The S&P 500 has spent most of the first half up. (Source: Yahoo Finance)

Stocks closed higher last week with the S&P 500 climbing 0.4%. The index is now up 12% year to date, up 20.2% from its October 12 closing low of 3,577.03, and down 10.4% from its January 3, 2022 record closing high of 4,796.56.

On Thursday, we finally got confirmation that the bear market ended in October and that we’ve been in a new bull market ever since.

We’re also realizing this year’s market moves so far have been far outside consensus expectations in a bullish way.

Let’s turn back the clock.

An ‘Overstated’ Concern

In December, I published a roundup of Wall Street strategists’ 2023 outlook for stocks. The takeaway at the time: “Strategists expect a volatile first half to be followed by an easier second half, which could see stocks climb modestly higher.“

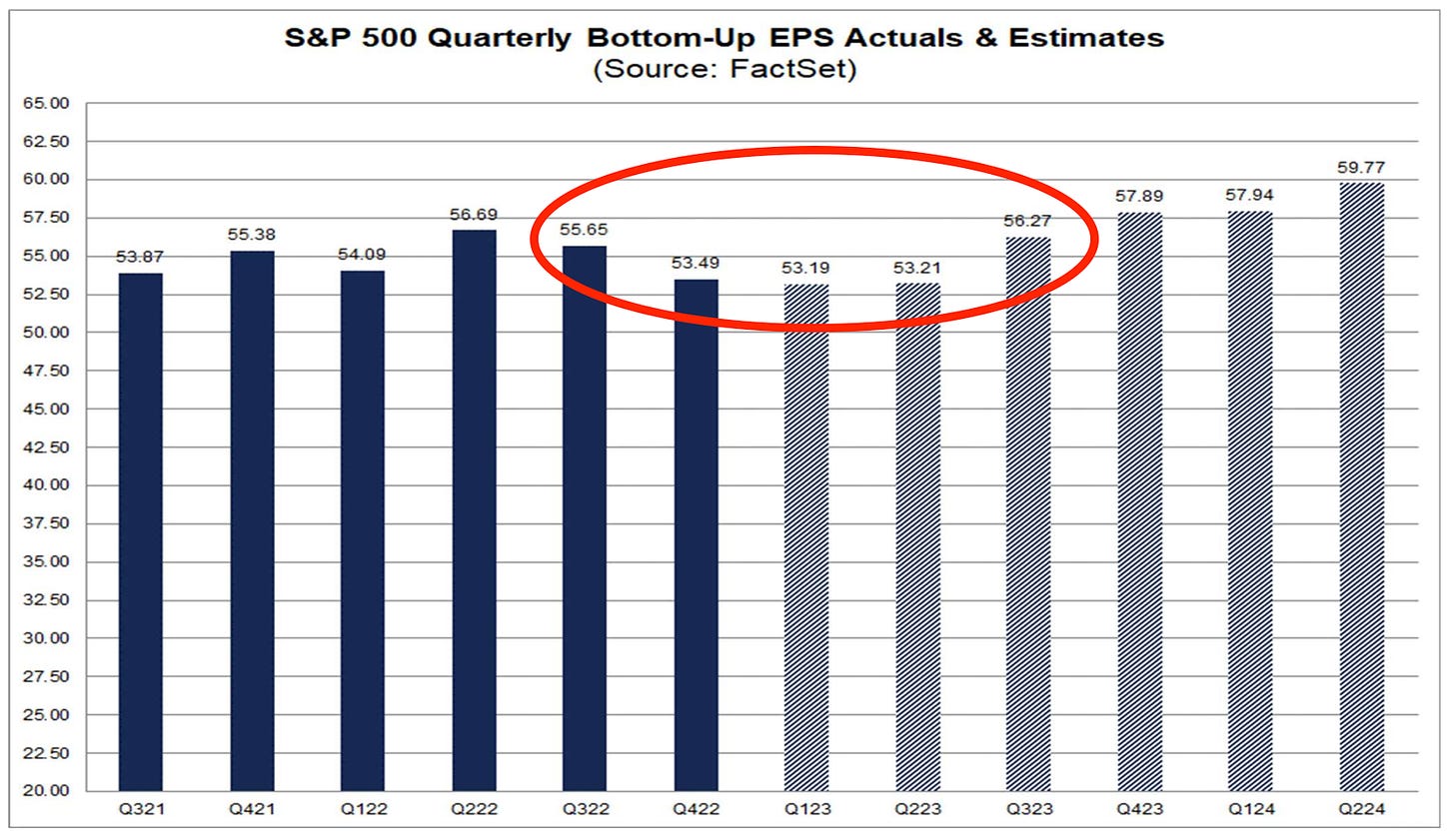

The big concern was that a brief earnings growth recession, which has sorta come to fruition, would come with renewed selling in stocks.

Quarterly earnings look like they’re in recession. (Source: FactSet)

But at the time, a handful of analysts, like Oppenheimer’s Ari Wald, ran the numbers and concluded “concerns are overstated.”

Not only is there a very weak linear relationship between one year’s earnings change and one year’s S&P 500 price change, but there’s actually some evidence that a trough in earnings is actually a lagging market indicator. Furthermore, history shows there are more instances when stocks didn’t fall but rose in years when earnings fell.

Stocks often rise in years when earnings fall. (Source: Janus Henderson via TKer)

For more on this, read: One of the most frequently cited risks to stocks in 2023 is 'overstated' 😑

A ‘Most Popular’ Concern

There was also the issue that many experts were openly calling for stock market weakness in the first half of the year. The prediction even made the cover of Barron’s!

The expectation for an early selloff made the cover of Barron’s. (Source: Barron’s via TKer)

At the time, two of the savviest Wall Street strategists I follow remarked on this. From the December 18, 2022 TKer:

“I do think that we are going to go down and then up… The problem is that is an increasingly consensus view. So I think the bigger risk heading into the first half is actually not being invested in equities.“ - BofA’s Savita Subramanian, Dec. 7

“Everybody and their mother, brother, sister, cousin, and uncle is negative on the first half of the year… So we'll come out and be a little bit different. I think the weakness is probably not going to be as long as everybody thinks.“ - BMO Capital Markets’ Brian Belski, Dec. 16

The thing about risks is that they become less of a problem for markets the more market participants talk about them because that means the risks are probably priced in.

Indeed, it’s mid-June and the stock market has spent the first five and a half months of the year mostly trending higher. The S&P 500 went modestly into the red on January 3 and 5; every other day it’s been in the green.

“The most popular prediction headed into 2023 was that markets would suffer through a rough first half but rally by year’s end,” Michael Arone, State Street Global Advisors, wrote on Tuesday. “However, stocks and bonds have refused to comply with the consensus forecast.”

In recent weeks, the consensus has shifted with strategists across Wall Street revising up their year-end price targets for the S&P 500, including Goldman Sachs’ David Kostin (to 4,500 from 4,000), BMO Capital Markets’ Brian Belski (to 4,550 from 4,300), BofA’s Savita Subramanian (to 4,300 from 4,000), and RBC Capital Markets’ Lori Calvasina (to 4,250 from 4,100).

The Big Picture

To be clear, this is not intended to be a celebration of bearish market-timers being wrong.

Rather, the point is that it is incredibly difficult to predict short-term moves with any accuracy, even when you know where the fundamentals are headed.

And it can be particularly dangerous to make bearish moves in a stock market that usually goes up. You risk missing out on significant short-term gains, doing irreversible damage to your potential long-term returns.

A version of this post was originally published on Tker.co

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.