By RoboForex Analytical Department

Gold's price soared to a new record high on Monday, stabilising around 2344.00 USD per troy ounce. A confluence of factors is currently bolstering the precious metal's value.

Geopolitical tensions in the Middle East are a significant driver, positioning gold as a preferred "safe-haven" investment. Additionally, central banks worldwide are increasing their gold reserves, while global exchange-traded funds (ETFs) that track the metal's price continue to show keen interest.

Recent US job market data for March surpassed expectations, indicating a robust end to the first quarter for the US economy. These developments could impact the Federal Reserve's interest rate decisions, as lower rates diminish the opportunity cost of holding gold, further supporting its price increase.

Since the start of the year, gold has appreciated over 12% in value, showcasing an impressive performance for what is traditionally viewed as a conservative asset.

XAU/USD Technical Analysis

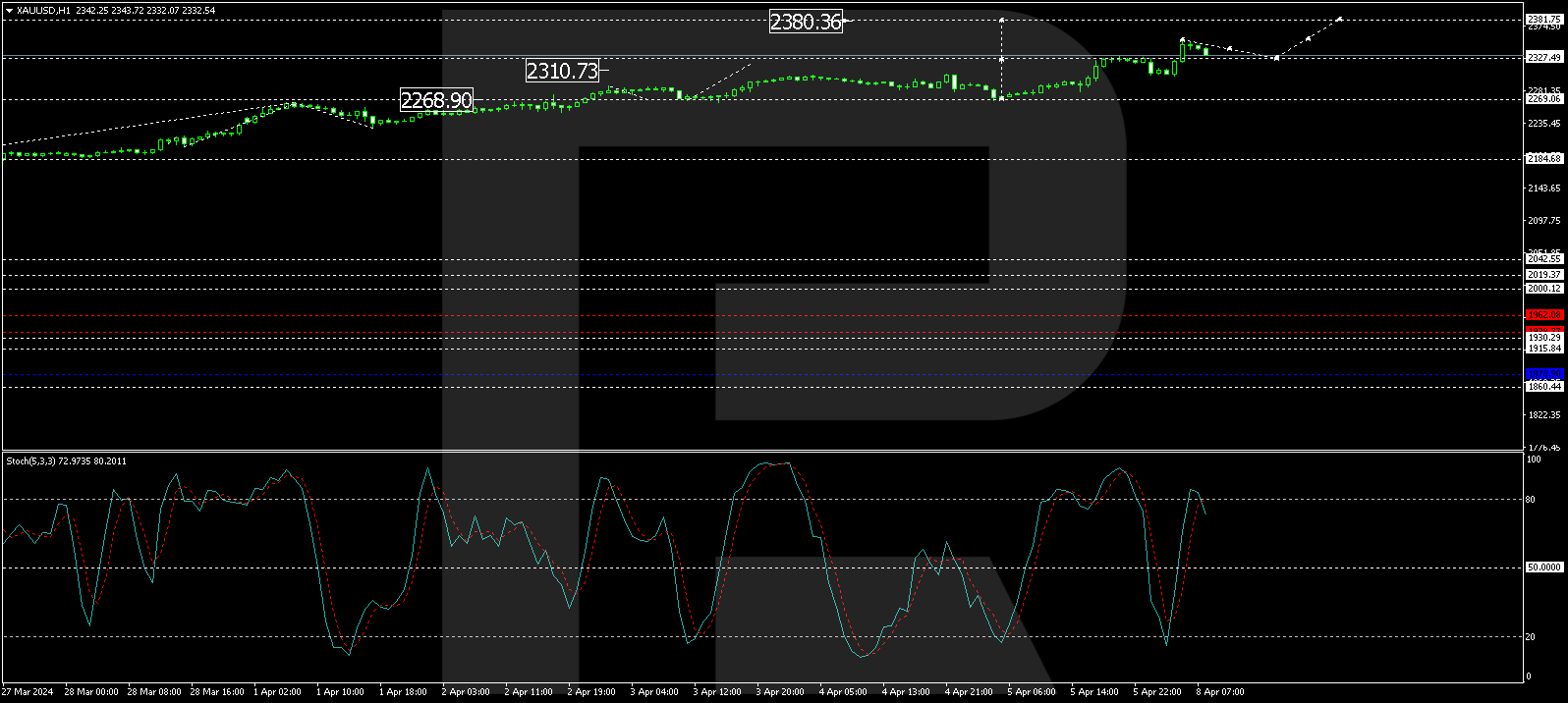

The H4 chart for XAU/USD indicates that a growth wave reached 2330.00, followed by the formation of a consolidation range around this level. This range has now expanded to 2353.85. A technical retracement to 2330.00 is anticipated (testing from above), with potential subsequent growth to 2380.33 as a local target. The MACD indicator, with its signal line well above zero and pointing upwards, supports this growth scenario.

On the H1 chart, XAU/USD established support at 2269.00, completing a growth structure to 2330.53. A consolidation range has formed around this level, now extended to 2353.85. A corrective move to 2327.50 (testing from above) is expected, potentially leading to a new growth wave towards 2386.36. This forecast is confirmed by the Stochastic oscillator, with its signal line preparing to drop to 50 before climbing back to 80.

Disclaimer

Any forecasts contained herein are based on the author's particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.

This article is from an unpaid external contributor. It does not represent Benzinga's reporting and has not been edited for content or accuracy.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.