2022 marked the 60th anniversary of the world’s first industrial robot. Not too long thereafter, in the early 1970s, the auto industry was the first industry to make practical use of this futuristic technology. Fast forward to today, industrial robotics remains in the early stages of adoption globally, with only 141 robots per 10,000 employees in the manufacturing industry.1 However, we expect robot density increase over the next few years, potentially reaching more than 500 robots per 10,000 manufacturing employees. As demand grows, driven by better technology and declining costs, labor shortages, aging populations, and reshoring, it’s important to understand the factors that may impact industrial robotics over the short term.

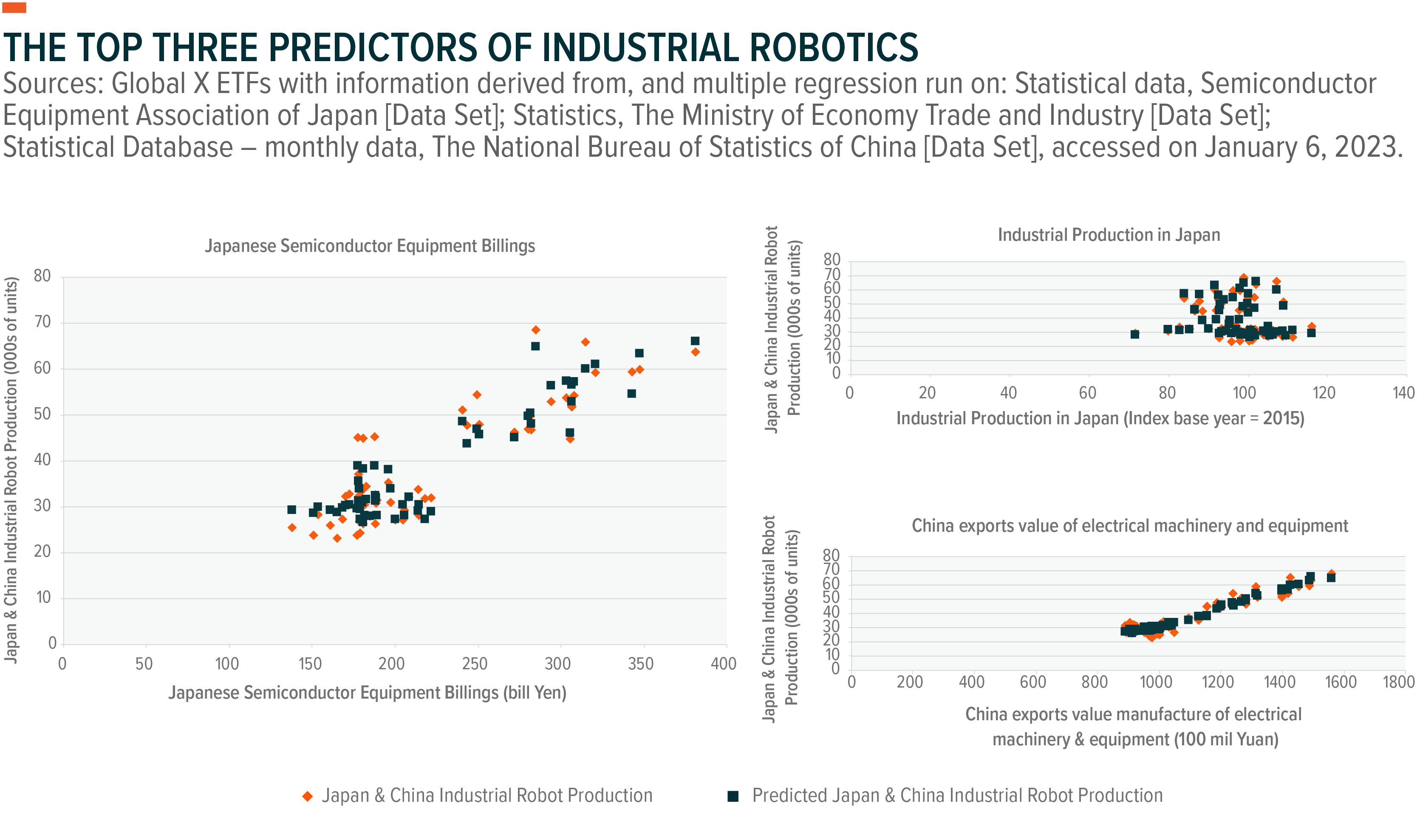

In this piece, we assess the three main factors that tend to drive the industrial robotics market: 1) Japanese semiconductor equipment billings, 2) industrial production in Japan, and 3) exports value of electrical machinery and equipment from China. Supported by a multiple regression analysis of these three factors, we explain our positive view on the industrial robotics outlook as the global economy increasingly turns to automation for new efficiencies.

