AT A GLANCE

- Higher inflation has boosted the stocks of commodity producers in 2022, while higher interest rates and bond yields have hurt the previous decade’s high fliers

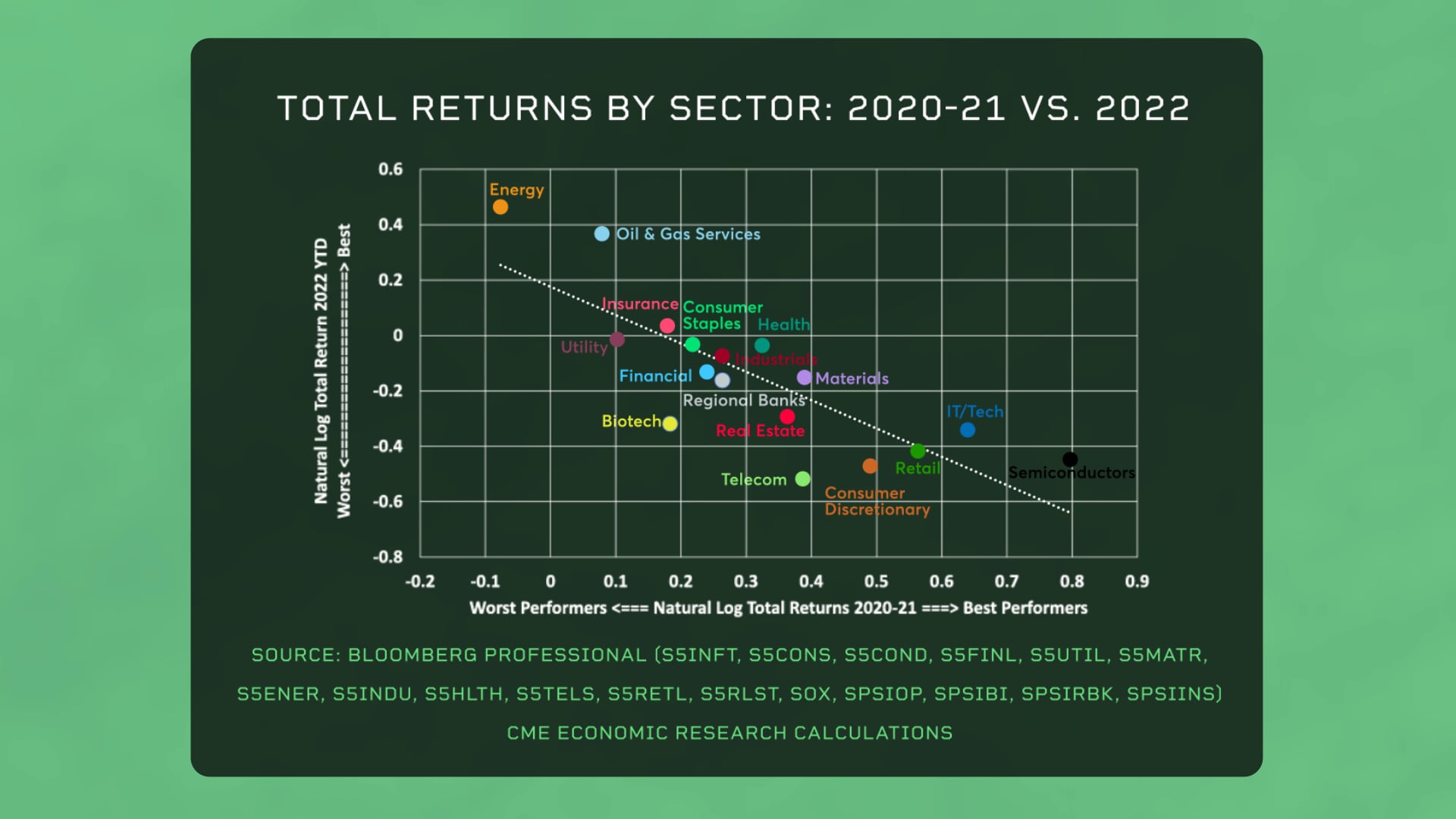

- Sectors that had performed well in 2020 and 2021, including tech, consumer discretionary and semiconductors, suffered declines as interest rates rose

In 2022, equity markets reversed in two distinct ways. First, the major indices, including the S&P 500, the Russell 2000 and the Nasdaq, fell after rising sharply in 2020 and 2021. Second, 2022 witnessed a near-perfect sector reversal. The sectors that had performed well in 2020 and 2021, including tech, consumer discretionary and semiconductors, suffered declines as interest rates rose. By contrast, sectors which had performed poorly in 2020 and 2021 soared, especially energy, oil and gas services stocks as travel rebounded.

