, but in our view some markets are better positioned than others. Among the Asian markets, India and Southeast Asia will likely help drive global growth in 2023. Bloomberg economics expects India’s GDP to grow 4.0% in Q1 2023 and 4.3% in Q2 2023.6 Meanwhile, the Nikkei Consensus Survey anticipates 4.9% growth for Indonesia, 4.0% growth for Malaysia, 5.4% growth for the Philippines, 3.7% growth for Thailand and 2.2% growth for Singapore in 2023.7

Going into Q4 and 2023, we are optimistic about Southeast Asia. In addition to a strong macro picture, the rising rate environment will likely continue to be a tailwind for the Financials sector as it was in Q3. If it turns out to be a strong period for Southeast Asian Financials, we believe the Global X FTSE Southeast Asia ETF (ASEA) is well-positioned to capture those gains with its high allocation to Financials.

However, there is an important caveat to be made about Vietnam’s equity market, which may struggle compared to its Southeast Asian peers, for reasons that we explain below. Conveniently, ASEA does not have direct exposure to Vietnamese equities. We therefore do not expect headwinds for Vietnam to dampen our outlook for ASEA.

Vietnamese equities performed fantastically in 2021 with the Vietnam Ho Chi Minh Stock Index (VN-Index) returning 37.36%. This has not been the case in 2022, with the VNndex down -34.50% YTD, as of Nov 17, 2022. Arguably the largest source of downward pressure on Vietnamese equities right now is the country’s property sector woes, as developers grapple with liquidity issues, a cash crunch, and government scrutiny into their bond issuances. VNAM has a particularly high allocation to Real Estate of 30.22%, as of Nov 31, 2022, which likely had an adverse effect on the fund’s performance this year.

Fortunately, we believe the macro picture remains solid for Vietnam, and we are still optimistic about its long-term trajectory. 2022’s tumble may turn into an opportunity for long-term investors. However, we believe it may take until at least first half of 2023 for Vietnam to stabilize its property sector issues. Until then, we believe investors should be ready for more downside risk before a potential rebound.

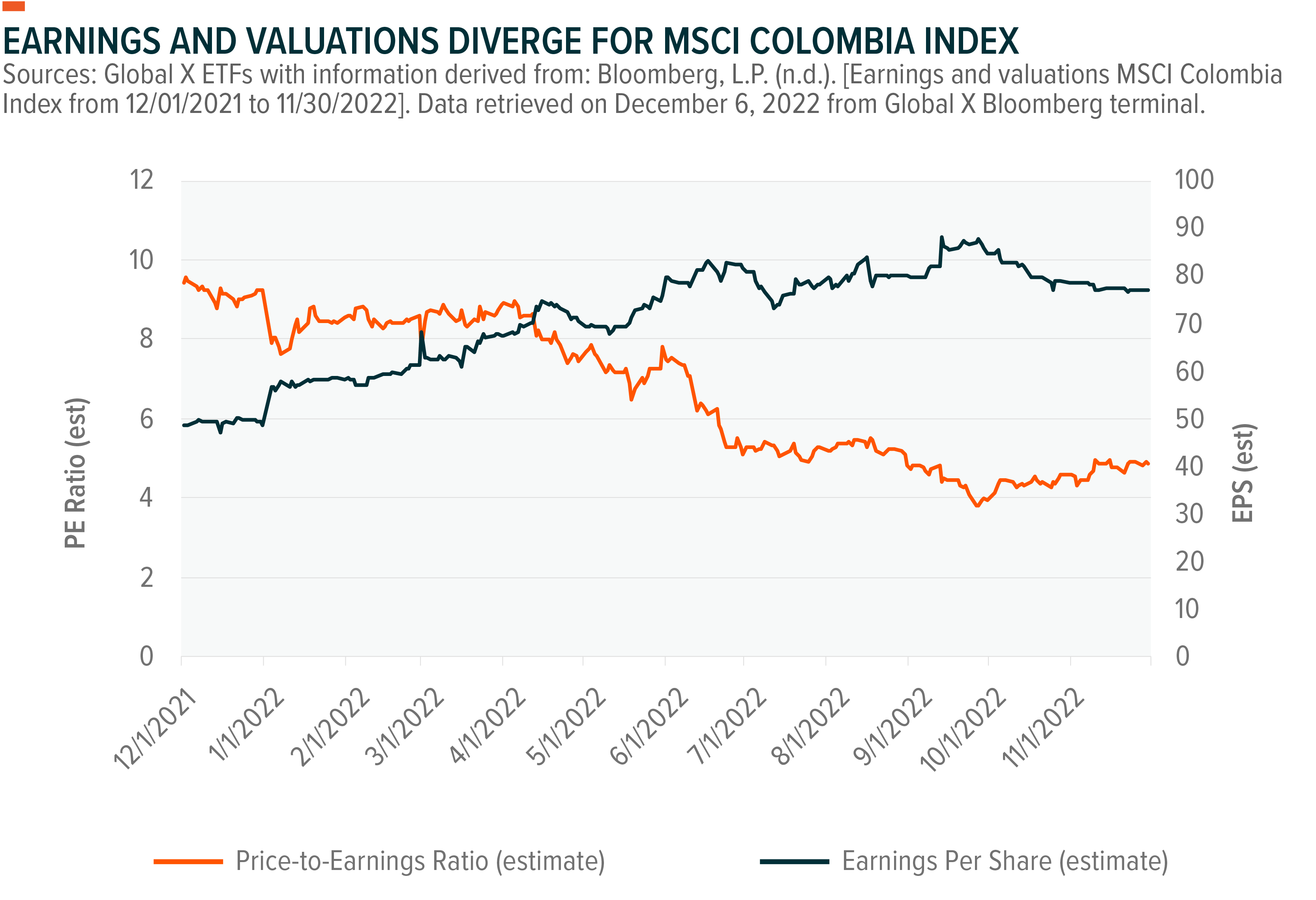

In Latin America, we continue to see potential in Colombian equities making an eventual recovery after the post-election rout. That recovery did not materialize in Q3 and it likely will not occur in Q4 either as “risk-off” sentiment remains elevated. Whether Colombian equities can stage a recovery to some extent depends on when there is less uncertainty on the Petro administration’s plans. An interesting development is the Petro administration’s review of its decision to block new oil and gas exploration. As of Dec 6, 2022, the review’s outcome remains uncertain.8 If the block is lifted, it could be a signal to anxious investors that the Petro administration is moderating its position as the realistic constraints of governance set in.

Despite stronger earnings over the past year, valuations for the MSCI Colombia Index have gone down. Part of the reason for the divergence could be negative investor sentiment from political uncertainty.

Despite stronger earnings over the past year, valuations for the MSCI Colombia Index have gone down. Part of the reason for the divergence could be negative investor sentiment from political uncertainty.

Image sourced from Shutterstock

This post contains sponsored advertising content. This content is for informational purposes only and not intended to be investing advice.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.