Key Takeaways

- Valuable predictors of industrial robotics demand point towards further strengthening, particularly as China’s Zero-COVID policy comes to an end.

- Recent industrial robotics production levels reached record highs despite challenging macroeconomic conditions.

- Expected revenue growth rates of major robotics companies remain robust amid the continued shift towards automation.

Why Japan and China Are Strong Predictors of Industrial Robotics

First, almost all end-user industries are heavy users of semiconductors, particularly the automotive and electronics industries. Semiconductors are also essential for major robotic processes such as sensing and motion control. Given Japan’s global leadership in industrial robotics, Japanese semiconductor equipment billings go a long way in explaining industrial robotic production.

Second, industrial production is a leading indicator of Japan’s gross domestic product (GDP) growth, which in turn is an industrial robotics market driver. Historically, global robotics demand is highly correlated with Japanese industrial robotic production, as almost half of the world’s industrial robotics are manufactured in Japan.2

The third factor is China’s exports value of electrical machinery and equipment, which is one of the largest sources of demand for industrial robotics, followed closely by automobiles. China is the world’s biggest market for industrial robots, and the government’s most recent Five-Year Plan involves making China a global leader in robot technology and industrial advancement.3

A multiple regression analysis on these three factors versus Japanese and Chinese industrial robotic production produces a coefficient of determination, also known as R^2, of 91%. The coefficient of determination can be understood as a model’s goodness of fit. In essence, it reveals the proportion of the variation in the dependent variable that is explained by the independent variables. In this case, the dependent variable is industrial production and the independent variables are the three factors. An R^2 of 100% would mean that all variation can be explained by the model’s inputs. So an R^2 of 91% means that the factors considered are strong predictors of Japanese and Chinese industrial robotic production, which we view as a proxy for global industrial robotic production.