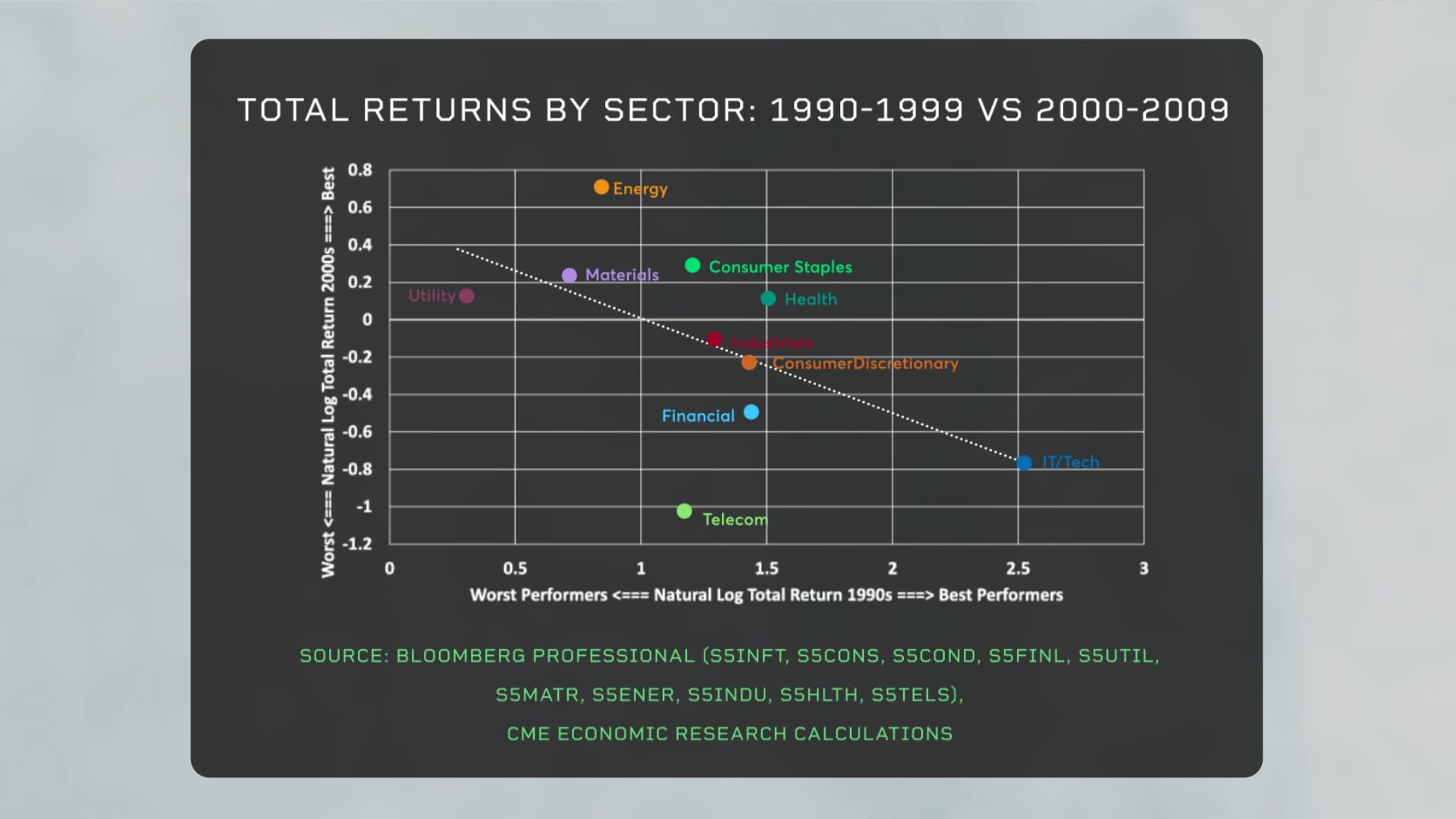

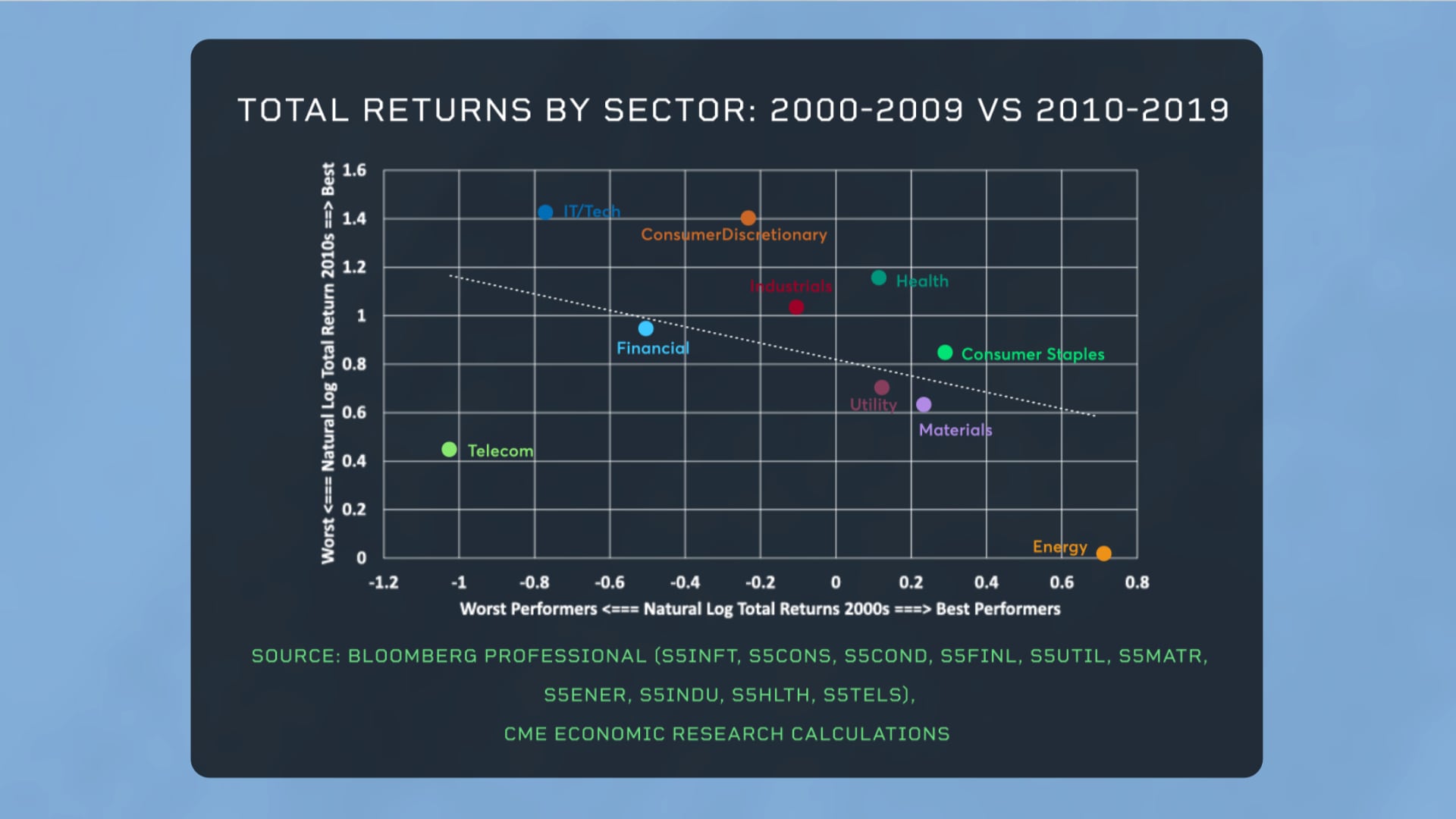

But was 2022 a flash in the pan or the beginning of a longer-term reversal in fortune for the various equity sectors? Since the 1990s, each new decade has seen a reversal of the previous decade’s sector performance. For example, during the 1990s, IT, consumer discretionary and financial stocks were among the best performers, while energy and materials stocks were among the worst. During the next decade, from 2000 to 2009, the opposite was true: energy and materials stocks soared while tech and financial services stocks suffered.

Sector performance reversed again in the 2010s with IT stocks, consumer discretionary and health dominating, while energy stocks, the darlings of the 2000s, underperformed. So, was 2022 the beginning of another decade-long sector reversal? It’s impossible to know for sure, but so far, higher inflation has boosted the stocks of commodity producers while higher interest rates and bond yields have hurt the previous decade’s high fliers.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.