Palantir Technologies Inc. PLTR will release earnings results for its third quarter, after the closing bell on Monday, Nov. 4.

Analysts expect the Denver, Colorado-based company to report quarterly earnings at 9 cents per share, up from 7 cents per share in the year-ago period. Palantir Technologies projects to report revenue of $701.13 million for the quarter, according to data from Benzinga Pro.

Don’t Miss:

- If there was a new fund backed by Jeff Bezos offering a 7-9% target yield with monthly dividends would you invest in it?

- The Ascent Income Fund from EquityMultiple targets stable income from senior commercial real estate debt positions and has a historical distribution yield of 12.1% backed by real assets. Earn a 1% return boost on your first EquityMultiple investment when you sign up here (accredited investors only).

The company recently announced a strategic partnership with L3Harris Technologies Inc. LHX to combine Palantir’s Artificial Intelligence Platform with L3Harris’ sensor and software-defined systems. The collaboration aims to support U.S. Army programs and expand capabilities in AI-driven defense technology, enhancing situational awareness and target identification.

Palantir Technologies shares gained 0.9% to close at $41.92 on Friday.

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

Let's have a look at how Benzinga's most-accurate analysts have rated the company in the recent period.

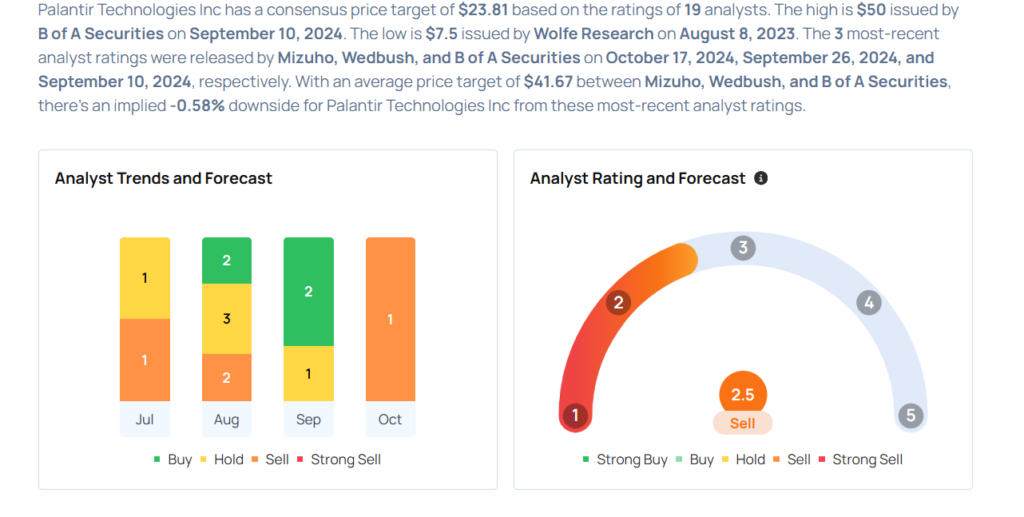

- Mizuho analyst Matthew Broome maintained an Underperform rating and raised the price target from $24 to $30 on Oct. 17.

- Wedbush analyst Daniel Ives maintained an Outperform rating and increased the price target from $38 to $45 on Sept. 26.

- Raymond James analyst Brian Gesuale downgraded the stock from Outperform to Market Perform on Sept. 23.

- B of A Securities analyst Mariana Perez maintained a Buy rating and raised the price target from $30 to $50 on Sept. 10.

- Northland Capital Markets analyst Michael Latimore initiated coverage on the stock with a Market Perform rating and a price target of $35 on Aug. 22.

Considering buying PLTR stock? Here’s what analysts think:

Check It Out:

You Can Profit From Real Estate Without Being A Landlord

Real estate is a great way to diversify your portfolio and earn high returns, but it can also be a big hassle. Luckily, there are other ways to tap into the power of real estate without owning property.

The Arrived Homes investment platform has created an Income Fund, which provides access to a pool of short-term loans backed by residential real estate with a target 7% to 9% net annual yield paid to investors monthly. The best part? Unlike other private credit funds, this one has a minimum investment of only $100.

Looking for fractional real estate investment opportunities? The Benzinga Real Estate Screener features the latest offerings.Wondering if your investments can get you to a $5,000,000 nest egg? Speak to a financial advisor today. SmartAsset’s free tool matches you up with up to three vetted financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.