Factors Suggest Industrial Robotics Can Continue to Trend in 2023

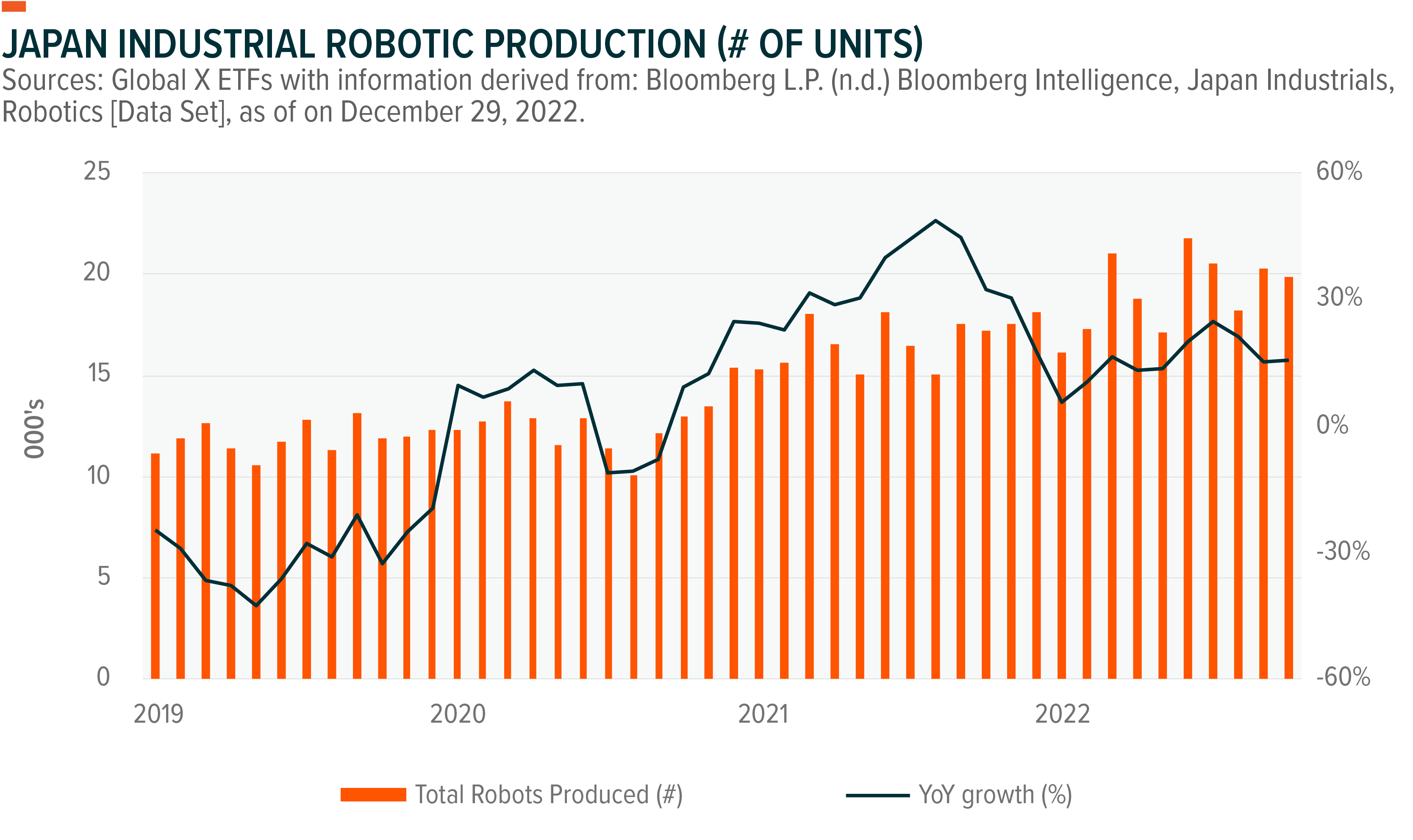

Japan set a record high for industrial robotics production in March 2022, and it remained strong throughout the year, despite short-term fluctuations.4 In October 2022, production increased 15.5% YoY (year-over-year), which followed September’s 15.4% and August’s 21.3% YoY increases.5 Recent strength in the industrial robotics market can be traced to the acceleration that occurred towards the end of 2020 when pandemic-induced labor shortages had companies turning towards automation. In addition, the broader pullback in globalization and countries moving to re-shore manufacturing further magnifies the shift towards automation.

When analyzing the performance indicators for 2023, we see that semiconductor billings in Japan reached record levels in July 2022 before peaking at 381 billion yen last September.6 The numbers softened slightly in October and November but remained higher than any other month prior to August.7

Management commentaries on semiconductors have been more cautious recently, but the semiconductor supply crunch has not yet had a meaningful effect on factory automation demand. The backlog of unfulfilled orders may continue to secure demand for the next couple of quarters, as long as companies don’t start to defer orders due to weaker end-market demand. In our view, the long-term outlook for semiconductors is positive given the resiliency in industrial and automotive demand. According to some estimates, the market is expected to surpass $1 trillion by the end of 2030, with an average annual growth rate of between 6 to 8%.8

Industrial production in Japan decreased 1.3% YoY in November, erasing three consecutive months of year-over-year increases.9 While industrial production is a leading indicator, we expect China, Japan’s biggest trading partner, to boost Japan’s industrial production towards the second half of 2023 now that China ended its Zero-Covid policy. China’s reopening can be a positive catalyst for the export value of electrical machinery and equipment, which recovered some ground in November, up 3.4% month-on-month (MoM) after a sharp 13.5% MoM drop in October.10 Another potential positive catalyst is continued solid U.S. industrial demand. However, consumer electronics-related demand may weaken further, particularly in Europe and emerging markets.

Recent Robotics Company Performances Suggest Continued Strength

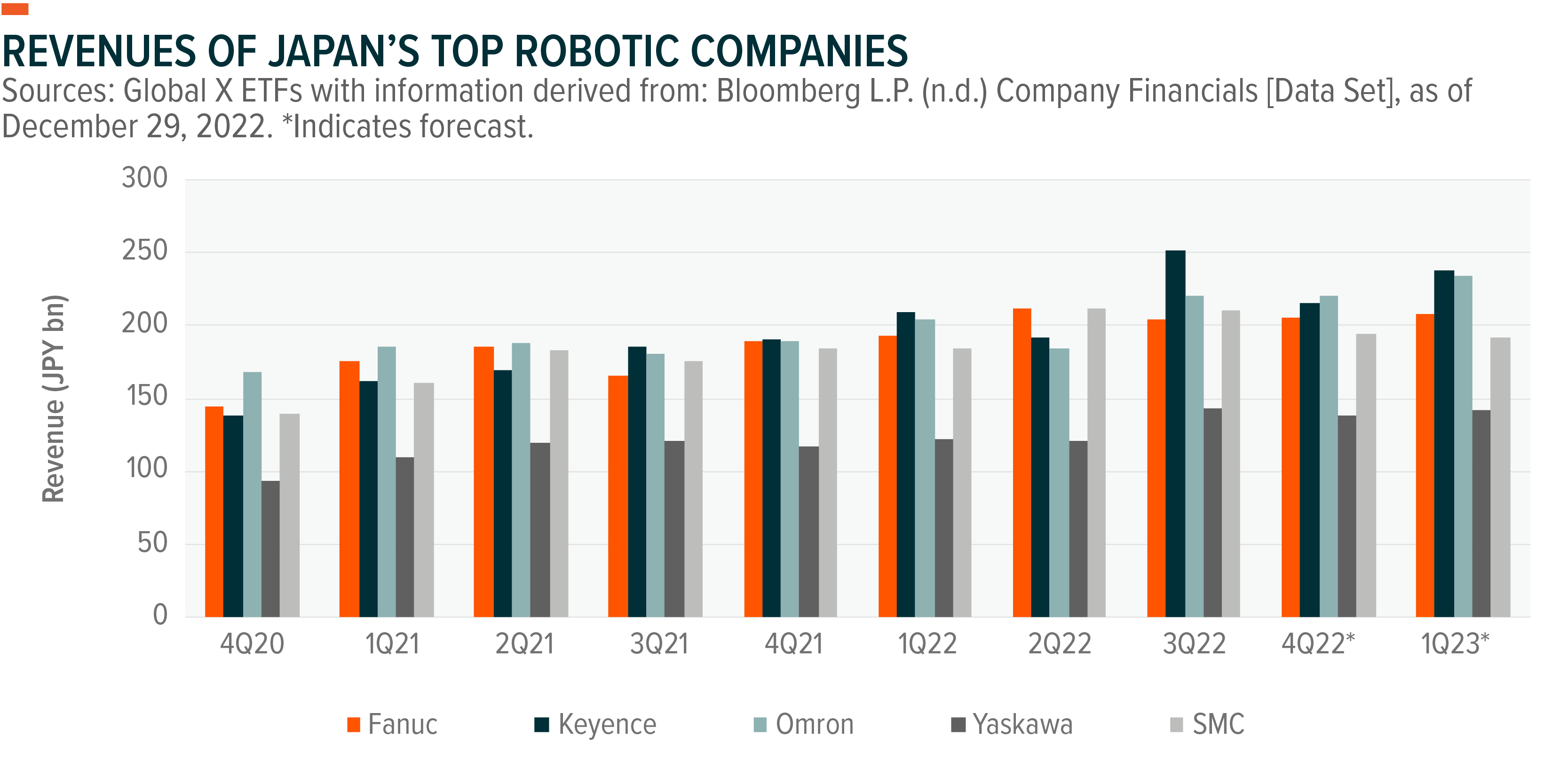

Robotics company sales and earnings remain solid, supported by continued strong demand for robotics and factory automation. If we look at some of the top Japanese robot companies, including Fanuc, Keyence, Omron, Yaskawa, and SMC, their estimated average year-over-year revenue growth rates are strong at 11.8% and 11.0% for calendar quarters Q4 2022 and Q1 2023, respectively.11

In Q3 2022, Fanuc’s earnings per share (EPS) increased 10% YoY in local currency.12 The company does not envision any near-term slowdown in robotics demand.13 However, input shortages and the increase in the cost of materials may make it difficult to increase production. Management does not expect semiconductor shortages to last beyond the second half of 2023.14

Year-over-year EPS growth for Keyence was a strong 36.1% in Q3 2022, though it is expected to moderate to 17.4% and 14.6% in the next two quarters, due to management commentaries pointing to rising uncertainty of demand in some end-markets, such as consumer electronics.15,16 Yaskawa’s EPS gained 40.3% for the quarter ended 30 November 2022, and forecasts are high at 80.9% and 30.7% for the next two quarters due to expected improvements in supply chain bottlenecks and component pricing.17,18

Conclusion: We Believe Automation Is Here to Stay

History tells us that we can look to Japan and China to gauge the outlook for industrial robotics and automation, and we expect 2023 to be no different. Industry dynamics are supportive of companies with strong exposure to the Robotics theme, as key data points continue to show strength. Global industrial robotic production and sales maintained their recent positive growth trajectories, supported by record levels of semiconductor billings from Japan. These trends stand out even more so given some weakness in China’s exports value of electrical machinery and equipment, weakness that we expect to reverse in 2023 as China reopens. The macroeconomic environment may pose challenges for industrial robotics in the short term, but in our view it is clear that companies’ drive for automation is here to stay.

Related ETFs

BOTZ: Global X Robotics & Artificial Intelligence ETF

Click the fund name above to view current holdings. Holdings are subject to change. Current and future holdings are subject to risk.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.